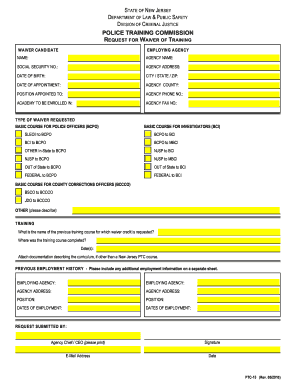

Nj Ptc Waiver Form

What is the Nj Ptc Waiver

The Nj Ptc waiver is a specific form designed for residents of New Jersey, allowing them to waive certain tax obligations under specific conditions. This waiver can be particularly beneficial for individuals who meet eligibility criteria set forth by the state. Understanding the purpose and implications of this form is crucial for taxpayers seeking to navigate their tax responsibilities effectively.

How to Obtain the Nj Ptc Waiver

To obtain the Nj Ptc waiver, individuals must first ensure they meet the eligibility criteria established by the state. This typically involves checking specific income thresholds and residency requirements. Once eligibility is confirmed, the form can be accessed through the New Jersey Division of Taxation website or local tax offices. It is advisable to gather any necessary documentation beforehand to facilitate a smooth application process.

Steps to Complete the Nj Ptc Waiver

Completing the Nj Ptc waiver involves several key steps:

- Gather necessary documents, including proof of income and residency.

- Carefully fill out the waiver form, ensuring all required fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form through the designated method, whether online, by mail, or in person.

Following these steps can help ensure that the waiver is processed efficiently and correctly.

Legal Use of the Nj Ptc Waiver

The legal use of the Nj Ptc waiver is governed by state tax laws and regulations. It is essential for taxpayers to understand that this waiver must be utilized in compliance with all applicable rules to avoid penalties. The waiver serves as a formal request to the state, and misuse or incorrect submission can lead to legal repercussions.

Eligibility Criteria

Eligibility for the Nj Ptc waiver is determined by specific criteria set by the New Jersey state government. Generally, applicants must be residents of New Jersey and meet certain income limits. Additional factors may include age, disability status, and other personal circumstances. It is important to review the latest guidelines to ensure compliance with current eligibility requirements.

Form Submission Methods

The Nj Ptc waiver can be submitted through various methods, providing flexibility for applicants. The available submission options typically include:

- Online submission through the New Jersey Division of Taxation's website.

- Mailing the completed form to the appropriate tax office.

- In-person submission at designated tax offices for direct assistance.

Choosing the right submission method can help facilitate a quicker response from tax authorities.

Key Elements of the Nj Ptc Waiver

Understanding the key elements of the Nj Ptc waiver is vital for successful completion and submission. Important components include:

- Personal identification information, such as name and address.

- Income details to establish eligibility.

- Signature and date to validate the submission.

Ensuring that these elements are accurately provided can significantly impact the processing of the waiver.

Quick guide on how to complete nj ptc waiver

Effortlessly Prepare Nj Ptc Waiver on Any Device

The management of documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage Nj Ptc Waiver on any device using the airSlate SignNow applications for Android or iOS and enhance any document-focused workflow today.

How to Modify and Electronically Sign Nj Ptc Waiver with Ease

- Obtain Nj Ptc Waiver and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes only seconds and has the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Nj Ptc Waiver to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nj ptc waiver

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nj ptc waiver and how does it work with airSlate SignNow?

The nj ptc waiver is a program that provides financial relief for eligible businesses in New Jersey. With airSlate SignNow, users can easily manage their documents needed for this waiver electronically, ensuring a streamlined and efficient application process.

-

How can airSlate SignNow help businesses apply for the nj ptc waiver?

AirSlate SignNow simplifies the application process for the nj ptc waiver by allowing users to prepare, send, and eSign required documents quickly. Our platform ensures all documents are securely stored and easily accessible, which is crucial for timely submission.

-

Is there a cost associated with using airSlate SignNow for the nj ptc waiver?

Yes, there is a subscription cost associated with using airSlate SignNow, but it is designed to be cost-effective. The pricing plans are flexible and cater to different business sizes, making it an affordable solution for managing nj ptc waiver applications.

-

What features does airSlate SignNow offer for nj ptc waiver document management?

AirSlate SignNow offers a range of features such as customizable templates, automated workflows, and secure eSigning, all vital for efficiently handling documents related to the nj ptc waiver. These features enhance productivity and reduce the time spent on paperwork.

-

Can airSlate SignNow integrate with other software when handling nj ptc waiver documents?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enabling businesses to manage their nj ptc waiver documentation alongside existing tools. This integration helps streamline operations and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for the nj ptc waiver application process?

Using airSlate SignNow for your nj ptc waiver application provides numerous benefits, including faster document turnaround times, enhanced security, and ease of use. This allows businesses to focus more on their operations and less on paperwork.

-

How does eSigning with airSlate SignNow work for the nj ptc waiver?

eSigning with airSlate SignNow is straightforward and compliant with legal standards, making it ideal for the nj ptc waiver process. Users can sign documents electronically from anywhere, facilitating quicker approvals and submissions.

Get more for Nj Ptc Waiver

- Upsp merger stb written decision union pacific form

- Lynton group inc initial statement preliminary form pre13e3a

- Saco me property for sale and lease commercial exchange form

- How to change your corporate articles of incorporation form

- Proposals two through eight form

- Coca cola bottling co consolidated secgov form

- Board approves interim and new investment sub advisory form

- Vanguard explorer fund statement of additional information

Find out other Nj Ptc Waiver

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy