Schedule Se Form

What is the Schedule Se Form

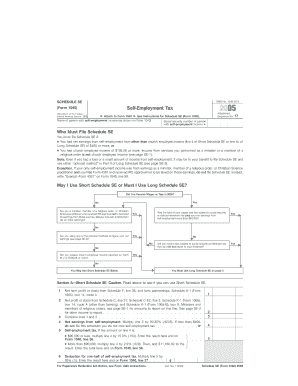

The Schedule SE Form, officially known as the Self-Employment Tax form, is used by individuals who are self-employed to calculate their self-employment tax. This tax is primarily composed of Social Security and Medicare taxes, which are typically withheld from wages by employers. Self-employed individuals must report their earnings and pay these taxes directly to the IRS. Understanding the Schedule SE Form is essential for ensuring compliance with federal tax obligations and accurately reporting income.

How to use the Schedule Se Form

Using the Schedule SE Form involves several steps to ensure accurate reporting of self-employment income. First, gather all relevant financial information, including income statements and expense records. Next, determine your net earnings from self-employment, which is calculated by subtracting business expenses from total income. Once you have this figure, you can complete the Schedule SE Form by following the provided instructions, which guide you through calculating the self-employment tax based on your net earnings.

Steps to complete the Schedule Se Form

Completing the Schedule SE Form requires careful attention to detail. Begin by entering your name and Social Security number at the top of the form. Next, report your net earnings from self-employment in Part I. If your net earnings are $400 or more, you will need to calculate your self-employment tax in Part II. Follow the instructions to determine the amount owed and ensure you include any additional credits or deductions applicable to your situation. Finally, transfer the calculated tax amount to your main tax return.

Legal use of the Schedule Se Form

The Schedule SE Form is legally required for individuals who earn income through self-employment. Failure to file this form when necessary can lead to penalties and interest on unpaid taxes. It is crucial to understand the legal implications of self-employment income and ensure that all earnings are reported accurately to comply with IRS regulations. Proper use of the Schedule SE Form helps maintain good standing with tax authorities and avoids potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule SE Form align with the overall tax filing deadlines set by the IRS. Typically, self-employed individuals must file their tax returns, including the Schedule SE Form, by April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be adjusted. It is important to stay informed about any changes to tax deadlines, as timely filing helps avoid penalties and ensures compliance with tax laws.

Required Documents

To complete the Schedule SE Form accurately, you will need several documents. These include your income statements, such as 1099 forms or business income records, and any documentation of business expenses. Additionally, having your previous year’s tax return can be helpful for reference. Organizing these documents before starting the form can streamline the process and reduce the risk of errors.

Quick guide on how to complete schedule se form

Effortlessly Prepare Schedule Se Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a sustainable alternative to conventional printed and signed papers, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Schedule Se Form on any device with the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

The easiest way to edit and electronically sign Schedule Se Form seamlessly

- Locate Schedule Se Form and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with the tools airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome form searches, or errors that require printing additional copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Schedule Se Form and guarantee excellent communication throughout your document preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule se form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule Se Form feature in airSlate SignNow?

The Schedule Se Form feature allows users to create and manage forms that can be filled out and eSigned on a designated schedule. This ensures that all necessary documents are completed on time, enhancing overall productivity. It's particularly beneficial for businesses needing timely submissions.

-

How does airSlate SignNow ensure the security of the Schedule Se Form?

airSlate SignNow prioritizes security, implementing advanced encryption protocols to protect data during transmission and storage. The Schedule Se Form feature also includes options for secure access control, ensuring that only authorized users can view or edit sensitive documents. Your data's safety is our top concern.

-

What pricing plans are available for using Schedule Se Form?

airSlate SignNow offers several pricing plans tailored for different business needs, all of which include access to the Schedule Se Form feature. Plans range from basic individual packages to comprehensive solutions suitable for large enterprises. You can choose a plan that best fits your organization’s scale and requirements.

-

Can I integrate Schedule Se Form with other applications?

Yes, airSlate SignNow provides numerous integrations with popular applications like Google Drive, Dropbox, and CRM systems. This allows you to streamline workflows and easily leverage the Schedule Se Form feature within your existing tech ecosystem, enhancing efficiency and collaboration.

-

What are the benefits of using the Schedule Se Form in my business?

The Schedule Se Form feature simplifies document management by allowing you to set deadlines for form submissions and signatures. This not only helps in maintaining compliance but also increases accountability among team members. Overall, it improves operational efficiency and reduces the time spent on follow-ups.

-

Is there a mobile app to manage Schedule Se Form?

Absolutely! airSlate SignNow offers a mobile app that allows users to manage their Schedule Se Form on-the-go. This means you can send, sign, and track documents from your mobile device, ensuring that you never miss a deadline, no matter where you are.

-

How do I get started with the Schedule Se Form feature?

Getting started with the Schedule Se Form in airSlate SignNow is easy. Simply sign up for an account, choose a pricing plan that fits your needs, and follow the setup guidelines to create your first form. You can utilize our extensive support resources to guide you through the process.

Get more for Schedule Se Form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property nebraska form

- Notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property 497318142 form

- Notice of termination of notice of commencement corporation or llc nebraska form

- Published notice form

- Agreed written termination of lease by landlord and tenant nebraska form

- Published notice of recording of notice of termination corporation nebraska form

- Affidavit that notice of termination sent to all claimants requesting notice individual nebraska form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497318150 form

Find out other Schedule Se Form

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online