Colorado Tax Form 104 Printable

What is the Colorado Tax Form 104 Printable

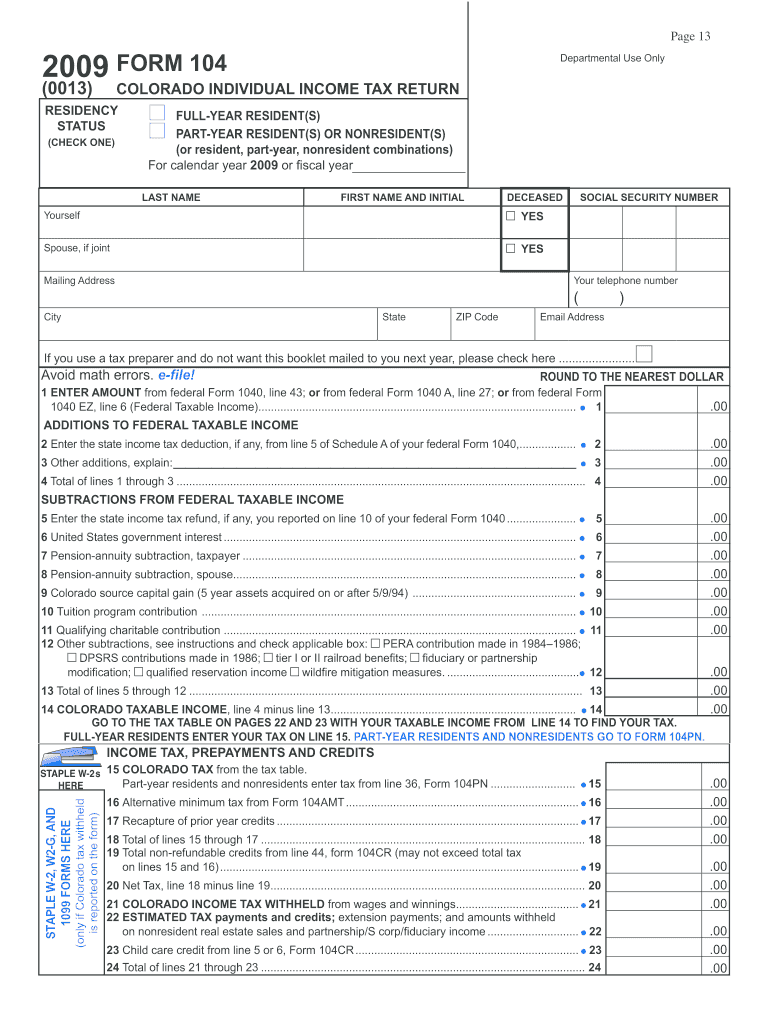

The Colorado Tax Form 104 is an essential document used by residents of Colorado to report their individual income tax to the state. This form is designed for individuals who earn income from various sources, including wages, self-employment, and investments. The Colorado 104 form allows taxpayers to calculate their tax liability based on their total income, deductions, and credits available under Colorado tax law. It is crucial for ensuring compliance with state tax regulations and for determining any tax refund or amount owed.

Steps to Complete the Colorado Tax Form 104 Printable

Completing the Colorado Tax Form 104 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documents, such as W-2s, 1099s, and records of other income. Next, fill out personal information, including your name, address, and Social Security number. Then, report your total income on the appropriate lines, followed by any deductions you qualify for. After calculating your taxable income, apply any credits to reduce your tax liability. Finally, review the completed form for accuracy before signing and dating it.

Legal Use of the Colorado Tax Form 104 Printable

The Colorado Tax Form 104 is legally binding when completed and submitted according to state regulations. To ensure that the form is recognized by tax authorities, it must be signed by the taxpayer. Electronic signatures, when executed through compliant platforms, are also valid. It is important to retain copies of the submitted form and any supporting documents for your records, as these may be requested by the Colorado Department of Revenue in the event of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the Colorado Tax Form 104 are typically aligned with federal tax deadlines. For most taxpayers, the due date is April 15 of each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers may also request an extension, allowing additional time to file, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Colorado Tax Form 104. The form can be filed electronically through approved e-filing services, which often provide a faster processing time and quicker refunds. Alternatively, taxpayers can print the completed form and mail it to the appropriate address listed on the form. In-person submissions are also accepted at local Colorado Department of Revenue offices, providing another option for those who prefer face-to-face interactions.

Key Elements of the Colorado Tax Form 104 Printable

The Colorado Tax Form 104 includes several key elements that are essential for accurate tax reporting. These elements consist of personal information sections, income reporting lines, deduction and credit claims, and the calculation of total tax owed or refunded. Understanding each section is vital for ensuring that all income is reported correctly and that eligible deductions and credits are applied. Additionally, the form includes instructions that guide taxpayers through the completion process, making it easier to navigate.

Quick guide on how to complete colorado tax form 104 printable

Prepare Colorado Tax Form 104 Printable easily on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a fantastic eco-friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Colorado Tax Form 104 Printable on any device through airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Colorado Tax Form 104 Printable effortlessly

- Find Colorado Tax Form 104 Printable and then click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight relevant sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choosing. Modify and eSign Colorado Tax Form 104 Printable and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the colorado tax form 104 printable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Colorado Form 104 instructions?

Colorado Form 104 instructions provide detailed guidance on how to complete the individual income tax return in Colorado. This includes information on required documents, eligibility criteria, and step-by-step instructions for filling out the form correctly to ensure compliance.

-

How can airSlate SignNow assist with Colorado Form 104 instructions?

airSlate SignNow simplifies the process of managing and eSigning documents related to Colorado Form 104 instructions. Our platform enables users to easily upload, share, and electronically sign important documents, streamlining your tax preparation workflow.

-

Are there any costs associated with using airSlate SignNow for Colorado Form 104 instructions?

Using airSlate SignNow offers cost-effective pricing plans to cater to your business needs. Our pricing structure ensures that you have access to efficient document management and eSigning solutions while complying with Colorado Form 104 instructions without breaking the bank.

-

What are the benefits of using airSlate SignNow for tax documents?

By utilizing airSlate SignNow, you can simplify and expedite the completion of tax documents, including Colorado Form 104 instructions. Benefits include easy access to templates, enhanced security for sensitive information, and the ability to track document status in real-time.

-

Can I integrate airSlate SignNow with other software for my Colorado Form 104 instructions?

Yes, airSlate SignNow supports integrations with various third-party applications to enhance your workflow. This means you can seamlessly connect your accounting software or tax preparation tools to better manage your Colorado Form 104 instructions and related documents.

-

What types of documents can I eSign related to Colorado Form 104 instructions?

With airSlate SignNow, you can eSign a variety of documents related to Colorado Form 104 instructions, including tax forms, consent forms, and supporting documentation. This feature allows for a more efficient tax filing process, ensuring that all necessary documents are completed and signed electronically.

-

Is airSlate SignNow user-friendly for someone unfamiliar with Colorado Form 104 instructions?

Absolutely! airSlate SignNow is designed with an intuitive interface, making it user-friendly even for individuals unfamiliar with Colorado Form 104 instructions. Our platform provides helpful guides and resources to assist users in navigating the eSigning process effectively.

Get more for Colorado Tax Form 104 Printable

Find out other Colorado Tax Form 104 Printable

- eSign Utah Share Transfer Agreement Template Fast

- How To eSign California Stock Transfer Form Template

- How Can I eSign Colorado Stock Transfer Form Template

- Help Me With eSignature Wisconsin Pet Custody Agreement

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free