Pension Income Splitting Canada Ca Form

What is the Pension Income Splitting?

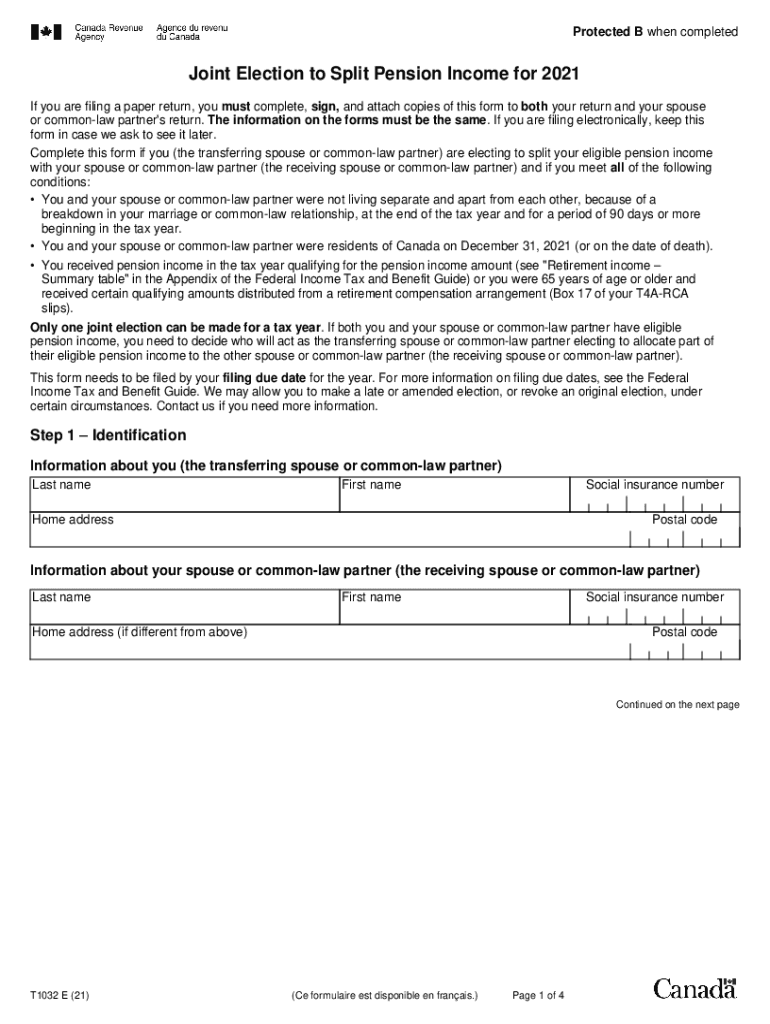

The Pension Income Splitting allows eligible individuals to allocate a portion of their pension income to their spouse or common-law partner for tax purposes. This can lead to potential tax savings by lowering the overall taxable income for the higher-earning partner. The process involves completing the form T1032, which is specifically designed for reporting this income split. Understanding the eligibility criteria and the types of income that qualify for splitting is essential for maximizing tax benefits.

Steps to Complete the Form T1032

Completing the T1032 form involves several key steps:

- Gather all necessary documentation, including details of your pension income and your spouse's income.

- Fill out the personal information section, ensuring accuracy in names and social security numbers.

- Report the total amount of eligible pension income you wish to split.

- Sign and date the form to validate the submission.

After completing the form, it can be submitted electronically or via mail, depending on your preference and the requirements of the IRS.

Eligibility Criteria for Pension Income Splitting

To qualify for pension income splitting, both partners must meet specific criteria. Generally, the individual receiving the pension must be at least fifty-five years old, and the pension income must be eligible for splitting. This includes amounts received from registered pension plans, registered retirement income funds, and certain annuities. Additionally, both partners must reside in the same household and file their taxes jointly to take advantage of the benefits.

IRS Guidelines for Pension Income Splitting

The IRS provides specific guidelines regarding the reporting and taxation of pension income splitting. It is crucial to follow these guidelines to ensure compliance and avoid any penalties. The IRS requires that both partners report their respective portions of the split income on their tax returns. Understanding these guidelines can help taxpayers navigate the complexities of filing and ensure they benefit from the tax advantages of income splitting.

Required Documents for Form T1032

When completing the T1032 form, certain documents are necessary to support your claims. These may include:

- Proof of pension income, such as statements from pension plans.

- Tax returns from the previous year for both partners.

- Any documentation that verifies the relationship status, such as marriage certificates or common-law declarations.

Having these documents ready will streamline the process and help ensure that all information is accurate and complete.

Form Submission Methods

The T1032 form can be submitted through various methods, including:

- Online submission via the IRS e-file system, which provides a quick and efficient way to file.

