It 2104e Form

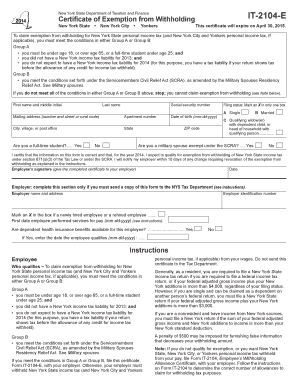

What is the It 2104e Form

The It 2104e Form is a tax document used in the United States, specifically for withholding purposes. This form is essential for employees who wish to adjust their state income tax withholding. By completing the It 2104e Form, individuals can ensure that the correct amount of tax is withheld from their paychecks, which can help prevent underpayment or overpayment of taxes. This form is particularly relevant for those who have specific tax situations, such as multiple jobs or significant deductions, allowing them to tailor their withholding to their financial needs.

How to use the It 2104e Form

Using the It 2104e Form involves a straightforward process. First, obtain the form from the appropriate state tax authority or download it from a reliable source. Next, fill out the required personal information, including your name, address, and Social Security number. It's important to accurately report your filing status and any allowances you are claiming. After completing the form, submit it to your employer, who will then adjust your withholding accordingly. Regularly reviewing your withholding status is advisable, especially if your financial situation changes throughout the year.

Steps to complete the It 2104e Form

Completing the It 2104e Form requires attention to detail. Follow these steps for accurate completion:

- Download the form from a reliable source or obtain it from your employer.

- Fill in your personal information, including your name, address, and Social Security number.

- Select your filing status: single, married, or head of household.

- Indicate the number of allowances you are claiming, which will affect your withholding amount.

- Review the completed form for accuracy.

- Submit the form to your employer for processing.

Legal use of the It 2104e Form

The It 2104e Form is legally recognized for tax withholding purposes in the United States. When completed accurately, it serves as a binding document that informs employers of the employee's desired withholding amounts. Compliance with state tax laws is essential, as improper use of the form can lead to penalties or incorrect tax payments. It is advisable to consult with a tax professional if there are any uncertainties regarding the completion or implications of the form.

Filing Deadlines / Important Dates

Filing deadlines for the It 2104e Form may vary depending on state regulations. Typically, employees should submit the form to their employer at the beginning of the tax year or whenever there is a change in their financial situation. It is crucial to stay informed about any specific deadlines set by the state tax authority to ensure compliance and avoid potential penalties. Regularly checking for updates on filing dates can help maintain accurate tax withholding throughout the year.

Examples of using the It 2104e Form

There are various scenarios in which an individual might need to use the It 2104e Form. For instance, a person who recently started a new job may want to adjust their withholding based on their expected income. Similarly, someone who has experienced a significant life change, such as marriage or the birth of a child, might need to update their allowances to reflect their new financial situation. Additionally, individuals with multiple income sources can use the form to ensure that their total tax withholding aligns with their overall tax liability.

Quick guide on how to complete it 2104e form

Effortlessly Prepare It 2104e Form on Any Device

Managing documents online has become a favored choice for businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage It 2104e Form on any platform using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to Modify and Electronically Sign It 2104e Form with Ease

- Find It 2104e Form and click Get Form to begin.

- Use the tools we provide to complete your form.

- Select relevant parts of the documents or hide sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Decide how you want to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of missing or lost documents, tedious form searching, or errors that necessitate creating new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device. Edit and electronically sign It 2104e Form and assure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 2104e form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the It 2104e Form?

The It 2104e Form is a tax document used by residents of New York to determine their state withholding tax status. It is essential for individuals looking to ensure the correct amount of taxes is withheld from their income. Using airSlate SignNow, you can easily create, send, and eSign your It 2104e Form without hassle.

-

How can airSlate SignNow help with the It 2104e Form?

AirSlate SignNow simplifies the process of managing the It 2104e Form by enabling you to fill it out online, collect necessary signatures, and send it securely. With our user-friendly platform, you can track the progress of your documents and ensure timely submission. It's an efficient solution for handling your tax forms.

-

Is airSlate SignNow cost-effective for managing the It 2104e Form?

Yes, airSlate SignNow offers a cost-effective solution for managing documents like the It 2104e Form. Our various pricing plans cater to businesses of all sizes, allowing you to choose an option that fits your budget. Save time and money by opting for our comprehensive eSignature services.

-

What features does airSlate SignNow offer for the It 2104e Form?

AirSlate SignNow includes features such as customizable templates, automatic reminders, and real-time tracking, which are highly beneficial for handling the It 2104e Form. Our platform also supports in-app messaging for easier communication with signers. Enhance your workflow with these helpful functionalities.

-

Are electronic signatures on the It 2104e Form legally binding?

Yes, electronic signatures on the It 2104e Form are legally binding in the United States, including New York. AirSlate SignNow adheres to the Electronic Signatures in Global and National Commerce (ESIGN) Act, ensuring your documents hold up in court. Trust our secure platform to handle your important tax documents.

-

Can I integrate airSlate SignNow with other software for the It 2104e Form?

Absolutely! AirSlate SignNow integrates seamlessly with various software tools to enhance your workflow when handling the It 2104e Form. You can easily connect to CRMs, cloud storage, and productivity applications, streamlining the entire document management process.

-

How secure is airSlate SignNow when working with the It 2104e Form?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and secure servers to protect your sensitive data while you manage the It 2104e Form. Additionally, we comply with industry standards to ensure your information remains confidential and secure.

Get more for It 2104e Form

- Ia rights form

- Iowa contract land 497304815 form

- Contract for deed sellers annual accounting statement iowa form

- Notice of default for past due payments in connection with contract for deed iowa form

- Notice default form 497304818

- Assignment of contract for deed by seller iowa form

- Notice of assignment of contract for deed iowa form

- Contract for sale and purchase of real estate with no broker for residential home sale agreement iowa form

Find out other It 2104e Form

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template