Commonwealth of Puerto Rico Form 2907 Fillable

What is the Commonwealth of Puerto Rico Form 2907 Fillable

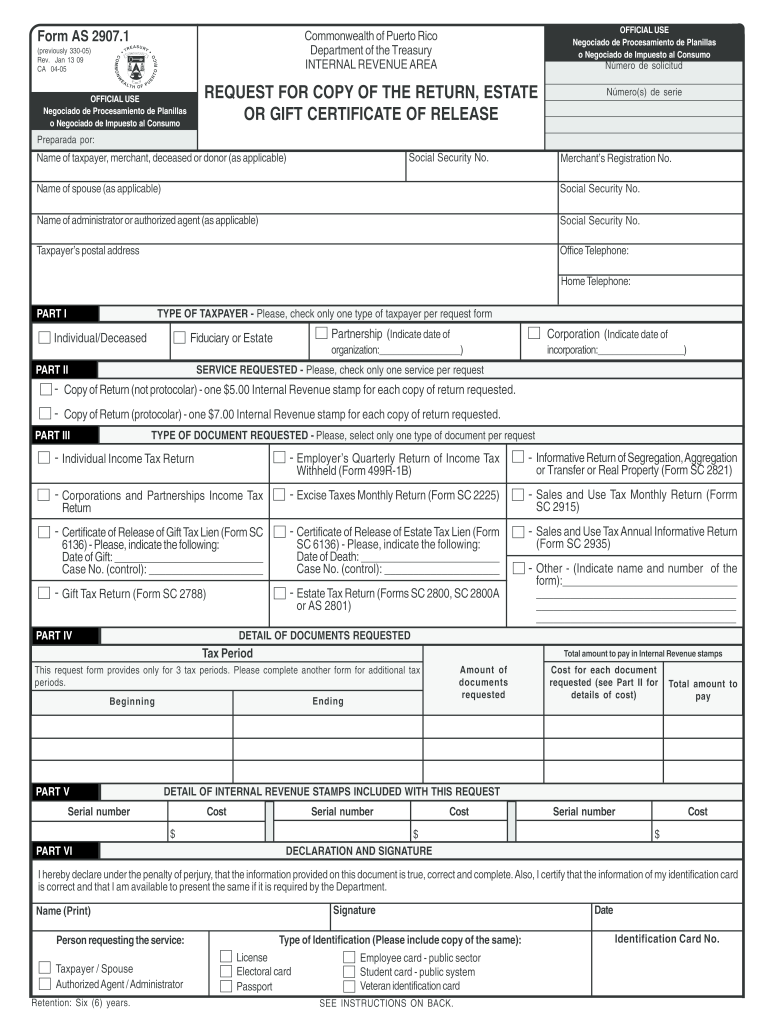

The Commonwealth of Puerto Rico Form 2907 is a specific document used for reporting certain financial transactions, particularly related to gift certificates. This form is essential for individuals and businesses that need to disclose information regarding the issuance and redemption of gift certificates. The fillable version of Form 2907 allows users to complete the document electronically, ensuring a more efficient and organized process. By utilizing a digital format, users can easily input their information, save their progress, and submit the form without the hassle of printing and mailing.

How to use the Commonwealth of Puerto Rico Form 2907 Fillable

Using the Commonwealth of Puerto Rico Form 2907 fillable version is straightforward. Begin by downloading the form from a reliable source. Once you have the form open, you can enter the required information directly into the designated fields. It is important to ensure that all sections are completed accurately to avoid any delays in processing. After filling out the form, review the information for accuracy before saving the document. The fillable format allows for easy corrections and adjustments, making it user-friendly for all individuals.

Steps to complete the Commonwealth of Puerto Rico Form 2907 Fillable

Completing the Commonwealth of Puerto Rico Form 2907 involves several key steps:

- Download the fillable form from a trusted source.

- Open the form using a compatible PDF reader.

- Fill in the required fields, including personal and financial information.

- Review the completed form for any errors or omissions.

- Save the document to your device.

- Submit the form according to the specified submission methods.

Following these steps ensures that the form is filled out correctly and submitted in a timely manner.

Legal use of the Commonwealth of Puerto Rico Form 2907 Fillable

The Commonwealth of Puerto Rico Form 2907 is legally binding when completed and submitted in accordance with applicable regulations. It is important to understand that the information provided on this form must be accurate and truthful, as any discrepancies can lead to legal repercussions. Utilizing a secure and compliant platform for digital signatures further enhances the legal standing of the form. Compliance with local laws and regulations is crucial to ensure that the form fulfills its intended purpose.

Key elements of the Commonwealth of Puerto Rico Form 2907 Fillable

Several key elements are essential when completing the Commonwealth of Puerto Rico Form 2907:

- Personal Information: This includes the name, address, and contact details of the individual or business submitting the form.

- Transaction Details: Information regarding the specific gift certificates being reported, including amounts and dates of issuance.

- Signature: A digital signature may be required to validate the form, confirming that the information provided is accurate.

- Submission Date: The date on which the form is completed and submitted is crucial for compliance with deadlines.

Ensuring that these elements are accurately filled out is vital for the successful processing of the form.

Form Submission Methods

The Commonwealth of Puerto Rico Form 2907 can be submitted through various methods, depending on the preferences of the user and the requirements of the issuing authority. Common submission methods include:

- Online Submission: Many users opt for online submission, which allows for immediate processing and confirmation.

- Mail: Users can print the completed form and send it via postal service to the designated address.

- In-Person Submission: Some individuals may choose to submit the form in person at relevant government offices for immediate assistance.

Choosing the appropriate submission method is essential to ensure timely processing and compliance with regulations.

Quick guide on how to complete request for copy of the return estate or gift certificate form

Effortlessly Prepare Commonwealth Of Puerto Rico Form 2907 Fillable on Any Device

Digital document management has become widely embraced by enterprises and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and efficiently. Manage Commonwealth Of Puerto Rico Form 2907 Fillable on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented tasks today.

The Easiest Way to Edit and eSign Commonwealth Of Puerto Rico Form 2907 Fillable with Ease

- Obtain Commonwealth Of Puerto Rico Form 2907 Fillable and click Get Form to begin.

- Utilize the tools at your disposal to fill out your document.

- Highlight important sections of the documents or obscure sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your updates.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced paperwork, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Modify and eSign Commonwealth Of Puerto Rico Form 2907 Fillable and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I have lost my fourth year certificate in classical music which is required to fill the form for fifth year. How can I get a copy of my certificate?

Contact institute from where you’ve been appearing for examination. Assuming you’ve 3rd year certificate, share your registration with the institute and also inform that you’ve appeared for 4th year examination and explain the situation. They’re the only people who can help you get the new certificate if feasible.If they might not get your certificate back, ask for consent letter to appear for 5th year examination, giving all the necessary details required.Also, get in touch with your examination center coordinator for any other help if required. And yes, frequent follow ups are necessary as the process might get longer time than required.Hope this would help you resolve problem you’re facing.

-

When is it too late to return a customer’s call or email? On my website customers can fill out a quote request form and leave their number. If someone sends one at 9 pm should I wait until the morning or should I call immediately?

The longer you leave it, the lower the response rate is.If you look at the advertising for Hubspot, one of the things they do is trigger pop-ups when people open your emails so that you can contact the customer. They cite some research on the effectiveness of doing this rather than contacting the customer the next day.Personally I find this a bit creepy, but I have to acknowledge that it is true. I have a ‘request a free demo’ link on my website. Clicking it triggers an email to my team asking them to create a demo system, which takes about an hour to do. I had the site reviewed a while back and one of the strongest pieces of feedback was that I had to automate the creation of a demo. Everybody who clicks that button will be distracted by something else in an hour.That said, I would not phone a customer at 9PM because I’d be worried about disturbing them at home, I’d email back straight away instead and include in that email a line requesting permission to call. If they reply saying “sure, give me a call now” then you’re all good, and if they don’t reply then I’d wait until regular business hours.

-

How can I write a request letter to the principal for a Xerox copy of a certificate in a degree?

Request such as yours go to the administration office. Call the schools administration office and ask what the procedure is to get a copy of the certificate. You maybe told to come in show your identification, sign a release and they would provide you with a certified copy that you have the certification or degree.

Create this form in 5 minutes!

How to create an eSignature for the request for copy of the return estate or gift certificate form

How to create an electronic signature for the Request For Copy Of The Return Estate Or Gift Certificate Form online

How to make an electronic signature for your Request For Copy Of The Return Estate Or Gift Certificate Form in Chrome

How to create an eSignature for putting it on the Request For Copy Of The Return Estate Or Gift Certificate Form in Gmail

How to create an electronic signature for the Request For Copy Of The Return Estate Or Gift Certificate Form straight from your smartphone

How to create an eSignature for the Request For Copy Of The Return Estate Or Gift Certificate Form on iOS devices

How to create an eSignature for the Request For Copy Of The Return Estate Or Gift Certificate Form on Android OS

People also ask

-

What is the Commonwealth Of Puerto Rico Form 2907 Fillable?

The Commonwealth Of Puerto Rico Form 2907 Fillable is a digital version of the tax form that allows users to complete and submit their tax information electronically. This fillable form simplifies the process of filing taxes in Puerto Rico, making it more efficient and accessible.

-

How can I obtain the Commonwealth Of Puerto Rico Form 2907 Fillable?

You can easily access the Commonwealth Of Puerto Rico Form 2907 Fillable through airSlate SignNow's platform. Simply visit our website, navigate to the forms section, and download the fillable version for immediate use.

-

Is the Commonwealth Of Puerto Rico Form 2907 Fillable compatible with mobile devices?

Yes, the Commonwealth Of Puerto Rico Form 2907 Fillable is designed to be mobile-friendly. You can fill out and sign the form using your smartphone or tablet, ensuring you can complete your tax filing on the go.

-

What features does airSlate SignNow offer for the Commonwealth Of Puerto Rico Form 2907 Fillable?

airSlate SignNow provides several features for the Commonwealth Of Puerto Rico Form 2907 Fillable, including easy eSigning, form collaboration, and secure document storage. These tools enhance your experience and streamline the filing process.

-

Are there any costs associated with using the Commonwealth Of Puerto Rico Form 2907 Fillable through airSlate SignNow?

While the Commonwealth Of Puerto Rico Form 2907 Fillable is accessible for free, airSlate SignNow offers premium features that may incur costs. Pricing plans vary based on the features you choose, ensuring you can find a solution that fits your budget.

-

Can I integrate the Commonwealth Of Puerto Rico Form 2907 Fillable with other applications?

Absolutely! airSlate SignNow allows seamless integration of the Commonwealth Of Puerto Rico Form 2907 Fillable with various applications. This enables you to enhance your workflow and streamline document management across different platforms.

-

What are the benefits of using airSlate SignNow for the Commonwealth Of Puerto Rico Form 2907 Fillable?

Using airSlate SignNow for the Commonwealth Of Puerto Rico Form 2907 Fillable offers numerous benefits, including quick access to forms, enhanced security through encrypted signing, and improved efficiency in document handling. These features help you save time and ensure accuracy.

Get more for Commonwealth Of Puerto Rico Form 2907 Fillable

- Instructions for the pseampg residential application for gas pseg form

- Doj form 201a us department of justice justice

- Voluntary self identification form

- 27 pine street lewiston me 04240 application form

- Athlete waiver form

- Capricorn college for fet polokwane form

- Financial information sheet nvr mortgage

- 24 35 01rules of the outfitters and guides licensing board form

Find out other Commonwealth Of Puerto Rico Form 2907 Fillable

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now