- Mailing a paper copy of the form to the appropriate IRS address.

- In-person submission at designated IRS offices, if preferred.

Choosing the right submission method can depend on personal preference and the urgency of the filing.

Quick guide on how to complete pension income splitting canada ca

Effortlessly Prepare Pension Income Splitting Canada ca on Any Device

Digital document management has gained traction among companies and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without complications. Handle Pension Income Splitting Canada ca on any gadget using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The easiest way to alter and eSign Pension Income Splitting Canada ca effortlessly

- Find Pension Income Splitting Canada ca and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet-ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method of submitting your form, either by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Pension Income Splitting Canada ca while ensuring effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pension income splitting canada ca

Create this form in 5 minutes!

How to create an eSignature for the pension income splitting canada ca

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form T1032 split income and why is it important?

The form T1032 split income is a tax form used in Canada that allows families to redistribute their income for taxation purposes. This is important because it can potentially reduce the overall tax burden for families, making it a vital tool in tax planning. Understanding how to properly complete this form is essential for maximizing tax benefits.

-

How does airSlate SignNow assist with the form T1032 split income process?

airSlate SignNow simplifies the process of completing and submitting the form T1032 split income by providing an efficient platform for eSigning and document management. Our intuitive interface allows users to fill out the form electronically and obtain necessary signatures quickly. This means less hassle and more time for clients to focus on their financial strategies.

-

What features does airSlate SignNow offer for form T1032 split income?

Key features of airSlate SignNow include customizable templates, secure eSignature capabilities, and real-time collaboration tools that enhance the workflow for completing the form T1032 split income. These features ensure that users can efficiently draft, edit, and finalize their documents without the typical paper-trail delays. Our platform is designed to streamline the experience from start to finish.

-

Is airSlate SignNow cost-effective for handling form T1032 split income?

Yes, airSlate SignNow is a cost-effective solution for handling the form T1032 split income. Our packages are designed to fit a range of budgets, making it accessible for both individuals and businesses seeking to minimize costs associated with document signing and management. With our competitive pricing, users can achieve signNow savings while ensuring compliance.

-

Can I integrate airSlate SignNow with other tools for the form T1032 split income?

Absolutely! airSlate SignNow offers seamless integrations with various applications that enhance your experience when handling the form T1032 split income. Whether you need to connect with accounting software or customer relationship management tools, our platform allows for easy integration, enriching overall functionality and user experience.

-

What are the benefits of using airSlate SignNow for form T1032 split income submissions?

Using airSlate SignNow for form T1032 split income submissions offers numerous benefits, including increased efficiency, reduced processing time, and enhanced security. With electronic signatures, your documents can be signed and sent in minutes instead of days. Additionally, our platform provides audit trails, ensuring that every action is recorded for compliance purposes.

-

How can I ensure the security of my form T1032 split income documents with airSlate SignNow?

Security is a top priority at airSlate SignNow. We employ advanced encryption protocols and secure access controls to protect your form T1032 split income and other sensitive documents. This ensures that your data remains confidential and safe from unauthorized access, giving you peace of mind throughout the signing process.

Get more for Pension Income Splitting Canada ca

- Tn quitclaim form

- Tennessee warranty deed for parents to child with reservation of life estate form

- Tennessee warranty deed form

- Texas beneficiary form

- Llc limited liability company tx form

- Tx corporation search form

- Texas quitclaim deed from husband and wife to husband and wife form

- Warranty deed real form

Find out other Pension Income Splitting Canada ca

- Help Me With Sign West Virginia Electrical Services Contract

- Can I Sign Wyoming Electrical Services Contract

- Sign Ohio Non-Solicitation Agreement Now

- How Can I Sign Alaska Travel Agency Agreement

- How Can I Sign Missouri Travel Agency Agreement

- How Can I Sign Alabama Amendment to an LLC Operating Agreement

- Can I Sign Alabama Amendment to an LLC Operating Agreement

- How To Sign Arizona Amendment to an LLC Operating Agreement

- Sign Florida Amendment to an LLC Operating Agreement Now

- How To Sign Florida Amendment to an LLC Operating Agreement

- How Do I Sign Illinois Amendment to an LLC Operating Agreement

- How Do I Sign New Hampshire Amendment to an LLC Operating Agreement

- How To Sign New York Amendment to an LLC Operating Agreement

- Sign Washington Amendment to an LLC Operating Agreement Now

- Can I Sign Wyoming Amendment to an LLC Operating Agreement

- How To Sign California Stock Certificate

- Sign Louisiana Stock Certificate Free

- Sign Maine Stock Certificate Simple

- Sign Oregon Stock Certificate Myself

- Sign Pennsylvania Stock Certificate Simple