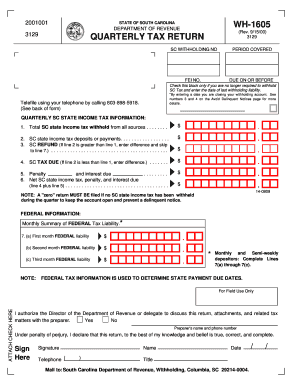

Wh 1605 Form

What is the WH 1605 Form

The WH 1605 form is a tax document used primarily in the United States for withholding exemption purposes. It allows employees to claim exemption from federal income tax withholding if they meet specific criteria. This form is essential for ensuring that the correct amount of tax is withheld from an employee's paycheck, helping to prevent over-withholding and ensuring compliance with IRS regulations.

How to Use the WH 1605 Form

Using the WH 1605 form involves several key steps. First, individuals must determine their eligibility for exemption based on their tax situation. After confirming eligibility, they should accurately complete the form, providing necessary personal information and signatures. Once completed, the form should be submitted to the employer's payroll department to adjust tax withholding accordingly. It's important to keep a copy for personal records.

Steps to Complete the WH 1605 Form

Completing the WH 1605 form involves the following steps:

- Obtain the WH 1605 form from a reliable source, such as the IRS website or your employer.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate your eligibility for exemption by checking the appropriate box.

- Sign and date the form to validate your declaration.

- Submit the completed form to your employer's payroll department.

Legal Use of the WH 1605 Form

The WH 1605 form is legally binding when filled out correctly and submitted to the employer. It is crucial for individuals to ensure that they meet the criteria for exemption to avoid potential penalties from the IRS. Employers are required to keep this form on file and may need to provide it during audits or tax reviews. Understanding the legal implications helps ensure compliance and protects against unnecessary tax liabilities.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the WH 1605 form. Employees must understand the criteria for exemption, which typically includes having no tax liability in the previous year and expecting none in the current year. The IRS also emphasizes the importance of submitting the form timely to ensure proper withholding adjustments. Familiarizing oneself with these guidelines can prevent issues during tax season.

Filing Deadlines / Important Dates

Filing deadlines for the WH 1605 form align with standard tax deadlines. Employees should submit the form at the beginning of the tax year or when their financial situation changes. It's advisable to check for any updates from the IRS regarding specific dates, as these can vary yearly. Staying aware of these deadlines helps ensure that tax withholding is adjusted promptly and accurately.

Quick guide on how to complete wh 1605 form

Easily Prepare Wh 1605 Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to generate, modify, and electronically sign your documents promptly without interruptions. Handle Wh 1605 Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Edit and eSign Wh 1605 Form Effortlessly

- Obtain Wh 1605 Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow has specifically designed for that purpose.

- Create your signature using the Sign function, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all your information and click on the Done button to save your alterations.

- Choose how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Wh 1605 Form and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wh 1605 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the wh 1605 form and how does airSlate SignNow help with it?

The wh 1605 form is a critical document for many businesses dealing with state and federal regulations. airSlate SignNow streamlines the signing and management of the wh 1605 form, providing a secure and efficient way to collect signatures without the hassle of printing and scanning.

-

How does airSlate SignNow support pricing for handling the wh 1605?

airSlate SignNow offers a transparent pricing model that is designed to be cost-effective for businesses handling the wh 1605 form. We provide various subscription plans that cater to different needs, ensuring that you only pay for what you use while benefiting from advanced features.

-

What features does airSlate SignNow offer for signing the wh 1605?

airSlate SignNow includes a range of features specifically designed for document signing, including templates, real-time tracking, and reminders for the wh 1605 form. These features help you manage your documents efficiently, ensuring that nothing gets overlooked.

-

Can I integrate airSlate SignNow with other software while handling the wh 1605?

Yes, airSlate SignNow offers seamless integrations with popular applications like Google Drive and Dropbox, making it easy to manage the wh 1605 form alongside your existing software solutions. This flexibility enhances your workflow and simplifies document management.

-

What are the benefits of using airSlate SignNow for the wh 1605?

Using airSlate SignNow for the wh 1605 form provides numerous benefits, including faster turnaround times and improved accuracy. Our solution reduces the risk of errors and allows for easy storage and retrieval of signed documents, boosting overall productivity.

-

Is there a mobile app for signing the wh 1605 with airSlate SignNow?

Absolutely! airSlate SignNow offers a mobile app that allows you to sign the wh 1605 form on-the-go. This feature ensures that you can manage your documents anywhere, anytime, enhancing convenience and saving time.

-

What security measures does airSlate SignNow implement for the wh 1605 forms?

Security is a top priority for airSlate SignNow. When processing the wh 1605 form, we utilize industry-standard encryption and authentication protocols, ensuring that your documents remain private and secure during the signing process.

Get more for Wh 1605 Form

- Nc notice form

- 30 day notice to terminate year to year lease nonresidential north carolina form

- 7 day notice to terminate month to month lease nonresidential north carolina form

- Nc 10 day notice 497316971 form

- Assignment of deed of trust by individual mortgage holder north carolina form

- Assignment of deed of trust by corporate mortgage holder north carolina form

- Unconditional waiver and release of lien upon final payment north carolina form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for residential property north carolina form

Find out other Wh 1605 Form

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order