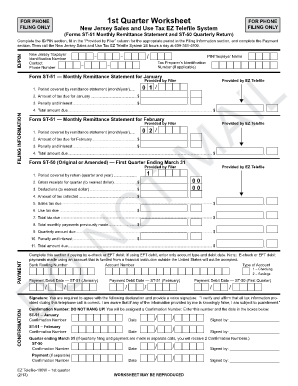

1st Quarter Worksheet New Jersey Sales and Use Tax EZ Telefile System 1st Quarter Worksheet New Jersey Sales and Use Tax EZ Tele Form

What is the 1st Quarter Worksheet New Jersey Sales And Use Tax EZ Telefile System?

The 1st Quarter Worksheet New Jersey Sales And Use Tax EZ Telefile System is a crucial document for businesses operating in New Jersey. This form is designed to facilitate the reporting of sales and use tax for the first quarter of the year. It allows taxpayers to accurately calculate their tax liabilities and submit their returns electronically, streamlining the process and ensuring compliance with state regulations. The EZ Telefile System enhances efficiency by enabling users to complete and file their forms online, reducing the need for paper submissions.

Steps to Complete the 1st Quarter Worksheet

Completing the 1st Quarter Worksheet involves several key steps. First, gather all necessary financial records, including sales receipts and any applicable exemptions. Next, access the EZ Telefile System through the New Jersey Division of Taxation website. Follow the prompts to input your sales data accurately. Ensure that you review all entries for accuracy before submitting. After submission, retain a copy of the confirmation for your records. This process not only ensures compliance but also helps in maintaining organized financial documentation.

State-Specific Rules for the 1st Quarter Worksheet

New Jersey has specific regulations that govern the completion and submission of the 1st Quarter Worksheet. It is essential to be aware of the state's tax rates, exemptions, and deadlines. For instance, businesses must adhere to the filing deadlines set by the New Jersey Division of Taxation to avoid penalties. Additionally, understanding local tax laws and any changes in legislation can significantly impact how you fill out the worksheet. Staying informed about these rules will help ensure that your filings are accurate and timely.

Legal Use of the 1st Quarter Worksheet

The legal use of the 1st Quarter Worksheet hinges on compliance with state tax laws. When filed correctly, this form serves as a legally binding document that reflects a business's tax obligations. It is important to ensure that all information provided is truthful and accurate, as discrepancies can lead to audits or penalties. Utilizing a reliable digital platform, like the EZ Telefile System, enhances the integrity of the submission process by providing secure and verifiable electronic signatures.

Filing Deadlines / Important Dates

Timely filing of the 1st Quarter Worksheet is critical for compliance. The deadline for submitting this form typically falls on the 20th day of the month following the end of the quarter. For the first quarter, this means that the form must be filed by April 20. Businesses should mark their calendars and prepare their documentation well in advance to avoid last-minute issues. Missing the deadline can result in penalties and interest charges, making it crucial to stay on schedule.

Who Issues the Form?

The 1st Quarter Worksheet is issued by the New Jersey Division of Taxation. This state agency is responsible for administering tax laws and ensuring compliance among businesses. The Division provides resources and guidance for taxpayers to help them understand their obligations. By utilizing the information and tools available through the Division, businesses can navigate the tax filing process more effectively.

Quick guide on how to complete 1st quarter worksheet new jersey sales and use tax ez telefile system 1st quarter worksheet new jersey sales and use tax ez

Complete 1st Quarter Worksheet New Jersey Sales And Use Tax EZ Telefile System 1st Quarter Worksheet New Jersey Sales And Use Tax EZ Tele effortlessly on any gadget

Digital document administration has gained traction among organizations and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly without interruptions. Handle 1st Quarter Worksheet New Jersey Sales And Use Tax EZ Telefile System 1st Quarter Worksheet New Jersey Sales And Use Tax EZ Tele on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to adjust and eSign 1st Quarter Worksheet New Jersey Sales And Use Tax EZ Telefile System 1st Quarter Worksheet New Jersey Sales And Use Tax EZ Tele with ease

- Locate 1st Quarter Worksheet New Jersey Sales And Use Tax EZ Telefile System 1st Quarter Worksheet New Jersey Sales And Use Tax EZ Tele and select Get Form to commence.

- Employ the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you prefer to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or mismanaged documents, tedious form searching, or errors that require new document copies to be printed. airSlate SignNow addresses all your document management needs in just a few clicks from any gadget of your selection. Adjust and eSign 1st Quarter Worksheet New Jersey Sales And Use Tax EZ Telefile System 1st Quarter Worksheet New Jersey Sales And Use Tax EZ Tele and guarantee outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1st quarter worksheet new jersey sales and use tax ez telefile system 1st quarter worksheet new jersey sales and use tax ez

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1st Quarter Worksheet New Jersey Sales And Use Tax EZ Telefile System?

The 1st Quarter Worksheet New Jersey Sales And Use Tax EZ Telefile System is a streamlined electronic method for New Jersey businesses to report and remit their sales and use taxes. This system simplifies the filing process, enabling users to efficiently complete and submit the necessary forms, including the ST 50 Quarterly Return.

-

How does the EZ Telefile System benefit businesses in New Jersey?

The EZ Telefile System offers New Jersey businesses a convenient way to manage their sales tax obligations. By using the 1st Quarter Worksheet New Jersey Sales And Use Tax EZ Telefile System, businesses can save time, reduce errors, and ensure compliance with state regulations, ultimately enhancing operational efficiency.

-

Are there any costs associated with using the EZ Telefile System?

The 1st Quarter Worksheet New Jersey Sales And Use Tax EZ Telefile System is designed to be a cost-effective solution for businesses. While there may be nominal fees associated with certain filings, utilizing the system can save businesses money by minimizing penalties for late submissions and errors.

-

What forms are included in the 1st Quarter Worksheet for New Jersey Sales Tax?

The 1st Quarter Worksheet New Jersey Sales And Use Tax EZ Telefile System includes essential forms such as the ST 51 Monthly Remittance Statement and the ST 50 Quarterly Return. These forms are crucial for accurately reporting sales tax collections and ensuring compliance with New Jersey's tax requirements.

-

How can businesses integrate the EZ Telefile System with their existing workflows?

The 1st Quarter Worksheet New Jersey Sales And Use Tax EZ Telefile System is designed to integrate seamlessly with various accounting and business management software. By connecting existing tools with the EZ Telefile System, businesses can automate data entry and streamline their filing processes.

-

What features does the EZ Telefile System offer for tracking tax submissions?

The 1st Quarter Worksheet New Jersey Sales And Use Tax EZ Telefile System includes comprehensive tracking features to monitor submitted tax documents. Businesses can easily check submission statuses, receive notifications of acceptance, and access archived documents for future reference, ensuring a well-organized filing system.

-

Is technical support available for users of the EZ Telefile System?

Yes, technical support is available for users of the 1st Quarter Worksheet New Jersey Sales And Use Tax EZ Telefile System. Businesses can access help via online resources, chat support, or phone assistance to resolve any issues they may encounter while using the system.

Get more for 1st Quarter Worksheet New Jersey Sales And Use Tax EZ Telefile System 1st Quarter Worksheet New Jersey Sales And Use Tax EZ Tele

- Legal last will and testament form for a domestic partner with no children hawaii

- Legal last will and testament form for married person with minor children hawaii

- Legal last will and testament form for domestic partner with minor children hawaii

- Hawaii will form

- Legal last will and testament form for divorced person not remarried with adult and minor children hawaii

- Legal last will and testament form for civil union partner with adult children hawaii

- Hawaii partner form

- Legal last will and testament form for civil union partner with minor children hawaii

Find out other 1st Quarter Worksheet New Jersey Sales And Use Tax EZ Telefile System 1st Quarter Worksheet New Jersey Sales And Use Tax EZ Tele

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online