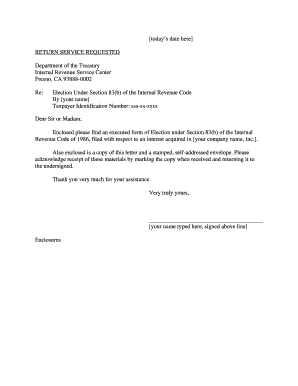

Sample 83b Form

What is the Sample 83b?

The Sample 83b is a tax election form that allows individuals to elect to include the value of restricted property in their gross income at the time of transfer, rather than when the property becomes vested. This election is particularly relevant for employees receiving stock options or restricted stock as part of their compensation package. By filing the Sample 83b, taxpayers can potentially reduce their overall tax liability by locking in the value of the stock at the time of transfer, which may be lower than its future value when it vests.

Steps to Complete the Sample 83b

Completing the Sample 83b involves a few straightforward steps:

- Fill out your personal information, including your name, address, and tax identification number.

- Provide details about the property being transferred, such as the type of property and the date of transfer.

- Indicate the fair market value of the property at the time of transfer.

- Sign and date the form to certify that the information provided is accurate.

Once completed, it is essential to retain a copy for your records and submit the form to the IRS within the required timeframe.

Legal Use of the Sample 83b

The Sample 83b is legally binding when properly completed and submitted within the designated time frame. It must comply with IRS regulations to ensure that the election is recognized. Failure to file the form correctly may result in significant tax implications, including the possibility of being taxed on the fair market value of the property when it vests, which could be higher than the value at the time of transfer.

Filing Deadlines / Important Dates

Timeliness is crucial when submitting the Sample 83b. The form must be filed with the IRS within thirty days of the property transfer date. Missing this deadline can lead to the loss of the election, resulting in unfavorable tax treatment. It is advisable to mark your calendar with important dates to ensure compliance.

Who Issues the Form

The Sample 83b is not issued by a specific agency but is a form that taxpayers create based on IRS guidelines. It is typically used by employees who receive stock options or restricted stock from their employers. Employers may provide guidance on how to fill out the form, but the responsibility for its completion and submission lies with the employee.

Examples of Using the Sample 83b

Consider a scenario where an employee receives restricted stock as part of their compensation package. By filing the Sample 83b, the employee elects to include the value of the stock in their income at the time of transfer. If the stock is valued at $10,000 at the time of transfer and later rises to $15,000 when it vests, the employee benefits by paying taxes on the lower amount. This election can be particularly advantageous in a rising market.

Quick guide on how to complete sample 83b

Prepare Sample 83b effortlessly on any device

Online document management has gained traction among organizations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to acquire the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents rapidly without delays. Manage Sample 83b on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Sample 83b without stress

- Locate Sample 83b and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow has specifically designed for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method of delivering your form, whether via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you choose. Modify and eSign Sample 83b and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sample 83b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 83b election, and why is it important?

The 83b election allows employees to accelerate taxation on their restricted stock or options at the time of grant rather than at vesting. This is important because it can lead to signNow tax savings and favorable capital gains treatment if the stock appreciates.

-

How can airSlate SignNow help with the 83b election process?

airSlate SignNow offers a seamless eSigning solution that simplifies the documentation process for the 83b election. Our platform ensures that your forms are completed, signed, and securely stored, making the filing process straightforward and efficient.

-

Is there a cost associated with filing an 83b election using airSlate SignNow?

While airSlate SignNow offers cost-effective solutions for document signing, the specific costs for filing an 83b election may vary. Our pricing plans are competitive, and the value of a streamlined eSigning experience can outweigh the fees.

-

What features does airSlate SignNow provide for managing 83b election documents?

airSlate SignNow provides features such as customizable templates, document tracking, and robust security measures to manage your 83b election documents efficiently. These features ensure that all necessary forms are easily accessible and properly signed.

-

Can I integrate airSlate SignNow with other tools for the 83b election?

Yes, airSlate SignNow integrates smoothly with various applications like CRMs and HR software to facilitate the management of the 83b election process. This allows for a streamlined workflow, ensuring you can handle all necessary documentation with ease.

-

What benefits does the 83b election offer to employees?

The 83b election offers employees potential tax advantages by allowing them to pay taxes on the fair market value of the stock at the time of granting. This can result in lower overall taxes if the stock increases in value, making it a vital consideration for those receiving equity compensation.

-

How do I ensure my 83b election is filed correctly?

To ensure your 83b election is filed correctly, it's crucial to use accurate documentation and the right forms. Utilizing airSlate SignNow’s eSigning features can help streamline this process while ensuring all forms are properly filled out and submitted timely.

Get more for Sample 83b

- Minutes consent 497314164 form

- Option to purchase stock short mississippi form

- Option to purchase stock long formal mississippi

- Petition for reinstatement of dissolved corporation mississippi form

- Mississippi declaratory judgment form

- Stipulation for dismissal mississippi form

- Complaint mississippi 497314173 form

- Full final release form

Find out other Sample 83b

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document