1031 Exchange Worksheet Form

What is the 1031 Exchange Worksheet

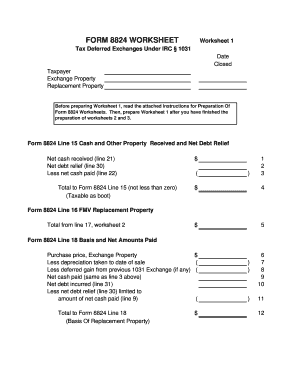

The 1031 Exchange Worksheet is a crucial document used by real estate investors to facilitate a like-kind exchange under Section 1031 of the Internal Revenue Code. This worksheet helps taxpayers defer capital gains taxes on the sale of an investment property by reinvesting the proceeds into a similar property. The worksheet includes essential information such as the properties involved, their values, and the timeline for the exchange. Proper completion of this form is vital for compliance with IRS regulations.

How to use the 1031 Exchange Worksheet

Using the 1031 Exchange Worksheet involves several steps. First, gather all relevant information about the properties involved in the exchange, including purchase prices, sales prices, and any associated costs. Next, accurately fill out the worksheet by entering this information in the designated fields. It is important to ensure that all values are correct and that the worksheet reflects the current status of the properties. After completing the worksheet, review it carefully to avoid any errors that could affect the exchange process.

Steps to complete the 1031 Exchange Worksheet

Completing the 1031 Exchange Worksheet requires attention to detail. Start by entering the details of the relinquished property, including its sale price and any selling expenses. Next, provide information about the replacement property, such as its purchase price and any acquisition costs. Be sure to include dates relevant to the exchange, like the date of sale and the deadline for acquiring the new property. Finally, double-check all entries for accuracy and completeness before submission.

Key elements of the 1031 Exchange Worksheet

Several key elements must be included in the 1031 Exchange Worksheet to ensure it meets IRS requirements. These include:

- Property Information: Details about both the relinquished and replacement properties.

- Sale and Purchase Prices: Accurate figures reflecting the financial aspects of the transaction.

- Timeline: Important dates related to the sale and purchase of properties.

- Identification of Replacement Property: Clear identification of the new property being acquired.

IRS Guidelines

The IRS provides specific guidelines for completing the 1031 Exchange Worksheet. These guidelines outline the requirements for the properties involved, the timeline for the exchange, and the documentation needed to support the transaction. It is essential to familiarize yourself with these guidelines to ensure compliance and to avoid potential penalties. Adhering to the IRS rules helps facilitate a smooth exchange process and maximizes tax benefits.

Required Documents

To complete the 1031 Exchange Worksheet, several documents are typically required. These may include:

- Sales contracts for both the relinquished and replacement properties.

- Closing statements from the sale and purchase transactions.

- Any appraisals or valuations of the properties involved.

- Documentation of any improvements made to the properties.

Gathering these documents in advance can streamline the completion of the worksheet and ensure all necessary information is readily available.

Quick guide on how to complete 1031 exchange worksheet

Prepare 1031 Exchange Worksheet effortlessly on any gadget

Virtual document management has become popular among companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct template and safely save it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage 1031 Exchange Worksheet across any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and eSign 1031 Exchange Worksheet effortlessly

- Obtain 1031 Exchange Worksheet and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you want to distribute your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign 1031 Exchange Worksheet to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1031 exchange worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1033 exchange worksheet?

A 1033 exchange worksheet is a crucial document used during the process of exchanging properties under IRS Section 1033. It helps users track their exchanges and ensure compliance with tax regulations. This worksheet aids in accurately reporting gains or losses related to involuntary property conversions.

-

How can airSlate SignNow help with 1033 exchange worksheets?

airSlate SignNow offers an intuitive platform that allows you to create, share, and eSign 1033 exchange worksheets easily. The solution streamlines the process, making it simple to manage your documentation while ensuring compliance. Our features enhance accessibility and collaboration among stakeholders in the exchange process.

-

Is there a cost associated with creating a 1033 exchange worksheet using airSlate SignNow?

Yes, there is a cost for using airSlate SignNow, but it provides a cost-effective solution for creating 1033 exchange worksheets. Our pricing plans are designed to fit various business needs, enabling you to efficiently manage your documents. A free trial is also available to explore our features before committing.

-

Can I integrate airSlate SignNow with other applications for 1033 exchange worksheets?

Absolutely! airSlate SignNow can easily integrate with a variety of applications to enhance your workflow for 1033 exchange worksheets. Whether it's accounting software, CRM systems, or other document management tools, our platform allows seamless integration to streamline your processes further.

-

What are the benefits of using airSlate SignNow for 1033 exchange documentation?

Using airSlate SignNow for your 1033 exchange documentation provides efficiency and security. With features like eSigning, cloud storage, and real-time collaboration, your paperwork becomes hassle-free. This boosts productivity and ensures all documents are securely stored and easily accessible.

-

Are there templates available for creating a 1033 exchange worksheet in airSlate SignNow?

Yes, airSlate SignNow offers templates specifically designed for creating 1033 exchange worksheets. These templates simplify the documentation process by providing a structured layout that you can easily customize to suit your needs. This feature minimizes errors and saves time in preparing your worksheets.

-

Is airSlate SignNow suitable for individuals and businesses needing 1033 exchange worksheets?

Yes, airSlate SignNow is versatile enough to cater to both individuals and businesses looking to manage 1033 exchange worksheets. Our user-friendly interface and robust features make it easy for anyone to create and manage their exchange documentation effectively. Whether you're dealing with personal involuntary conversions or larger business transactions, we have you covered.

Get more for 1031 Exchange Worksheet

- Employment employee personnel file package michigan form

- Assignment of mortgage package michigan form

- Assignment of lease package michigan form

- Lease purchase agreements package michigan form

- Cancellation release 497311677 form

- Michigan premarital form

- Painting contractor package michigan form

- Framing contractor package michigan form

Find out other 1031 Exchange Worksheet

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now