Payday Loans Form

What is the payday loan?

A payday loan is a short-term borrowing option designed to provide quick access to cash, typically until the borrower receives their next paycheck. These loans often come with high-interest rates and are intended for urgent financial needs, such as unexpected expenses or bills. Borrowers usually repay the loan in full on their next payday, which can create a cycle of debt if not managed carefully.

How to obtain a payday loan

Obtaining a payday loan involves a straightforward process. First, borrowers should research and choose a reputable lender, often available online or in physical locations. Next, applicants need to provide personal information, including proof of income, identification, and bank account details. After submitting the application, lenders typically review it quickly, often providing approval within minutes. Once approved, funds are usually deposited directly into the borrower’s bank account.

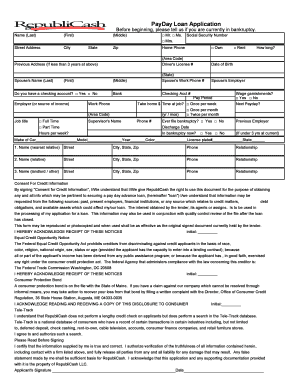

Steps to complete the payday loan form

Completing the payday loan form requires careful attention to detail. Start by accurately filling in your personal information, including your name, address, and contact details. Next, provide information about your employment, including your employer's name, your job title, and your income. It is essential to disclose your bank account information for direct deposit. Finally, review the form for any errors before submitting it to ensure a smooth approval process.

Legal use of payday loans

Payday loans are legal in many states across the U.S., but regulations vary significantly. Some states impose limits on the amount that can be borrowed, interest rates, and the number of loans a borrower can take out at one time. It is crucial for borrowers to understand their state’s laws regarding payday loans to ensure compliance and avoid potential legal issues.

Eligibility criteria for payday loans

To qualify for a payday loan, applicants typically must meet certain criteria. Most lenders require borrowers to be at least eighteen years old, have a steady source of income, and possess a valid government-issued ID. Additionally, lenders may check the applicant’s credit history, although many payday lenders do not require a high credit score for approval.

Key elements of payday loans

Key elements of payday loans include the loan amount, repayment terms, and interest rates. Borrowers can usually borrow between a few hundred to a few thousand dollars, depending on the lender and state regulations. Repayment terms typically range from two weeks to a month, coinciding with the borrower’s payday. Interest rates on payday loans can be significantly higher than traditional loans, making it essential for borrowers to understand the total cost of borrowing before proceeding.

Examples of using payday loans

Payday loans can be used for various purposes, such as covering unexpected medical expenses, repairing a car, or paying utility bills. For instance, if a borrower faces an urgent car repair that cannot wait until their next paycheck, a payday loan may provide the necessary funds to address the issue promptly. However, borrowers should consider their ability to repay the loan on time to avoid falling into a cycle of debt.

Quick guide on how to complete payday loans

Effortlessly Complete Payday Loans on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without delays. Handle Payday Loans on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Edit and eSign Payday Loans Effortlessly

- Find Payday Loans and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important parts of the documents or redact sensitive data with tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all information carefully and click on the Done button to save your changes.

- Select your preferred method of delivering your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Payday Loans and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the payday loans

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are payday loans?

Payday loans are short-term loans designed to cover urgent expenses until the borrower's next payday. These loans typically feature high-interest rates and are meant for quick access to cash. It’s important to research and understand the terms before borrowing.

-

How do payday loans work?

Payday loans work by allowing borrowers to receive a cash advance on their next paycheck. After applying, if approved, the lender provides a loan that must be repaid by the next payday. This quick turnaround makes payday loans popular among those in immediate financial need.

-

What are the costs associated with payday loans?

The costs of payday loans can vary but often include high interest and fees, which can accumulate quickly if not paid on time. Understanding the total repayment amount is essential. Always read the terms and consider alternatives if the costs seem excessive.

-

What are the benefits of payday loans?

One of the primary benefits of payday loans is their quick approval process, allowing individuals to access funds almost immediately. They are especially beneficial in emergencies where traditional loans may be too slow. However, it's crucial to weigh these benefits against the potential risks.

-

Are payday loans safe to use?

Payday loans can be safe if you apply with reputable lenders who follow regulatory guidelines. It's important to research the lender beforehand and read reviews. However, users should remain cautious of the high-interest rates and the possibility of entering a cycle of debt.

-

Can I get a payday loan with bad credit?

Yes, many payday loan providers accept applicants with bad credit since approval primarily hinges on income rather than credit scores. However, borrowers should be mindful of potentially higher interest rates. Always ensure the terms are manageable based on your financial situation.

-

How quickly can I receive funds from payday loans?

Most payday loans can be funded within a few hours to the next business day once the application is approved. This rapid access to funds is a key reason many individuals turn to payday loans for emergency financial needs. Always verify with your lender about their specific timelines.

Get more for Payday Loans

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction 497317544 form

- Letter from landlord to tenant returning security deposit less deductions north dakota form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return north dakota form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return north dakota form

- Letter from tenant to landlord containing request for permission to sublease north dakota form

- Letter from landlord to tenant that sublease granted rent paid by subtenant but tenant still liable for rent and damages north form

- Letter from landlord to tenant that sublease granted rent paid by subtenant old tenant released from liability for rent north form

- Nd tenant form

Find out other Payday Loans

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal