Estimate Federal Income Taxes for for Back Taxes or the for Current Tax Year with the Federal Income Tax Calculator Form

Understanding the Federal Income Tax Calculator for Back Taxes and Current Tax Year

The Federal Income Tax Calculator is a valuable tool designed to help individuals estimate their federal income taxes for both back taxes and the current tax year. This calculator simplifies the process of determining potential tax liabilities by taking into account various factors such as income, deductions, and credits. By inputting relevant financial information, users can gain insights into their tax obligations, which is especially useful for planning and compliance purposes.

How to Utilize the Federal Income Tax Calculator

Using the Federal Income Tax Calculator involves a straightforward process. First, gather necessary financial documents, including your income statements and any applicable deductions. Next, access the calculator and enter your financial details accurately. The calculator will then process this information and provide an estimate of your federal income tax liability. This estimate can assist you in understanding your tax situation and making informed decisions regarding payments or adjustments.

Key Elements of the Federal Income Tax Calculator

Several key elements influence the estimates provided by the Federal Income Tax Calculator. These include:

- Income Level: Your total income from all sources, including wages, dividends, and interest.

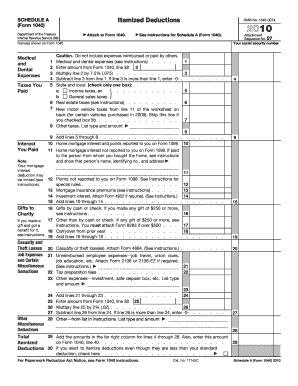

- Deductions: Standard or itemized deductions that can lower your taxable income.

- Tax Credits: Available credits that can directly reduce your tax liability.

- Filing Status: Your filing status, such as single, married filing jointly, or head of household, which affects tax rates and brackets.

Steps to Complete the Federal Income Tax Calculator

Completing the Federal Income Tax Calculator involves several steps:

- Collect all relevant financial documents.

- Access the calculator online.

- Input your total income accurately.

- Enter any deductions and credits you qualify for.

- Review the estimated tax liability generated by the calculator.

IRS Guidelines for Using the Federal Income Tax Calculator

The Internal Revenue Service (IRS) provides guidelines for estimating federal income taxes. It is important to ensure that the information entered into the calculator aligns with IRS regulations. This includes understanding the latest tax laws, rates, and allowable deductions. Users should refer to IRS publications or consult a tax professional if they have questions about specific tax situations or the accuracy of their estimates.

Examples of Using the Federal Income Tax Calculator

Examples of scenarios where the Federal Income Tax Calculator can be beneficial include:

- A self-employed individual estimating quarterly tax payments.

- A family determining their tax liability after significant life changes, such as marriage or the birth of a child.

- A retiree assessing tax implications on retirement income.

These examples illustrate how diverse situations can be effectively managed using the calculator, providing clarity and aiding in financial planning.

Quick guide on how to complete estimate federal income taxes for for back taxes or the for current tax year with the federal income tax calculator

Prepare [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and streamline any document-based workflow today.

The simplest method to modify and eSign [SKS] with ease

- Find [SKS] and click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Select important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes just moments and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to preserve your modifications.

- Decide how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searching, or errors requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Estimate Federal Income Taxes For For Back Taxes Or The For Current Tax Year With The Federal Income Tax Calculator

Create this form in 5 minutes!

How to create an eSignature for the estimate federal income taxes for for back taxes or the for current tax year with the federal income tax calculator

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the Federal Income Tax Calculator?

The Federal Income Tax Calculator is designed to help you estimate federal income taxes for back taxes or the current tax year. By inputting your financial information, you can quickly get an estimate of your tax obligations, making it easier to plan your finances.

-

How can I use the Federal Income Tax Calculator for back taxes?

To estimate federal income taxes for back taxes, simply enter your previous income details and any applicable deductions into the Federal Income Tax Calculator. This tool will provide you with an estimate of what you owe, helping you to address any outstanding tax liabilities.

-

Is the Federal Income Tax Calculator easy to use?

Yes, the Federal Income Tax Calculator is designed to be user-friendly and intuitive. With a straightforward interface, you can easily input your financial data and receive an estimate of federal income taxes for the current tax year or back taxes without any hassle.

-

Are there any costs associated with using the Federal Income Tax Calculator?

The Federal Income Tax Calculator is a cost-effective solution provided by airSlate SignNow. You can access the calculator without any fees, allowing you to estimate federal income taxes for back taxes or the current tax year without worrying about additional costs.

-

What features does the Federal Income Tax Calculator offer?

The Federal Income Tax Calculator includes features such as customizable input fields for various income sources and deductions. This allows you to accurately estimate federal income taxes for back taxes or the current tax year, ensuring you have a clear understanding of your tax situation.

-

Can I integrate the Federal Income Tax Calculator with other tools?

Yes, the Federal Income Tax Calculator can be integrated with other airSlate SignNow tools and services. This integration allows you to streamline your document management and eSigning processes while estimating federal income taxes for back taxes or the current tax year.

-

What are the benefits of using the Federal Income Tax Calculator?

Using the Federal Income Tax Calculator helps you gain clarity on your tax obligations, whether for back taxes or the current tax year. It empowers you to make informed financial decisions and avoid surprises during tax season, all while being part of airSlate SignNow's cost-effective solutions.

Get more for Estimate Federal Income Taxes For For Back Taxes Or The For Current Tax Year With The Federal Income Tax Calculator

- 943 employers annual federal tax return irs tax forms

- Form cdtfa 501 dg ampquotgovernment entity diesel fuel tax returnampquot california

- Instrucciones para el anexo b formulario 941 pr rev junio 2022 instrucciones para el anexo b formulario 941 pr registro de la

- 2022 instructions for schedule d 2022 instructions for schedule d capital gains and losses form

- 2022 form 1098 e student loan interest statement

- Instructions for schedule i form 1041 2020internalinstructions for schedule i form 1041 2020internalirs 1041 schedule i 2021

- Form 1040 nr schedule a

- Form 14039 sp rev 3 2022 identity theft affidavit spanish version

Find out other Estimate Federal Income Taxes For For Back Taxes Or The For Current Tax Year With The Federal Income Tax Calculator

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter

- How Can I Sign Kentucky Legal Quitclaim Deed

- Sign Kentucky Legal Cease And Desist Letter Fast

- Sign Maryland Legal Quitclaim Deed Now

- Can I Sign Maine Legal NDA

- How To Sign Maine Legal Warranty Deed

- Sign Maine Legal Last Will And Testament Fast

- How To Sign Maine Legal Quitclaim Deed

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed