Dtf 723 Form

What is the Dtf 723 Form

The Dtf 723 Form is a document used in the state of New York for tax purposes, specifically related to the sales and use tax exemption for certain organizations. This form allows qualifying entities, such as nonprofit organizations, to claim exemption from sales tax on purchases made for their exempt purposes. Understanding the Dtf 723 Form is crucial for organizations that wish to take advantage of tax exemptions to support their missions.

How to use the Dtf 723 Form

To effectively use the Dtf 723 Form, organizations must first ensure they meet the eligibility criteria for tax exemption. Once eligibility is confirmed, the organization should complete the form accurately, providing necessary details such as the organization's name, address, and type of exemption sought. After filling out the form, it should be presented to vendors at the time of purchase to claim the exemption. Maintaining copies of the form for record-keeping is also advisable for future reference and compliance.

Steps to complete the Dtf 723 Form

Completing the Dtf 723 Form involves several key steps:

- Gather necessary information, including the organization's tax identification number and details about the purchases.

- Fill in the organization’s name and address accurately.

- Specify the type of exemption being claimed and provide any additional required details.

- Review the completed form for accuracy and completeness.

- Sign and date the form before presenting it to vendors.

Legal use of the Dtf 723 Form

The legal use of the Dtf 723 Form is essential for ensuring compliance with New York tax laws. Organizations must use the form strictly for qualifying purchases related to their exempt purposes. Misuse of the form, such as using it for non-qualifying purchases, can result in penalties, including back taxes owed and potential fines. It is important for organizations to understand the legal implications of using the Dtf 723 Form to avoid any issues with tax authorities.

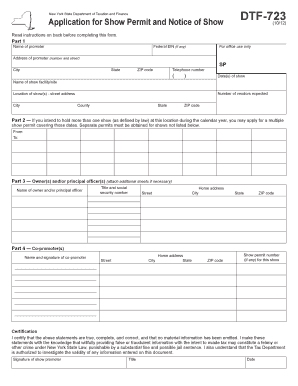

Key elements of the Dtf 723 Form

Key elements of the Dtf 723 Form include:

- Organization Information: Name, address, and tax identification number.

- Exemption Type: The specific exemption being claimed, such as for nonprofit purposes.

- Vendor Information: Details of the vendor to whom the form is presented.

- Signature: An authorized representative of the organization must sign the form.

Who Issues the Form

The Dtf 723 Form is issued by the New York State Department of Taxation and Finance. This agency oversees the administration of tax laws in New York, including the issuance of forms necessary for tax exemptions. Organizations seeking to use the Dtf 723 Form should ensure they are using the most current version, as tax regulations and forms can change over time.

Quick guide on how to complete dtf 723 form

Complete [SKS] seamlessly on any gadget

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal weight as a standard wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or mistakes that require printing additional document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from any device of your preference. Edit and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Dtf 723 Form

Create this form in 5 minutes!

How to create an eSignature for the dtf 723 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Dtf 723 Form, and why is it important?

The Dtf 723 Form is an essential tax document used for various tax reporting purposes in New York. It helps businesses accurately report their withholdings and provides necessary details for tax compliance. Understanding this form is crucial to ensure you meet all local tax requirements seamlessly.

-

How can airSlate SignNow help me with the Dtf 723 Form?

airSlate SignNow simplifies the process of completing and signing the Dtf 723 Form by providing a user-friendly platform for eSignatures and document management. You can easily upload, fill out, and securely send this form, reducing the risk of errors and delays. This efficiency can save you time and help maintain compliance.

-

What are the pricing options for using airSlate SignNow for the Dtf 723 Form?

airSlate SignNow offers various pricing plans that cater to teams of all sizes needing to manage documents like the Dtf 723 Form. These plans provide access to advanced features, including bulk sending and templates, at competitive rates. For detailed pricing based on your needs, visit our pricing page or contact our sales team.

-

Are there any features specifically for handling the Dtf 723 Form with airSlate SignNow?

Yes, airSlate SignNow includes features tailored for efficiently managing the Dtf 723 Form, such as customizable templates and automated workflows. You can create a template for the Dtf 723 Form, enabling quick reuse for future filings. This streamlines the signing process for you and your clients.

-

Can I integrate airSlate SignNow with other software to manage the Dtf 723 Form?

Absolutely! airSlate SignNow offers robust integrations with various CRM and accounting software applications. This allows you to seamlessly manage the Dtf 723 Form within your existing systems, enhancing efficiency and ensuring that all documentation is centralized and easily accessible.

-

What are the benefits of using airSlate SignNow for the Dtf 723 Form?

Using airSlate SignNow for the Dtf 723 Form provides numerous benefits, including reduced processing time, improved accuracy, and enhanced security. The electronic signing process minimizes physical paperwork and helps maintain compliance with tax regulations. You'll experience a more streamlined workflow that ultimately saves you resources.

-

Is airSlate SignNow secure for submitting the Dtf 723 Form?

Yes, airSlate SignNow prioritizes security when handling documents like the Dtf 723 Form. The platform employs bank-level encryption, ensuring that your data remains confidential and protected during transmission and storage. You can have peace of mind knowing that your sensitive information is safe.

Get more for Dtf 723 Form

Find out other Dtf 723 Form

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT