1310 Form

What is the 1310 Form

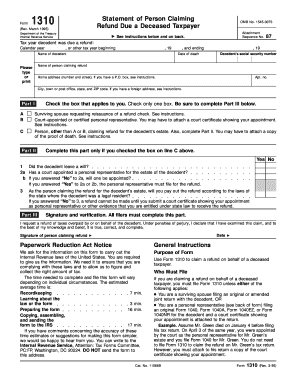

The 1310 Form is a tax form used by individuals in the United States to claim a refund on a deceased taxpayer's account. This form is essential for executors or administrators of estates to facilitate the recovery of any overpaid taxes on behalf of the deceased. It allows the rightful claimant to request a refund from the Internal Revenue Service (IRS) when the taxpayer has passed away and there are funds owed to the estate.

How to use the 1310 Form

Using the 1310 Form involves several steps to ensure proper completion and submission. First, the individual claiming the refund must fill out the form with accurate information regarding the deceased taxpayer, including their Social Security number and details about the tax return filed. Next, the claimant must provide their own information, indicating their relationship to the deceased. Finally, the completed form should be submitted along with any necessary documentation, such as the death certificate, to the IRS for processing.

Steps to complete the 1310 Form

To effectively complete the 1310 Form, follow these steps:

- Gather necessary documents, including the deceased's tax returns and death certificate.

- Provide the deceased taxpayer's information, including name, address, and Social Security number.

- Fill in the claimant's details, ensuring to specify the relationship to the deceased.

- Indicate the tax year for which the refund is being claimed.

- Sign and date the form, certifying the accuracy of the information provided.

Legal use of the 1310 Form

The legal use of the 1310 Form is governed by IRS regulations. It is crucial that the form is completed accurately and submitted in accordance with IRS guidelines to ensure that the claim for refund is valid. The form must be filed by the appropriate party, such as an executor or administrator, and should include all required supporting documentation to substantiate the claim. Failure to comply with these legal requirements may result in delays or denial of the refund request.

Filing Deadlines / Important Dates

Filing deadlines for the 1310 Form align with the general tax return deadlines set by the IRS. Typically, the form must be submitted within three years from the original due date of the tax return for which the refund is being claimed. It is important to keep track of these deadlines to ensure timely processing of the refund request. Additionally, if the deceased taxpayer had an extension for filing their tax return, the deadline for submitting the 1310 Form may also be extended accordingly.

Required Documents

When submitting the 1310 Form, several documents are required to support the claim. These typically include:

- A copy of the deceased taxpayer's tax return for the year in question.

- A certified copy of the death certificate.

- Any other documentation that may be relevant, such as proof of relationship to the deceased.

Form Submission Methods (Online / Mail / In-Person)

The 1310 Form can be submitted through various methods, depending on the preference of the claimant. The form can be mailed directly to the IRS at the address specified for tax returns, ensuring that all required documents are included. Currently, the IRS does not offer an online submission option for the 1310 Form. Therefore, it is essential to check the latest IRS guidelines for any updates regarding submission methods.

Quick guide on how to complete 1310 form

Finalize 1310 Form seamlessly on any gadget

Web-based document administration has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct template and securely keep it online. airSlate SignNow equips you with all the tools necessary to draft, edit, and eSign your documents swiftly without any hold-ups. Handle 1310 Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric task today.

How to modify and eSign 1310 Form with ease

- Find 1310 Form and click on Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign function, which takes mere seconds and holds the same legal significance as a conventional handwritten signature.

- Review all details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your selected device. Modify and eSign 1310 Form and guarantee excellent communication at any step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1310 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 1310 and why is it important?

The form 1310 is a document used to claim a refund on behalf of a deceased taxpayer. It is essential for executors and heirs to ensure any overpaid taxes are reimbursed. Submitting the form 1310 accurately can streamline the process of achieving a tax refund efficiently.

-

How can airSlate SignNow help me manage form 1310?

airSlate SignNow simplifies the process of completing and signing form 1310 with its intuitive interface. You can easily upload, fill out, and eSign the document, ensuring a smooth experience. This eliminates paperwork hassles and speeds up submission to the IRS.

-

What are the costs associated with using airSlate SignNow for form 1310?

airSlate SignNow offers flexible pricing plans that cater to different business needs. With competitive rates, you can access features like unlimited document signing and storage while using form 1310. Check our pricing page for a detailed comparison and find the right plan for you.

-

Is it safe to use airSlate SignNow for submitting form 1310?

Yes, airSlate SignNow prioritizes the security of your documents, including form 1310. We implement encryption and other security measures to protect your sensitive information, ensuring your submissions are safe and confidential. You can trust us with your important documents.

-

What features does airSlate SignNow offer for form 1310 users?

With airSlate SignNow, users can take advantage of features like customizable templates, document tracking, and electronic signing for form 1310. These features enhance efficiency and help you stay organized throughout the process of filing your tax refund.

-

Can I integrate airSlate SignNow with other tools for form 1310 processing?

Absolutely, airSlate SignNow offers integrations with various platforms such as Google Drive and Dropbox, facilitating a seamless workflow when handling form 1310. These integrations allow you to manage your documents and eSign them without disruption.

-

Does airSlate SignNow provide support for filling out form 1310?

Yes, airSlate SignNow offers customer support to assist you with any questions regarding form 1310. We provide resources and guidance to help you complete the form correctly and efficiently, making the eSigning process smooth.

Get more for 1310 Form

Find out other 1310 Form

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document