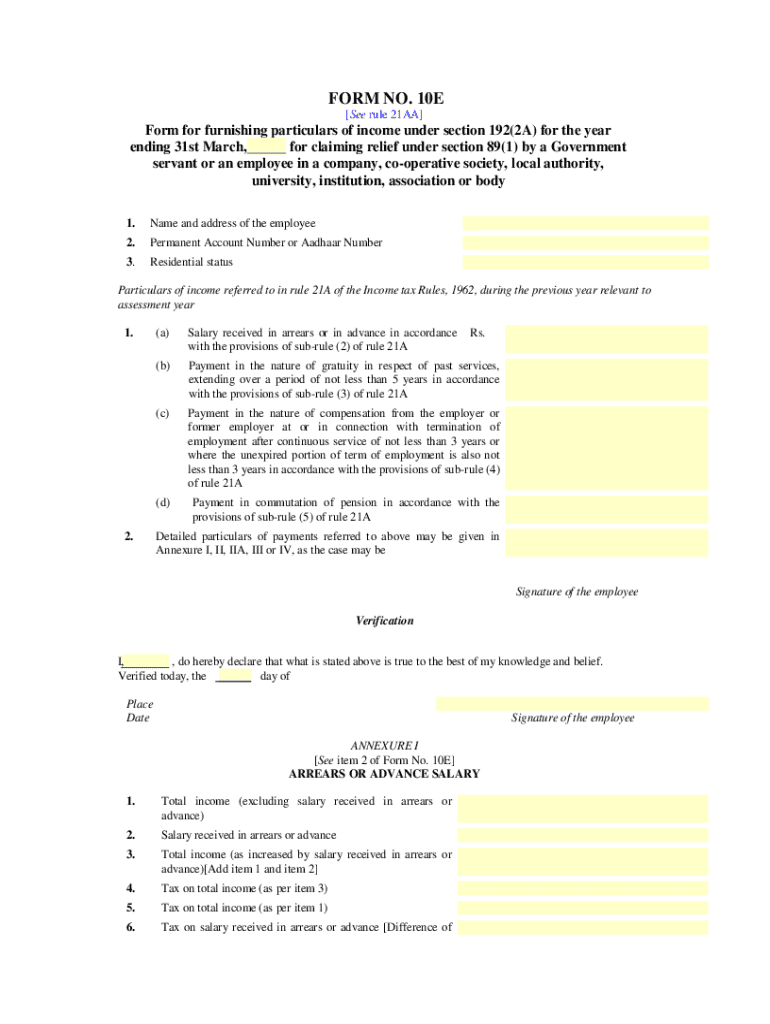

10e Form in Excel Format Ay 24 2019-2026

What is the form 10e income tax?

The form 10e income tax is a specific document used for reporting income and tax liabilities to the Internal Revenue Service (IRS). This form is essential for individuals and businesses to ensure compliance with U.S. tax laws. It captures detailed financial information, including income sources, deductions, and credits applicable to the taxpayer's situation. Understanding the purpose and structure of the form is crucial for accurate reporting and avoiding potential penalties.

Steps to complete the form 10e income tax online

Completing the form 10e income tax online involves several straightforward steps. First, download the form in PDF format from a reliable source. Next, gather all necessary financial documents, such as W-2s, 1099s, and any relevant receipts for deductions. Once you have the required information, open the form in a PDF editor or e-signature platform. Fill in the required fields accurately, ensuring that all information matches your supporting documents. After completing the form, review it for errors before electronically signing it. Finally, submit the form as per the IRS guidelines, either through e-filing or by mailing a printed copy.

IRS guidelines for form 10e income tax

The IRS provides specific guidelines for the completion and submission of the form 10e income tax. These guidelines include instructions on eligibility, required documentation, and deadlines for submission. It's essential to familiarize yourself with these rules to ensure compliance. The IRS also outlines acceptable methods for filing the form, including electronic submission and traditional mail. Adhering to these guidelines helps avoid delays in processing and potential penalties for non-compliance.

