Puerto Rico Form as 2745 a 2003

What is the Puerto Rico Form AS 2745 A

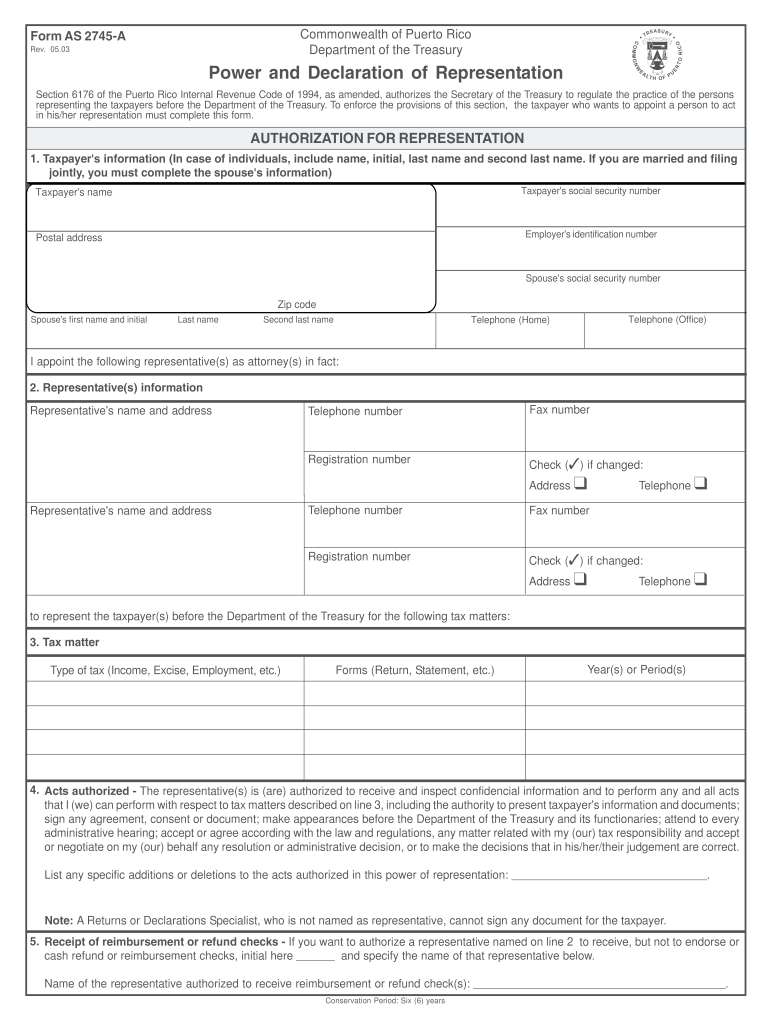

The Puerto Rico Form AS 2745 A is an official document used for reporting specific tax information to the Puerto Rico Department of the Treasury. This form is primarily utilized by individuals and businesses to comply with local tax regulations. It serves as a means to report income, deductions, and credits, ensuring that taxpayers fulfill their obligations under Puerto Rican tax law. Understanding this form is essential for accurate tax reporting and compliance.

How to use the Puerto Rico Form AS 2745 A

Using the Puerto Rico Form AS 2745 A involves several steps to ensure proper completion and submission. First, gather all necessary financial documents, including income statements and previous tax returns. Next, fill out the form with accurate information, ensuring that all required fields are completed. After filling out the form, review it for any errors or omissions. Once verified, the form can be submitted either online or through traditional mail, depending on your preference and the guidelines provided by the Department of the Treasury.

Steps to complete the Puerto Rico Form AS 2745 A

Completing the Puerto Rico Form AS 2745 A requires careful attention to detail. Follow these steps:

- Obtain the form from the official Puerto Rico Department of the Treasury website or other authorized sources.

- Collect all relevant financial documents, such as W-2s, 1099s, and receipts for deductions.

- Fill in personal information, including your name, address, and taxpayer identification number.

- Report your income accurately, ensuring that all sources of income are included.

- Detail any deductions and credits you are eligible for, following the instructions provided on the form.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline, either electronically or via mail.

Legal use of the Puerto Rico Form AS 2745 A

The legal use of the Puerto Rico Form AS 2745 A is governed by the tax laws of Puerto Rico. This form must be completed and submitted in accordance with these laws to ensure compliance. Failure to use the form correctly can result in penalties, including fines or additional taxes owed. It is important to keep a copy of the submitted form and any supporting documents for your records, as these may be needed in case of an audit or review by tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Puerto Rico Form AS 2745 A are crucial for taxpayers to meet to avoid penalties. Generally, the form must be submitted by the designated due date, which is typically aligned with the federal tax filing deadline. It is advisable to check the official Puerto Rico Department of the Treasury website for specific dates each tax year, as they may vary. Marking these dates on your calendar can help ensure timely submission and compliance.

Form Submission Methods (Online / Mail / In-Person)

The Puerto Rico Form AS 2745 A can be submitted through various methods, providing flexibility for taxpayers. The available submission methods include:

- Online: Submit the form electronically through the Puerto Rico Department of the Treasury's online portal, which may offer quicker processing times.

- Mail: Send a printed version of the completed form to the designated address provided by the Department of the Treasury.

- In-Person: Deliver the form directly to a local Department of the Treasury office, if available, for immediate processing.

Quick guide on how to complete puerto rico form as 2745 a 2003

Your assistance manual on how to prepare your Puerto Rico Form As 2745 A

If you're wondering how to finalize and submit your Puerto Rico Form As 2745 A, here are a few straightforward instructions on how to simplify tax reporting.

To begin, you just need to create your airSlate SignNow profile to revolutionize the way you manage documents online. airSlate SignNow is a user-friendly and powerful document solution that enables you to modify, draft, and complete your tax paperwork effortlessly. With its editor, you can shift between text, checkboxes, and eSignatures and revisit to edit answers where necessary. Optimize your tax oversight with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your Puerto Rico Form As 2745 A in a matter of minutes:

- Create your account and start working on PDFs within minutes.

- Utilize our directory to locate any IRS tax form; browse through versions and schedules.

- Select Get form to open your Puerto Rico Form As 2745 A in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-binding eSignature (if applicable).

- Review your document and rectify any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Use this manual to submit your taxes electronically with airSlate SignNow. Keep in mind that submitting by mail can lead to return errors and delay refunds. Certainly, before e-filing your taxes, consult the IRS website for submission regulations in your area.

Create this form in 5 minutes or less

Find and fill out the correct puerto rico form as 2745 a 2003

FAQs

-

If Puerto Rico or somewhere else gets statehood, what might a 51-star US flag look like?

In the canton (the blue field).Beyond that, it’s impossible to say in advance. The most likely design is something like this:But there are other ideas:Or this one:The design of the canton, indeed of the entire flag, is not anywhere set in law. The law only requires that there be one white star per state in a blue canton to the upper left, and that the balance of the flag be white and red stripes alternating, to total six white and seven red. The remainder of the details are not specified in law.The specific design of the canton to be used on official US flags is set forth by executive order, but that simply specifies what sort of flags the US government will buy for official use. You are free to make a US flag with any pattern of stars you like. Most flags sold to the public do not comport with the specification for government use as they’re usually the wrong height-to-width ratio.If the United States gains a state, the President will ultimately decide what the design of the new canton will be, and the President’s decision will be binding on all federal agencies including the military. It is likely that the President will delegate this decision to a committee of some sort, and that citizens will be invited to submit designs in a competition, as happened in 1958 in anticipation of the accession of Alaska and Hawaii to statehood, resulting in the 49-star flag that flew from July 4, 1959 until July 3, 1960, and the 50-star flag that has flown since July 4, 1960.

-

How do we have 10 billion for a damn wall but are quick to pull help out of Puerto Rico as we still help New Orleans?

