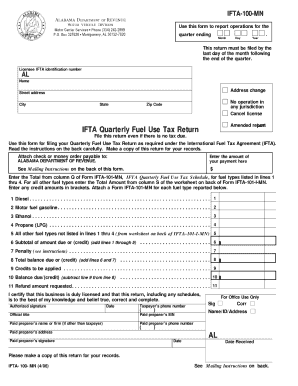

Alabama Ifta Online Filing Form

What is the Alabama IFTA Online Filing

The Alabama IFTA online filing is a digital process that allows businesses operating commercial vehicles to report and pay their fuel taxes to the state of Alabama and other member jurisdictions. The International Fuel Tax Agreement (IFTA) simplifies the reporting of fuel use by interstate motor carriers. By utilizing the online filing system, users can efficiently manage their tax obligations without the need for paper forms, ensuring timely submissions and compliance with state regulations.

How to use the Alabama IFTA Online Filing

Using the Alabama IFTA online filing system involves a few straightforward steps. First, users need to create an account on the designated platform. Once logged in, they can access the IFTA filing section, where they will be prompted to enter relevant information, including fuel purchases and mileage traveled in each jurisdiction. After completing the necessary fields, users can review their entries for accuracy before submitting the form electronically. This method not only streamlines the filing process but also provides immediate confirmation of submission.

Steps to complete the Alabama IFTA Online Filing

Completing the Alabama IFTA online filing requires careful attention to detail. Here are the essential steps:

- Create an account on the Alabama IFTA online filing platform.

- Log in to your account and navigate to the IFTA filing section.

- Gather necessary information, including fuel purchase receipts and mileage logs for each jurisdiction.

- Input the required data into the online form, ensuring all entries are accurate.

- Review the completed form for any errors or omissions.

- Submit the form electronically and save the confirmation for your records.

Legal use of the Alabama IFTA Online Filing

The Alabama IFTA online filing is legally recognized, provided that it adheres to specific regulations set forth by the state and federal laws. Electronic submissions are considered valid as long as they meet the requirements outlined by the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). This legal framework ensures that electronically filed documents hold the same weight as traditional paper filings, promoting efficiency and compliance.

Required Documents

To successfully complete the Alabama IFTA online filing, certain documents are necessary. These include:

- Fuel purchase receipts that detail the amount and type of fuel bought.

- Mileage logs that record the distance traveled in each jurisdiction.

- Any previous IFTA returns that may be required for reference.

Having these documents readily available will facilitate a smoother filing process and ensure accurate reporting.

Filing Deadlines / Important Dates

Staying aware of filing deadlines is crucial for compliance with Alabama's tax regulations. The IFTA filing is typically due quarterly, with specific deadlines for each quarter. It is essential to check the Alabama Department of Revenue's official calendar for exact dates to avoid penalties. Timely submissions help maintain good standing and prevent unnecessary fines.

Quick guide on how to complete alabama ifta online filing

Effortlessly Prepare Alabama Ifta Online Filing on Any Device

Digital document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed papers, enabling you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage Alabama Ifta Online Filing on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

Steps to Modify and eSign Alabama Ifta Online Filing with Ease

- Find Alabama Ifta Online Filing and click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all your details and click on the Done button to finalize your changes.

- Select how you wish to deliver your form, via email, SMS, or invitation link, or save it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Transform and eSign Alabama Ifta Online Filing and ensure exceptional communication at each stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the alabama ifta online filing

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Alabama IFTA online filing?

Alabama IFTA online filing refers to the process of submitting your International Fuel Tax Agreement reports electronically via an online platform. This method simplifies the reporting process for fuel taxes, ensuring compliance with state laws while saving time.

-

What are the benefits of using airSlate SignNow for Alabama IFTA online filing?

Using airSlate SignNow for Alabama IFTA online filing offers several benefits, including an intuitive interface and automated calculations to minimize errors. Additionally, eSigning capabilities speed up the approval process, making your filings more efficient.

-

How much does it cost to file Alabama IFTA online with airSlate SignNow?

The pricing for airSlate SignNow’s Alabama IFTA online filing service is competitive and designed to cater to a variety of business sizes. Our plans are cost-effective, ensuring you get the best value for your investment while managing your fuel tax obligations efficiently.

-

Can airSlate SignNow integrate with my existing accounting software for Alabama IFTA online filing?

Yes, airSlate SignNow supports integration with many popular accounting software applications, allowing seamless data transfer. This integration makes Alabama IFTA online filing even easier by eliminating manual data entry and reducing the risk of errors.

-

Is Alabama IFTA online filing secure with airSlate SignNow?

Absolutely. airSlate SignNow prioritizes security in all online transactions, including Alabama IFTA online filing. Our platform employs encryption and compliance measures to ensure that your sensitive information is protected throughout the filing process.

-

How does airSlate SignNow help in tracking my Alabama IFTA filings?

airSlate SignNow provides tracking tools that help you monitor your Alabama IFTA online filing status in real-time. This feature ensures that you can verify submissions and stay updated on any changes or requirements directly from your dashboard.

-

What types of documents can be signed when filing Alabama IFTA online?

When using airSlate SignNow for Alabama IFTA online filing, you can sign various documents, such as reports, certifications, and payment authorizations. Our platform is designed to handle all necessary paperwork involved in the filing process efficiently.

Get more for Alabama Ifta Online Filing

- Agreement between carrier and shipper general form

- Motion for permission to proceed form

- Application for public defenders services form

- Release and waiver of liability given by customer in favor of owneroperator of miniature golf course including assumption of form

- Bill of sale for a recreational vehicle all terrain vehicle andor dirt bike form

- Order appointing special prosecutor form

- Comes now by and through his attorney and files this his motion in form

- Agreement between composer and vocalist regarding the recording of a musical form

Find out other Alabama Ifta Online Filing

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form