Wyoming Resale Certificate Form

What is the Wyoming Resale Certificate

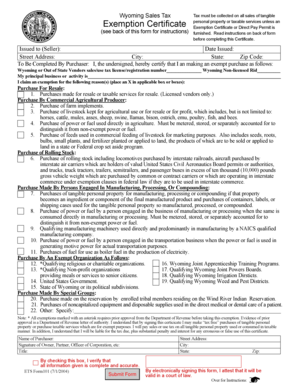

The Wyoming Resale Certificate is a document that allows businesses to purchase goods without paying sales tax, provided those goods are intended for resale. This certificate is essential for retailers and wholesalers who want to avoid the upfront costs associated with sales tax on inventory that will eventually be sold to consumers. By presenting this certificate to suppliers, businesses can streamline their purchasing process and manage their cash flow more effectively.

How to use the Wyoming Resale Certificate

To use the Wyoming Resale Certificate, a business must fill out the form accurately and present it to the seller at the time of purchase. The seller retains the certificate for their records and does not charge sales tax on the transaction. It is important for the buyer to ensure that the goods purchased are indeed for resale and not for personal use, as misuse of the certificate can lead to penalties.

Steps to complete the Wyoming Resale Certificate

Completing the Wyoming Resale Certificate involves several straightforward steps:

- Obtain the official resale certificate form from the Wyoming Department of Revenue or authorized sources.

- Fill in your business information, including name, address, and sales tax identification number.

- Specify the type of goods being purchased for resale.

- Sign and date the certificate to validate it.

Once completed, present the certificate to your supplier to facilitate tax-exempt purchases.

Legal use of the Wyoming Resale Certificate

The legal use of the Wyoming Resale Certificate is governed by state tax laws. Businesses must only use the certificate for items that they intend to resell. Misuse, such as purchasing items for personal use or for non-resale purposes, can result in penalties, including back taxes and fines. It is crucial for businesses to maintain accurate records and ensure compliance with state regulations to avoid any legal repercussions.

Eligibility Criteria

To be eligible for the Wyoming Resale Certificate, a business must be registered with the Wyoming Department of Revenue and possess a valid sales tax permit. The business must also be engaged in the sale of tangible personal property or taxable services. Non-profit organizations and certain government entities may have different eligibility requirements, so it is advisable to consult the relevant guidelines to ensure compliance.

Required Documents

When applying for the Wyoming Resale Certificate, businesses typically need to provide the following documents:

- A completed application form for the resale certificate.

- A copy of the business's sales tax permit.

- Identification documents that verify the business's legal status, such as Articles of Incorporation or a business license.

These documents help establish the legitimacy of the business and ensure that the resale certificate is issued appropriately.

Quick guide on how to complete wyoming resale certificate

Prepare Wyoming Resale Certificate effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely preserve it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Wyoming Resale Certificate on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

The simplest way to modify and eSign Wyoming Resale Certificate without hassle

- Obtain Wyoming Resale Certificate and click on Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and holds the same legal significance as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Wyoming Resale Certificate and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wyoming resale certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an exemption form taxable?

An exemption form taxable is a document that allows individuals or entities to claim certain tax exemptions. This form can help reduce a tax burden by clearly defining exemptions applicable under specific circumstances. Understanding how to properly complete and submit an exemption form taxable is crucial for compliance.

-

How does airSlate SignNow assist with exemption form taxable submissions?

airSlate SignNow streamlines the process of preparing and submitting exemption form taxable documents, ensuring accuracy and compliance. With its easy-to-use platform, users can quickly fill out forms, gather eSignatures, and manage document workflows efficiently. This reduces the time and hassle typically involved in tax-related document management.

-

What features does airSlate SignNow offer for managing exemption form taxable documents?

airSlate SignNow offers various features for managing exemption form taxable documents, including customizable templates, eSigning capabilities, and secure storage. Users can leverage workflow automation to track document status and ensure timely submissions. All these features work together to enhance document efficiency and organization.

-

Is airSlate SignNow a cost-effective solution for handling exemption form taxable?

Yes, airSlate SignNow is designed to be a cost-effective solution for handling exemption form taxable documents. With competitive pricing packages tailored for businesses of all sizes, it enables users to save money while maximizing efficiency. This affordability makes it accessible for startups and large enterprises alike.

-

Can I integrate airSlate SignNow with other applications for exemption form taxable processes?

Absolutely! airSlate SignNow offers seamless integration with various applications, enhancing the management of exemption form taxable processes. Integrations with popular tools such as CRM systems and accounting software ensure that your workflow remains smooth and interconnected. This flexibility helps businesses maintain efficiency across platforms.

-

What benefits can businesses expect from using airSlate SignNow for exemption form taxable management?

Using airSlate SignNow for exemption form taxable management provides numerous benefits, including improved accuracy and faster processing times. The platform simplifies the document workflow, allowing seamless collaboration among team members and stakeholders. Moreover, users can access documents from anywhere, which promotes remote work flexibility.

-

How secure is the data when using airSlate SignNow for exemption form taxable?

Security is a top priority for airSlate SignNow, especially when handling sensitive information like exemption form taxable documents. The platform employs advanced encryption and authentication measures to protect user data. This commitment to security ensures compliance and fosters trust among users.

Get more for Wyoming Resale Certificate

- Heirship 481378034 form

- Closing real estate 481378036 form

- Illinois limited power of attorney for stock transactions and corporate powers form

- Illinois special durable power of attorney for bank account matters form

- Indiana commercial building or space lease form

- Indiana bmv form

- Dnr 481378042 form

- Ks corporations form

Find out other Wyoming Resale Certificate

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement