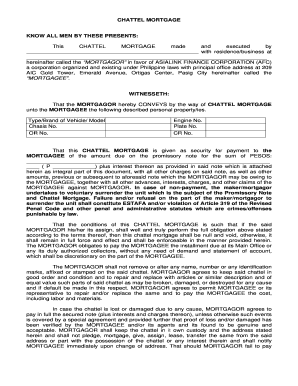

Chattel Mortgage Asialink Finance Corporation Form

What is the chattel mortgage?

A chattel mortgage is a type of loan secured by personal property, typically movable assets such as vehicles or equipment. Unlike real estate mortgages, which are secured by land or buildings, a chattel mortgage allows borrowers to retain ownership of the asset while using it as collateral for the loan. This arrangement provides flexibility for businesses and individuals seeking financing without losing access to the property they need for operations or personal use.

Key elements of the chattel mortgage

Understanding the key elements of a chattel mortgage is essential for both lenders and borrowers. The primary components include:

- Collateral: The asset being financed serves as collateral, which means the lender can seize it if the borrower defaults on the loan.

- Loan Agreement: A formal agreement outlining the terms of the loan, including repayment schedules, interest rates, and any fees associated with the mortgage.

- Ownership Rights: Borrowers maintain ownership of the asset throughout the loan term, allowing them to use it as needed.

- Registration: In many cases, the mortgage must be registered with a relevant authority to protect the lender's interest in the asset.

Steps to complete the chattel mortgage

Completing a chattel mortgage involves several steps to ensure that the process is legally sound and meets the requirements of both parties. Here are the typical steps:

- Identify the Asset: Determine which movable asset will be used as collateral.

- Negotiate Terms: Discuss and agree on the loan terms with the lender, including interest rates and repayment schedules.

- Draft the Agreement: Prepare a written mortgage agreement that outlines all terms and conditions.

- Sign the Agreement: Both parties must sign the document to make it legally binding.

- Register the Mortgage: If required, register the mortgage with the appropriate authority to protect the lender's interests.

Legal use of the chattel mortgage

The legal use of a chattel mortgage is governed by state laws and regulations, which can vary significantly. It is crucial for borrowers and lenders to understand these legal frameworks to ensure compliance. Key legal considerations include:

- State Regulations: Each state may have specific rules regarding the registration and enforcement of chattel mortgages.

- Consumer Protection Laws: Borrowers should be aware of laws designed to protect them from unfair lending practices.

- Default Procedures: The legal process that lenders must follow in the event of a borrower defaulting on the loan.

Examples of using the chattel mortgage

Chattel mortgages are commonly used in various scenarios, particularly in business financing. Examples include:

- Vehicle Financing: Businesses often use chattel mortgages to finance company vehicles while retaining the right to use them.

- Equipment Loans: Companies may secure loans for machinery or equipment needed for operations, using the equipment as collateral.

- Inventory Financing: Retailers might use chattel mortgages to finance inventory purchases, allowing them to manage cash flow effectively.

Eligibility criteria

Eligibility for a chattel mortgage typically depends on several factors, including:

- Creditworthiness: Lenders assess the borrower's credit history and financial stability.

- Asset Value: The value of the asset being financed plays a crucial role in determining loan amounts.

- Business Type: Certain types of businesses may have different eligibility requirements based on their industry and operational structure.

Quick guide on how to complete chattel mortgage asialink finance corporation

Complete Chattel Mortgage Asialink Finance Corporation effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-conscious substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely archive it online. airSlate SignNow equips you with all the features required to generate, modify, and eSign your documents promptly without delays. Manage Chattel Mortgage Asialink Finance Corporation on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The simplest way to modify and eSign Chattel Mortgage Asialink Finance Corporation with ease

- Obtain Chattel Mortgage Asialink Finance Corporation and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal significance as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Chattel Mortgage Asialink Finance Corporation and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the chattel mortgage asialink finance corporation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the chattel mortgage meaning?

Chattel mortgage meaning refers to a loan structured to help businesses finance movable personal property. In a chattel mortgage, the borrower retains possession of the asset while the lender holds a security interest. This type of financing is commonly used for vehicles and equipment.

-

How does a chattel mortgage differ from traditional mortgages?

The chattel mortgage meaning primarily distinguishes itself from traditional mortgages by financing movable assets rather than real estate. Unlike a conventional mortgage where the property serves as collateral, a chattel mortgage uses personal property. This flexibility is beneficial for businesses needing to acquire signNow assets without extensive collateral.

-

What are the benefits of using a chattel mortgage?

The benefits of a chattel mortgage include easier access to financing for businesses needing movable assets, lower initial capital outlay, and tax advantages. With chattel mortgage meaning, companies can often deduct interest costs, which can enhance cash flow. This financial tool is ideal for businesses looking to grow without straining cash resources.

-

What types of assets can be financed with a chattel mortgage?

With chattel mortgage meaning, various types of movable assets can be financed, including vehicles, machinery, and equipment. This gives businesses flexibility in acquiring crucial assets to support operations. It's essential to check with the lender to determine acceptable asset types.

-

How does pricing work for a chattel mortgage?

Pricing for a chattel mortgage typically involves interest rates that can vary depending on the asset type and borrower’s creditworthiness. Understanding the chattel mortgage meaning helps businesses evaluate total loan costs, including fees and terms. Buyers can often negotiate terms that suit their financial needs.

-

Can I integrate a chattel mortgage with my existing financing options?

Yes, integrating a chattel mortgage with existing financing options is often possible and beneficial. Understanding chattel mortgage meaning enables businesses to plan comprehensive financing strategies. This can enhance overall asset management and streamline cash flow.

-

What features should I look for in a chattel mortgage provider?

When evaluating a chattel mortgage provider, look for features like flexible repayment terms, competitive interest rates, and excellent customer service. The chattel mortgage meaning is better understood when assessing the lender's reputation and ease of transaction. Make sure to choose a provider that supports your business needs efficiently.

Get more for Chattel Mortgage Asialink Finance Corporation

- Landlord tenant closing statement to reconcile security deposit new hampshire form

- Name change for 497318776 form

- Name change notification form new hampshire

- Commercial building or space lease new hampshire form

- New hampshire disability compensation form

- New hampshire legal form

- Nh guardian form

- New hampshire bankruptcy form

Find out other Chattel Mortgage Asialink Finance Corporation

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement