Financial Information Sheet NVR Mortgage 2009-2026

What is the Financial Information Sheet for NVR Mortgage

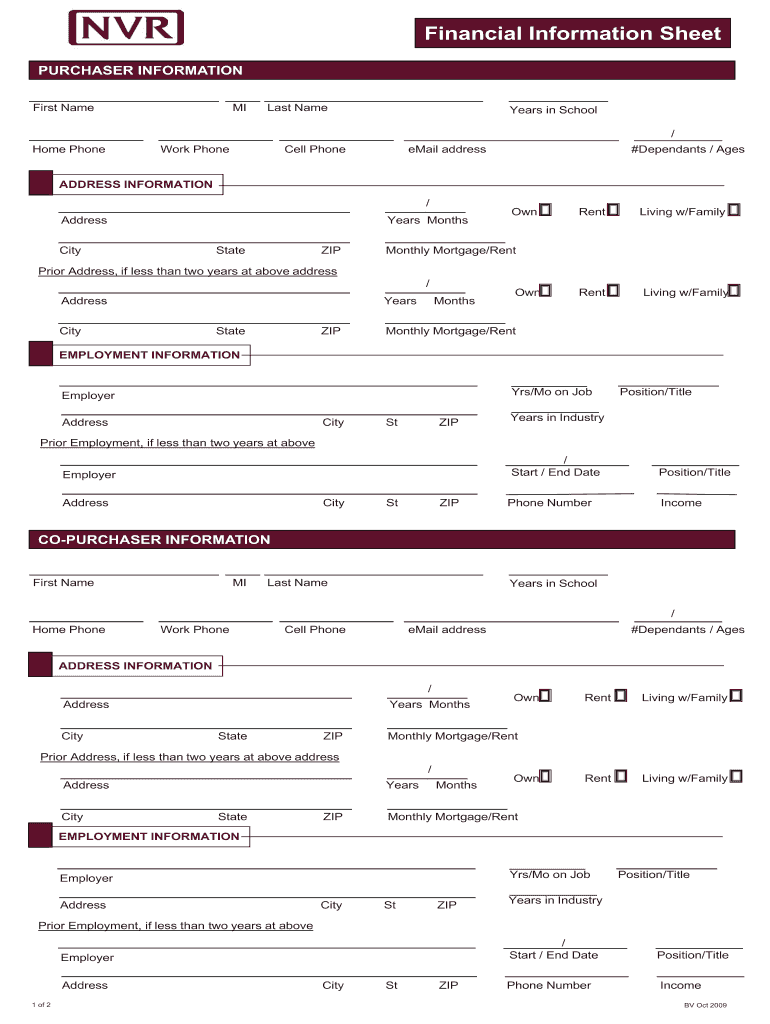

The Financial Information Sheet for NVR Mortgage is a crucial document that outlines a borrower's financial status. It includes details such as income, assets, debts, and credit history. This sheet is used by lenders to assess the borrower's ability to repay the mortgage. Providing accurate and comprehensive information on this sheet is essential for a smooth mortgage application process.

Key elements of the Financial Information Sheet for NVR Mortgage

Several key elements must be included in the Financial Information Sheet to ensure it meets the requirements set by lenders:

- Income Information: This includes salary, bonuses, and any other sources of income.

- Asset Details: List of assets such as savings accounts, real estate, and investments.

- Debt Obligations: All current debts, including credit cards, car loans, and student loans.

- Credit History: A summary of the borrower’s credit score and any relevant credit accounts.

Steps to complete the Financial Information Sheet for NVR Mortgage

Completing the Financial Information Sheet involves several steps:

- Gather Financial Documents: Collect pay stubs, bank statements, tax returns, and other relevant documents.

- Fill Out Personal Information: Enter your name, address, and contact information at the top of the sheet.

- Detail Income Sources: Clearly list all sources of income, ensuring to include any additional earnings.

- List Assets and Debts: Provide a comprehensive list of assets and liabilities to give a complete financial picture.

- Review and Sign: Double-check all information for accuracy before signing the document.

How to obtain the Financial Information Sheet for NVR Mortgage

The Financial Information Sheet can typically be obtained directly from NVR Mortgage or through their official website. It may also be available at local branches or through mortgage brokers. Ensure you have the most recent version of the sheet to meet current requirements.

Legal use of the Financial Information Sheet for NVR Mortgage

The Financial Information Sheet must be completed and submitted in accordance with federal and state regulations. This document serves as a legal declaration of your financial status and is used by lenders to make informed decisions regarding mortgage applications. Misrepresentation or inaccuracies can lead to legal repercussions, including denial of the mortgage application.

Eligibility Criteria for NVR Mortgage

To qualify for an NVR Mortgage, borrowers generally need to meet specific eligibility criteria, which may include:

- Minimum credit score requirements.

- Proof of stable income and employment history.

- Debt-to-income ratio limits.

- Verification of assets and savings.

Quick guide on how to complete financial information sheet nvr mortgage

The simplest method to locate and endorse Financial Information Sheet NVR Mortgage

At the level of an entire organization, ineffective procedures involving paper approval can consume a signNow amount of productive time. Endorsing documents such as Financial Information Sheet NVR Mortgage is an inherent aspect of operations in any enterprise, which is why the productivity of each agreement's lifecycle has a substantial impact on the overall efficiency of the business. With airSlate SignNow, endorsing your Financial Information Sheet NVR Mortgage is as straightforward and speedy as possible. You will discover with this platform the latest version of virtually any document. Even better, you can endorse it on the spot without the need to install external software on your machine or print anything as physical copies.

How to obtain and endorse your Financial Information Sheet NVR Mortgage

- Explore our repository by category or use the search bar to locate the document you require.

- Examine the form preview by clicking on Learn more to ensure it's the correct one.

- Hit Get form to begin editing immediately.

- Fill out your form and include any essential details using the toolbar.

- When finished, click the Sign tool to endorse your Financial Information Sheet NVR Mortgage.

- Select the signature method that is most suitable for you: Draw, Create initials, or upload a picture of your handwritten signature.

- Click Done to finalize editing and proceed to document-sharing options as required.

With airSlate SignNow, you possess everything necessary to manage your documents effectively. You can find, complete, edit, and even send your Financial Information Sheet NVR Mortgage in one tab without complications. Enhance your workflows by utilizing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How do I fill out FAFSA without my kid seeing all my financial information?

You will have a FSA ID. Keep it somewhere secure and where you can find it when it is needed again over the time your kid is in college. Use this ID to “sign” the parent’s part of the FAFSA.Your student will have their own FSA ID. They need to keep it somewhere secure and where they can find it when it is needed again over the time they are in college. They will use the ID to “sign” their part of the FAFSA.There is no need to show your student your part of the FAFSA. I do suggest you just casually offer to help your student fill out their part of the form.The Parent’s Guide to Filling Out the FAFSA® Form - ED.gov BlogThe FAFSA for school year 2018–19 has been available since October 1. Some financial aid is first come-first served. I suggest you get on with this.How to Fill Out the FAFSA, Step by StepNotes:Reading the other answers brings up some other points:The student pin was replaced by the parent’s FSA ID and the student’s FSA ID in May, 2015. Never the twain need meet.Families each need to deal with three issues in their own way:AffordabilityIf you read my stuff you know I am a devotee of Frank Palmasani’s, Right College, Right Price. His book describes an “affordability” exercise with the parents and the student. The purpose is to determine what the family can afford to spend on post-secondary education and to SET EXPECTATIONS. He’s not talking about putting your 1040 on the dining room table, but sharing some of the basics of family finances.I get the impression that many families ignore this issue. I have a study that shows five out of eight students assume their families are going to pay for college regardless of cost. Most of these students are in for a big surprise.PrivacySome parents may want to hold their “financial cards” closer to their chest than others. In my opinion that’s OK. I suppose an 18 year old kid, theoretically, has the right to keeping his finances private. My approach to this would not be to make a big deal out of it but to offer to help them fill out their part of the FAFSA. The main objective should be to get the FAFSA filled out properly, in a timely fashion.FraudThis is absolutely not acceptable, and, hopefully, those who try it get caught and suffer the consequences. (I had a conversation with a father recently who was filling out the CSS Profile. He wasn’t intent on committing fraud. He thought he was being clever in defining assets. After our conversation he had to file a signNow revision. This revision was a good thing because two or three years from now his mistake was going to come to light. I’m not sure what the consequences of all that would have been, but, at a minimum, it would have been a big mess to unwind.)

-

How can I get information I copy and paste onto a sheet, to fill into the correct columns I want?

Use the tools on the Data…Get and Transform to import the data from its source onto the proper columns in Excel. This feature (formerly called PowerQuery is a native part of Excel 2016, and is available as an add-in for Excel 2010 & 2013.What can you do with Get and Transform? You can split or combine columns, remove unneeded columns or rows, add calculated columns, retrieve matching values from lookup tables, change text strings to upper or lower case, unpivot summarized data, and transpose data. Behind the scenes, Excel is making a little script that can be used to automate these operations in the future. So if this is a repetitive task (something you do every week or need to do on a bunch of files), it is well worth your while to build and debug the script.Sample problem performed using Get and TransformVideo clip showing Get and Transform in action

-

When Cognizant drops an email to you containing a candidate information sheet and asks you to fill out details and respond back, what does it mean?

A2AAre you an experienced person looking for a Job change? If yes, then the company HR might require your details for initial screening to schedule an interview.Myself being a developer here, I have given you a info as per my knowledge. If you need more information regarding this you can contact HR who has sent you the email.

-

What is the procedure for filling out the candidate information sheet of Cognizant online?

S Kiran's answer to What should every engineering student know before joining TCS, CTS, Wipro, Infosys, Accenture, HCL, or IBM?

-

How can I add my business location on instagram"s suggested locations?

Making a custom location on Instagram is actually quite easy and gives you an advantage to other businesses because it allows you to drive traffic via location.First off, Facebook owns Instagram; therefore, any location listed on Facebook also appears on Instagram. So you are going to need to create a business location on Facebook.So let’s dive into how to create a business location on Instagram.Make sure that you have enabled location services through the Facebook App or in your phone settings. If you are using an iPhone, select “Settings” → “Account Settings” → “Location” → “While Using The App”You need to create a Facebook check-in status. You do this by making a status and type the name of what you want your location to be called. For example “Growth Hustlers HQ”. Scroll to the bottom of the options and select “Add Custom Location” then tap on it!Now that you’ve created a custom location you need to describe it. It will ask you to choose which category describes your location, which you will answer “Business”.After choosing a category Facebook will ask you to choose a location. You can either choose “I’m currently here” or you can search for a location that you want to create for your business.Finally, publish your status. Congratulations! You have just created a custom location to be used on Facebook and Instagram.Now you are able to tag your business or a custom location on Instagram.If you have any questions about Social Media Marketing for businesses feel free to check out GrowthHustlers.com where you can find tons of resources about growing your Instagram following.

Create this form in 5 minutes!

How to create an eSignature for the financial information sheet nvr mortgage

How to generate an electronic signature for your Financial Information Sheet Nvr Mortgage online

How to create an eSignature for the Financial Information Sheet Nvr Mortgage in Chrome

How to create an eSignature for signing the Financial Information Sheet Nvr Mortgage in Gmail

How to create an eSignature for the Financial Information Sheet Nvr Mortgage from your smart phone

How to generate an eSignature for the Financial Information Sheet Nvr Mortgage on iOS

How to make an eSignature for the Financial Information Sheet Nvr Mortgage on Android OS

People also ask

-

What are the NVR mortgage credit score requirements for approval?

To qualify for an NVR mortgage, the credit score requirements typically start at 620. However, achieving a higher score can improve your chances of getting approved and may lead to better terms. It's essential to check with your lender for any specific requirements that may apply to your situation.

-

How do NVR mortgage credit score requirements affect interest rates?

The NVR mortgage credit score requirements directly impact the interest rates offered to borrowers. Higher credit scores generally lead to lower interest rates, as they indicate a lower risk to lenders. Staying informed about these requirements can help you secure a more favorable rate.

-

Can I improve my credit score to meet NVR mortgage credit score requirements?

Yes, you can improve your credit score to meet NVR mortgage credit score requirements by paying down existing debts, making timely payments, and avoiding new credit inquiries. Additionally, regularly reviewing your credit report for errors can be beneficial. Taking these steps can enhance your creditworthiness and increase your loan options.

-

What types of mortgages comply with NVR mortgage credit score requirements?

Various mortgage types comply with NVR mortgage credit score requirements, including conventional loans, FHA loans, and VA loans. Each type has specific conditions and benefits, so it’s crucial to understand how your credit score affects your eligibility. Consulting with a mortgage specialist can help you identify which option is best for you.

-

Are there any fees associated with meeting NVR mortgage credit score requirements?

While there are no specific fees for meeting NVR mortgage credit score requirements, lenders may charge origination or processing fees based on your credit profile. A lower credit score could lead to higher fees or mortgage insurance. It’s important to inquire about all potential costs when reviewing your loan options.

-

What documentation is needed to assess NVR mortgage credit score requirements?

To assess NVR mortgage credit score requirements, you typically need to provide documentation such as your credit report, income statements, tax returns, and employment verification. This information helps lenders gauge your creditworthiness and financial stability. Being prepared with complete documentation can streamline the approval process.

-

How can airSlate SignNow assist with the mortgage application process?

airSlate SignNow can streamline the mortgage application process by enabling you to eSign necessary documents quickly and securely. This ease of use can expedite the documentation needed to meet NVR mortgage credit score requirements. Utilizing SignNow allows you to focus more on managing your finances rather than logistical paperwork.

Get more for Financial Information Sheet NVR Mortgage

- Form 8815 exclusion of interest from series ee andform 8815 exclusion of interest from series ee andee bondstreasurydirect2020

- Ccataxciclevelandohuscca division of taxation form

- Kansas liquor license ownership abc 890 form

- 2020 2022 form irs publication 527 fill online printable fillable

- Estimated real estate taxes and operating expenses for form

- Schedule 2pdf schedule 2 department of the treasury internal revenue form

- Wwwsignnowcomfill and sign pdf form76952city of perrysburg declaration of estimated tax fill out

- Low income taxpayer clinicsinternal revenue service irs tax forms

Find out other Financial Information Sheet NVR Mortgage

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy