Wv W4 Form

What is the WV W4?

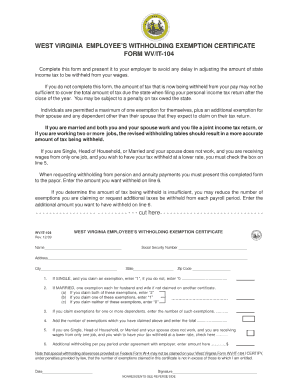

The WV W4 form, also known as the West Virginia State Withholding Form, is a crucial document for employees in West Virginia. It is used to determine the amount of state income tax that should be withheld from an employee's paycheck. This form allows individuals to specify their filing status, exemptions, and any additional withholding amounts they wish to have deducted. Proper completion of the WV W4 ensures that employees meet their tax obligations while avoiding over-withholding, which can affect take-home pay.

How to Use the WV W4

Using the WV W4 form involves several straightforward steps. First, employees should obtain the form from their employer or download it from the official state website. Next, individuals fill out their personal information, including their name, address, and Social Security number. The form requires employees to select their filing status and indicate the number of exemptions they are claiming. It is essential to review the completed form for accuracy before submitting it to the employer, as this will directly impact tax withholding amounts.

Steps to Complete the WV W4

Completing the WV W4 form requires careful attention to detail. Follow these steps for accurate completion:

- Obtain the WV W4 form from your employer or the state’s official website.

- Fill in your personal details, including your name, address, and Social Security number.

- Select your filing status (single, married, etc.) from the provided options.

- Indicate the number of exemptions you are claiming based on your personal circumstances.

- Consider any additional withholding amounts if applicable.

- Review the form for accuracy and sign it before submission.

Legal Use of the WV W4

The WV W4 form is legally binding and must be completed accurately to comply with state tax laws. It is essential for employees to understand that providing false information on this form can lead to penalties, including fines or additional tax liabilities. The form must be updated whenever there are significant changes in personal circumstances, such as marriage, divorce, or the birth of a child, to ensure proper withholding.

State-Specific Rules for the WV W4

West Virginia has specific rules governing the use of the WV W4 form. Employees must adhere to state income tax regulations, which dictate how withholding is calculated based on income levels and exemptions. It is important to stay informed about any changes in state tax laws that may affect the completion of the form. Additionally, employers are responsible for ensuring that the forms are collected and processed in compliance with state requirements.

Form Submission Methods

Once the WV W4 form is completed, it can be submitted to the employer through various methods. The most common method is to hand-deliver the form directly to the payroll or human resources department. Alternatively, some employers may accept electronic submissions via secure email or online portals. It is advisable to confirm with the employer regarding their preferred submission method to ensure timely processing.

Quick guide on how to complete wv w4

Complete Wv W4 smoothly on any device

Managing documents online has become favored by businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed papers, as you can obtain the correct form and securely keep it online. airSlate SignNow delivers all the tools you require to create, alter, and eSign your documents quickly and without interruptions. Handle Wv W4 on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Wv W4 effortlessly

- Obtain Wv W4 and click on Get Form to initiate.

- Utilize the tools we provide to finish your document.

- Mark relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choosing. Alter and eSign Wv W4 and ensure exceptional communication at any step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wv w4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the WV state withholding form and why do I need it?

The WV state withholding form is essential for employers in West Virginia to report and withhold state income taxes from employees' paychecks. This form ensures compliance with state tax regulations and helps employees accurately manage their tax liabilities. Using airSlate SignNow, you can easily complete and submit the WV state withholding form digitally.

-

How can airSlate SignNow assist in filling out the WV state withholding form?

AirSlate SignNow offers a user-friendly platform that streamlines the completion of the WV state withholding form. You can easily input employee information, add electronic signatures, and securely share the form with your payroll department. This simplifies the entire process, saving you time and reducing errors.

-

Is airSlate SignNow a cost-effective solution for managing the WV state withholding form?

Yes, airSlate SignNow provides an affordable solution for managing the WV state withholding form, eliminating the need for costly paper processes. Our pricing plans cater to businesses of all sizes, offering flexibility and scalability as your needs evolve. Transitioning to our eSignature platform can also save you money on in-house printing and mailing costs.

-

What features does airSlate SignNow offer for the WV state withholding form?

AirSlate SignNow includes features such as customizable templates, real-time tracking, and integrated cloud storage, all of which enhance your experience when managing the WV state withholding form. Additionally, the platform allows for secure signature collection and automated reminders, ensuring that your forms are submitted on time without hassle.

-

Can I integrate airSlate SignNow with my existing payroll software for the WV state withholding form?

Absolutely! AirSlate SignNow integrates seamlessly with various payroll software, making it easy to automate the process of completing and submitting the WV state withholding form. This integration helps maintain accurate records, streamlines your workflow, and ensures that your tax compliance efforts are efficient.

-

What benefits does using airSlate SignNow bring when handling the WV state withholding form?

Utilizing airSlate SignNow for the WV state withholding form enhances efficiency and accuracy in your payroll processes. The platform minimizes paperwork and provides a secure method for collecting necessary signatures. Additionally, you gain the ability to track form status and manage submissions from anywhere, increasing your operational flexibility.

-

Are there templates available for the WV state withholding form in airSlate SignNow?

Yes, airSlate SignNow offers customizable templates for the WV state withholding form, making it effortless to prepare and send to employees. These templates can be tailored to meet specific business needs, ensuring that all necessary information is included without starting from scratch. This feature saves you valuable time and enhances accuracy.

Get more for Wv W4

Find out other Wv W4

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online