Required documents for form 10e income tax

To complete the form 10e income tax accurately, several documents are required. These typically include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Receipts for deductible expenses, such as medical costs or charitable contributions

- Previous year's tax return for reference

- Any other relevant financial documents that support your income and deductions

Having these documents on hand will streamline the process and help ensure that your form is filled out correctly.

Filing deadlines for form 10e income tax

Filing deadlines for the form 10e income tax are critical to avoid penalties. Typically, individual tax returns are due on April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It's important to note that extensions can be requested, but any taxes owed must still be paid by the original deadline to avoid interest and penalties. Keeping track of these dates will help ensure timely compliance with tax obligations.

Digital vs. paper version of the form 10e income tax

When considering the form 10e income tax, taxpayers have the option to complete it digitally or on paper. The digital version allows for easier editing, electronic signatures, and direct submission to the IRS, which can expedite processing times. Conversely, the paper version may be preferred by those who are more comfortable with traditional methods or who lack access to digital tools. Understanding the benefits and limitations of each format can help taxpayers choose the best option for their needs.

Quick guide on how to complete 10e form in excel format ay 24

Complete 10e Form In Excel Format Ay 24 effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow provides you with the necessary tools to create, edit, and eSign your documents quickly without delays. Handle 10e Form In Excel Format Ay 24 on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to edit and eSign 10e Form In Excel Format Ay 24 with ease

- Find 10e Form In Excel Format Ay 24 and click Get Form to begin.

- Use the tools available to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Verify all the information and click the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign 10e Form In Excel Format Ay 24 and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 10e form in excel format ay 24

Create this form in 5 minutes!

How to create an eSignature for the 10e form in excel format ay 24

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 10e income tax download?

The form 10e income tax download is a specific tax form required for filing certain income tax returns. It is designed to assist taxpayers in claiming deductions and ensuring compliance with federal regulations. You can easily access and fill out this form using airSlate SignNow's platform.

-

How can I get the form 10e income tax download?

You can get the form 10e income tax download directly from the airSlate SignNow website. Our platform provides an easy and hassle-free way to download and complete the form, ensuring you have the most updated version for your tax filing needs. Simply navigate to the resources section on our site.

-

Is airSlate SignNow free for downloading the form 10e income tax?

While airSlate SignNow offers a variety of features that include the form 10e income tax download, we have different pricing plans available. We recommend checking our pricing page to see which plan best suits your needs, as some features may require a subscription for unlimited access.

-

What features does airSlate SignNow offer for the form 10e income tax download?

airSlate SignNow offers several features for the form 10e income tax download, including electronic signing, document sharing, and secure storage. These features streamline the tax filing process, allowing you to manage your documents efficiently and safely, even on the go.

-

Can I integrate airSlate SignNow with other software for the form 10e income tax download?

Yes, airSlate SignNow offers integrations with various software applications that enhance the process of handling the form 10e income tax download. Our platform can seamlessly connect with popular tools such as CRM systems and cloud storage services to improve your workflow.

-

What are the benefits of using airSlate SignNow for the form 10e income tax download?

Using airSlate SignNow for the form 10e income tax download brings several benefits, including ease of use, speed, and security. Our platform ensures that you can complete your tax forms efficiently while keeping your sensitive information protected with top-notch security measures.

-

Is the form 10e income tax download compatible with mobile devices?

Absolutely! The form 10e income tax download is fully compatible with mobile devices when using airSlate SignNow. Our mobile-friendly interface allows you to fill out and sign your tax forms from anywhere, ensuring you never miss a deadline while on the go.

Get more for 10e Form In Excel Format Ay 24

- Notice of intent to vacate at end of specified lease term from tenant to landlord for residential property missouri form

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential missouri form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property missouri form

- Notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property 497313211 form

- Mo business entity form

- Notice sale form

- Agreed written termination of lease by landlord and tenant missouri form

- Missouri notice intended sale form

Find out other 10e Form In Excel Format Ay 24

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form