The facts of the US financial situation tell us that there isn’t money for a wall nor is there money for Puerto Rico’s so called recovery or any area’s recovery for that matter (the government isn’t even close to the most effective way to find recovery, so let’s be grateful private businesses get an opportunity to serve potential customers as they desire to be). There isn’t money for much of anything. The US government has been spending stolen funds as if there’s no end to the flow.This video with Professor Antony Davies offers perspective on how the government has no chance to resolve this problem without drastic changes in their spending. Further taxation won’t solve it. Massive cuts in spending is the only way.This video, again with Professor Davies, helps us visualize how horrific the US government budget has been neglected and abused.Personally I don’t feel any responsibility for the abuse, neglect, or any of the debt at all. The bureaucrats who have plundered productive individuals in society are responsible. Instead of feeling responsible, I feel it’s best to find a way to donate time, money, and effort to needs I feel are worthy of that time, money, and effort. As a large group of individual actors we can make a much more signNow difference than the outrageously inefficient government.

-

Puerto Rico's electric grid was wiped out by a hurricane. Why don't they rebuild it underground as opposed to on poles?

Money.According to Wikipedia, power lines cost about $10/foot, while underground cable ducts cost $20-$40 per foot (more in cities). If Puerto Rico were a state, we would be the poorest state in the Union (Mississippi, America’s poorest state, had a median household income of $41,754 in 2016, compared with Puerto Rico’s $18,626 - and I shudder to think what that last figure is going to look like in the new post-Maria reality).Federal disaster recovery funding expressly pays to replace the existing infrastructure, not improve it. And there *is* no funding except disaster funding.There was a time when America invested in infrastructure. That era is long past. We’re just coasting as long as we can, at this point.

-

How difficult is Castilian to understand as a Spanish speaker from Puerto Rico?

Castilian is Spanish.It’s two names for the same exact thing, Spanish originated in Castile, and “Castilian” is used mostly in Spain to differentiate it from the other co-official languages.The only thing a Puerto Rican would notice in Spain is a different accent, the use of the θ sound for z and the soft c, some different idioms and slang words, and the use of vosotros instead of ustedes.That’s it.Basically like someone from California can understand British English.

-

How do US citizens feel about Puerto Rico adding a star to the US flag as propaganda for statehood?

Well, my first response was "They did that? Interesting." In all honestly, most Americans just don't think of Puerto Rican statehood. Statehood for the District of Columbia is more of an issue, because DC is very vocal about it. But even then, I'm biased, having lived near, though not in, DC for twenty five years now. I suppose you could say I support Puerto Rican statehood in that I'd be for it if it came to a Congressional vote and the people of Puerto Rico clearly favored it. It's hardly a big issue for me, though. Others might oppose it, but very few would get really angry about it, with the exception of bigots who don't want a Hispanic state added to the Union. As for the tactic of adding a star, I think it's probably ill-considered. The words "publicity stunt" spring to mind. I'd say it's most likely to tick off people who view the flag as sacred and inviolable.

-

How is it that when you fill out a form, "Asian" is somehow listed as one race?

It’s worse than that: on most forms that have only a few options (Joseph Boyle is right that the US Census now gets more specific), Asians-and-Pacific-Islanders is all one group. That means from the Maori through Indonesia and Polynesia, then Vietnam, straight up past Mongolia, and east out to Japan and west right out past India — all one “race”. Why?Because racism, that’s why.To be specific, because historically in the US the only racial difference that counted was white/black — that is, white and and not-white. For centuries that was how distinctions of race and (implied) class were made. There were quite a few court cases where light-skinned Japanese (etc) petitioned to be declared white — they usually weren’t — and where dark-skinned South Asians (etc) petitioned to be declared non-black — which sometimes worked. In fact, it worked so well that some American Blacks donned turbans and comic-opera inaccurate “Eastern” garb to perform more widely as an “Indian” musician than they’d ever be allowed to do in their original identity.So in the 1800s, there was white and Black. Period. Well, ok, and Native Americans, but to the people that mattered, they hardly counted (and were all dead, anyhow, right?). As colonialism and rising globalization brought more and more people who were neither white nor black to North America, there became an increasing dilemma about how to classify this cacophonous mob of confusing non-white people.Eventually the terms “Arab” and “Asian” came to be widely used, and some classifiers (see also Why is "Caucasian" a term used to label white people of European descent? ) also separated Pacific islander from the general morass of “Asian”. But in general, everyone from the Mysteeeeerious East was just called one thing, unless you felt you needed to specify a country.So, like I said: racism. And a racist tendency to dismiss as unimportant distinctions between different groups of “unimportant” people.

-

How will Puerto Rico's status as a US territory affect its recovery from Hurricane Maria (compared to a state like Texas or Florida)?

In the short term, the federal government will continue to provide aid under federal disaster declarations for Irma and Maria. Some expenses will be unique or unavailable for the territory (can't easily send in trucks to restore power lines, more military closer to assist than most states). When FEMA needs more money, some politicians may have some issue with the funding (i.e. Ted Cruz with Super Storm Sandy) but generally these emergency funding measures go through relatively quickly. While many Americans may not want to help a “foreign” land, many industries (like cruise lines) and Puertorican ex-pats (more Puerto Ricans live in Florida or Greater NYC than on the island) will provide support.In the long term, Puerto Rico may need special help with long term debt. Puerto Rico, and her various local governments, cannot declare bankruptcy and are excluded from many fiscal relief efforts States take advantage of. This was already an issue before the storms with default and bailout talks. Without changing this, it will be difficult or impossible for Puerto Rico to get back on it's fiscal feet.

Create this form in 5 minutes!

How to create an eSignature for the puerto rico form as 2745 a 2003

How to make an electronic signature for your Puerto Rico Form As 2745 A 2003 online

How to generate an eSignature for your Puerto Rico Form As 2745 A 2003 in Google Chrome

How to generate an eSignature for signing the Puerto Rico Form As 2745 A 2003 in Gmail

How to generate an electronic signature for the Puerto Rico Form As 2745 A 2003 right from your smart phone

How to make an electronic signature for the Puerto Rico Form As 2745 A 2003 on iOS

How to create an electronic signature for the Puerto Rico Form As 2745 A 2003 on Android devices

People also ask

-

What is Puerto Rico Form As 2745 A?

Puerto Rico Form As 2745 A is a tax form used by businesses to report specific financial information to the Puerto Rico government. It is essential for ensuring compliance with tax regulations and accurately presenting your financials. Utilizing airSlate SignNow can simplify the completion and submission processes for this form.

-

How does airSlate SignNow assist with Puerto Rico Form As 2745 A?

airSlate SignNow provides users with an intuitive platform to create, sign, and send Puerto Rico Form As 2745 A seamlessly. The tool enables you to streamline the entire process, reducing the time spent on documentation and ensuring that all forms are filled out accurately and efficiently.

-

What are the pricing options for using airSlate SignNow for Puerto Rico Form As 2745 A?

airSlate SignNow offers various pricing plans to accommodate different business needs when dealing with Puerto Rico Form As 2745 A. Our flexible pricing models are designed to be cost-effective, allowing you to select a plan that fits your budget while providing all the necesary features for efficient document management.

-

Can I integrate airSlate SignNow with other software for Puerto Rico Form As 2745 A?

Yes, airSlate SignNow offers integration capabilities with a variety of software platforms, enhancing your experience with Puerto Rico Form As 2745 A. You can easily connect with CRM, project management tools, and cloud storage solutions to streamline your workflows and improve efficiency.

-

What are the benefits of using airSlate SignNow for Puerto Rico Form As 2745 A?

Using airSlate SignNow for Puerto Rico Form As 2745 A provides numerous benefits, such as fast processing, improved accuracy, and reduced paperwork. The platform helps you manage your documents electronically, ensuring that you can access, sign, and store forms securely and efficiently at any time.

-

Is airSlate SignNow secure for handling Puerto Rico Form As 2745 A?

Absolutely! airSlate SignNow prioritizes the security of your documents, including Puerto Rico Form As 2745 A. The platform employs industry-leading encryption standards and compliance measures to ensure that all your sensitive information remains protected throughout the transmission and storage processes.

-

Can airSlate SignNow be used on mobile devices for Puerto Rico Form As 2745 A?

Yes, airSlate SignNow is fully compatible with mobile devices, allowing you to manage Puerto Rico Form As 2745 A on the go. You can easily access the application from your smartphone or tablet, making it convenient to review, sign, and send documents anytime, anywhere.

Get more for Puerto Rico Form As 2745 A

Find out other Puerto Rico Form As 2745 A

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement