Form 941 SS Rev January Irs

What is the Form?

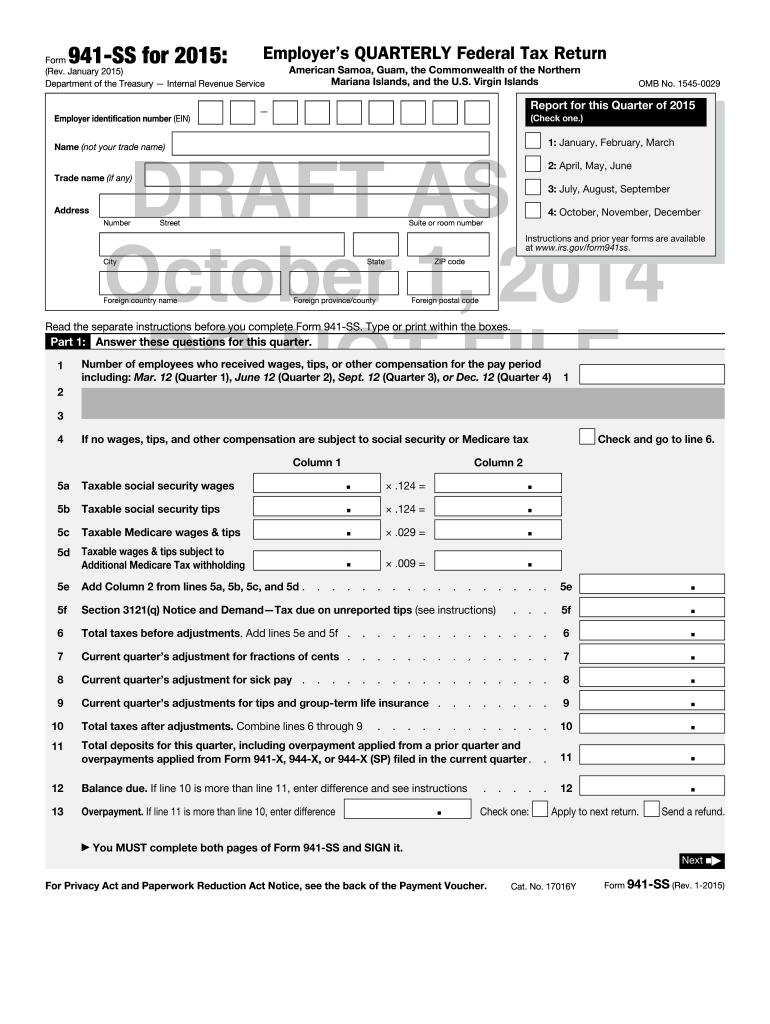

The Form 941 for 2015 is a quarterly tax form used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is essential for businesses to comply with federal tax regulations. It provides the IRS with information about the number of employees, wages paid, and the taxes withheld. Employers must file this form every quarter, ensuring that they accurately report their tax obligations to avoid penalties.

Steps to Complete the Form

Completing the Form 941 for 2015 involves several key steps:

- Gather Employee Information: Collect details about your employees, including their names, Social Security numbers, and wages paid during the quarter.

- Calculate Taxes Withheld: Determine the total amount of federal income tax, Social Security tax, and Medicare tax withheld from employee wages.

- Fill Out the Form: Enter the collected information into the appropriate sections of the Form. Ensure accuracy to prevent issues with the IRS.

- Review and Sign: Double-check all entries for correctness. The form must be signed by an authorized person to validate the submission.

- Submit the Form: File the completed Form with the IRS by the due date, either electronically or by mail.

Filing Deadlines / Important Dates

It is crucial for employers to be aware of the filing deadlines for the Form. The due dates for each quarter are as follows:

- First Quarter: April 30, 2015

- Second Quarter: July 31, 2015

- Third Quarter: October 31, 2015

- Fourth Quarter: January 31, 2016

Filing on time helps avoid penalties and interest on unpaid taxes.

Form Submission Methods

Employers have several options for submitting the Form:

- Online Submission: The IRS offers e-filing options through approved software providers, which can streamline the process and ensure timely submission.

- Mail: Employers can print the completed form and mail it to the appropriate IRS address based on their location.

- In-Person: Some employers may choose to deliver the form directly to their local IRS office, although this method is less common.

Penalties for Non-Compliance

Failure to file the Form on time can result in significant penalties. Employers may face:

- Late Filing Penalty: A penalty of five percent of the unpaid tax amount for each month the return is late, up to a maximum of 25 percent.

- Failure to Pay Penalty: A penalty of 0.5 percent of the unpaid tax amount for each month the tax remains unpaid.

These penalties can add up quickly, making timely filing critical for compliance.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form. Employers should refer to these guidelines to ensure compliance:

- Follow the instructions provided with the form to understand each section's requirements.

- Keep accurate records of employee wages and tax withholdings to support the information reported on the form.

- Stay updated on any changes to tax laws that may affect the completion of the form.

Quick guide on how to complete form 941 ss rev january 2015 irs

Easily Prepare Form 941 SS Rev January Irs on Any Device

Managing documents online has become widespread among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow offers all the features necessary to create, modify, and eSign your documents swiftly without delays. Handle Form 941 SS Rev January Irs on any device using the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

How to Modify and eSign Form 941 SS Rev January Irs Effortlessly

- Obtain Form 941 SS Rev January Irs and click on Get Form to begin.

- Utilize the features we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign Form 941 SS Rev January Irs and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

I am 2015 passed out CSE student, I am preparing for GATE2016 from a coaching, due to some reasons I do not have my provisional certificate, am I still eligible to fill application form? How?

Yes you are eligible. There is still time, application closes on October 1 this year. So if you get the provisional certificate in time you can just wait or if you know that you won't get it in time, just mail GATE organising institute at helpdesk@gate.iisc.ernet.in mentioning your problem. Hope it helps.

Create this form in 5 minutes!

How to create an eSignature for the form 941 ss rev january 2015 irs

How to generate an electronic signature for your Form 941 Ss Rev January 2015 Irs online

How to create an electronic signature for the Form 941 Ss Rev January 2015 Irs in Google Chrome

How to generate an electronic signature for signing the Form 941 Ss Rev January 2015 Irs in Gmail

How to create an electronic signature for the Form 941 Ss Rev January 2015 Irs from your smart phone

How to generate an electronic signature for the Form 941 Ss Rev January 2015 Irs on iOS devices

How to make an eSignature for the Form 941 Ss Rev January 2015 Irs on Android OS

People also ask

-

What is form 941 2015 and why is it important?

Form 941 2015 is the Employer's Quarterly Federal Tax Return used to report income taxes, social security tax, and Medicare tax withheld from employee's paychecks. It's important for businesses, as accurate filing ensures compliance with IRS regulations and helps avoid penalties.

-

How can airSlate SignNow assist with form 941 2015?

airSlate SignNow enables businesses to streamline the signing process for form 941 2015 with its digital signature capabilities. This helps ensure that important tax documents are signed quickly and securely, facilitating timely submission to the IRS.

-

Is there a cost associated with using airSlate SignNow for form 941 2015?

Yes, airSlate SignNow offers a range of pricing plans to accommodate different business needs. Each plan includes features to simplify the signing of form 941 2015, providing a cost-effective solution for businesses looking to manage their tax documents efficiently.

-

What features does airSlate SignNow provide for handling form 941 2015?

airSlate SignNow offers features such as customizable templates, automated reminders, and secure cloud storage, all of which enhance the management of form 941 2015. These features allow businesses to reduce errors and improve their workflow when dealing with tax documents.

-

Can I integrate airSlate SignNow with other software for form 941 2015?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and payroll software, making it easy to manage form 941 2015 alongside your existing systems. This integration helps streamline processes and ensures that all data is current and accurately captured.

-

What are the benefits of using airSlate SignNow for form 941 2015?

Using airSlate SignNow for form 941 2015 simplifies the signing process, reduces paperwork, and enhances security. Additionally, it allows for easy tracking of document status, ensuring that you meet your filing deadlines without hassle.

-

Is electronic signing of form 941 2015 legally valid?

Yes, electronic signatures provided by airSlate SignNow are legally valid and comply with the ESIGN Act. This ensures that your signed form 941 2015 is recognized by the IRS and other governmental agencies.

Get more for Form 941 SS Rev January Irs

Find out other Form 941 SS Rev January Irs

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors