150 101 159 Form

What is the 150 101 159

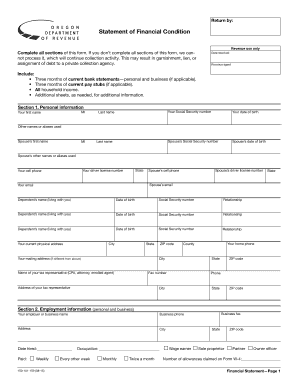

The 150 101 159 form is a specific document used within the United States for various administrative purposes. It serves as a formal request or declaration, often related to tax or regulatory compliance. Understanding the purpose of this form is crucial for individuals and businesses to ensure they meet necessary legal requirements. This form may be required for reporting income, claiming deductions, or fulfilling other obligations set forth by government agencies.

How to use the 150 101 159

Using the 150 101 159 form involves several steps to ensure accurate completion and submission. First, gather all necessary information, including personal details and any relevant financial data. Next, fill out the form carefully, ensuring that all fields are completed as required. It is essential to review the form for accuracy before submission. Depending on the specific requirements, the completed form can be submitted online, by mail, or in person, as specified by the issuing agency.

Steps to complete the 150 101 159

Completing the 150 101 159 form involves a systematic approach:

- Gather required documents and information, such as identification and financial records.

- Carefully read the instructions provided with the form to understand each section.

- Fill out the form, ensuring all required fields are completed accurately.

- Double-check the information for any errors or omissions.

- Submit the form according to the specified submission method, whether online, by mail, or in person.

Legal use of the 150 101 159

The legal use of the 150 101 159 form is defined by the regulations set forth by the relevant government agency. This form must be filled out accurately to ensure compliance with applicable laws. Misrepresentation or errors on the form can lead to legal repercussions, including fines or penalties. It is advisable to consult with a legal professional or tax advisor if there are any uncertainties regarding the completion or submission of this form.

Required Documents

To complete the 150 101 159 form, certain documents may be required. These typically include:

- Identification documents, such as a driver's license or Social Security card.

- Financial records relevant to the information being reported.

- Previous tax returns or related forms, if applicable.

- Any additional documentation specified in the instructions for the form.

Form Submission Methods

The 150 101 159 form can be submitted through various methods, depending on the requirements set by the issuing agency. Common submission methods include:

- Online submission through the agency's official website.

- Mailing the completed form to the designated address.

- Submitting the form in person at a local office or agency.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the use and submission of the 150 101 159 form. It is important to adhere to these guidelines to ensure compliance and avoid potential issues. This includes understanding deadlines for submission, eligibility criteria, and any updates to the form or its requirements. Consulting the IRS website or a tax professional can provide additional clarity on these guidelines.

Quick guide on how to complete 150 101 159 66548920

Effortlessly Prepare 150 101 159 on Any Device

Online document management has gained popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Handle 150 101 159 on any device using the airSlate SignNow Android or iOS applications and enhance any document-based tasks today.

The Easiest Way to Edit and eSign 150 101 159 Without the Hassle

- Locate 150 101 159 and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for such needs.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all details and then click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your PC.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign 150 101 159 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 150 101 159 66548920

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow, and how does it relate to 150 101 159?

airSlate SignNow is an innovative eSignature solution that allows businesses to send and sign documents seamlessly. It enhances workflows, making document management more efficient and cost-effective. With the integration of features outlined in the 150 101 159 framework, businesses can ensure compliance and streamline their agreement processes.

-

How does pricing work for airSlate SignNow considering the 150 101 159 standards?

airSlate SignNow offers flexible pricing plans designed to fit various business needs while adhering to the standards set by 150 101 159. You can choose from individual, business, or enterprise plans, each tailored to deliver maximum value at competitive prices. This structure allows organizations of any size to leverage eSigning efficiently.

-

What features does airSlate SignNow provide that comply with 150 101 159 requirements?

airSlate SignNow includes robust features such as customizable templates, advanced security measures, and mobile access that comply with 150 101 159 guidelines. These capabilities ensure that documents are signed electronically while maintaining integrity and authenticity. This compliance is crucial for businesses operating in regulated environments.

-

What are the benefits of using airSlate SignNow for businesses under 150 101 159?

Using airSlate SignNow, businesses can signNowly increase efficiency and reduce costs related to document management, in line with 150 101 159 principles. The platform enables faster turnaround times for agreements and minimizes paper waste, supporting sustainability goals. Ultimately, it helps businesses focus on core operations rather than administrative tasks.

-

Can airSlate SignNow integrate with our existing systems under the 150 101 159 framework?

Yes, airSlate SignNow easily integrates with various existing systems, including CRMs, payment processors, and cloud storage solutions, in alignment with the 150 101 159 framework. This seamless connectivity allows businesses to maintain their existing workflows while enhancing their document signing processes. Integration ensures that all tools work harmoniously for optimal productivity.

-

Is airSlate SignNow secure and compliant with 150 101 159 industry standards?

Absolutely, airSlate SignNow prioritizes security and complies with the 150 101 159 industry standards. The platform employs encryption, user authentication, and audit trails to protect sensitive information and ensure the validity of signed documents. Businesses can trust that their data is handled with the utmost care and legal compliance.

-

How can we get started with airSlate SignNow to meet 150 101 159 compliance?

Getting started with airSlate SignNow is simple and user-friendly. You can sign up for a free trial to explore the platform's features and ensure it aligns with the 150 101 159 compliance requirements of your business. The intuitive interface makes it easy to create, send, and manage documents efficiently.

Get more for 150 101 159

- Complaint for custody mail oslsa form

- Health america enrollment form

- Fidelity loan application form

- Hinduja hospital online registration form

- Ceta application form

- Nevada application for concealed firearm permit fillable form

- Dance guest pass neuqua valley high school nvhs ipsd form

- Student intake form template 448752088

Find out other 150 101 159

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney