INSTRUCTIONS for COMPLETING IRS FORM 4506 T

What is the 4506 T form?

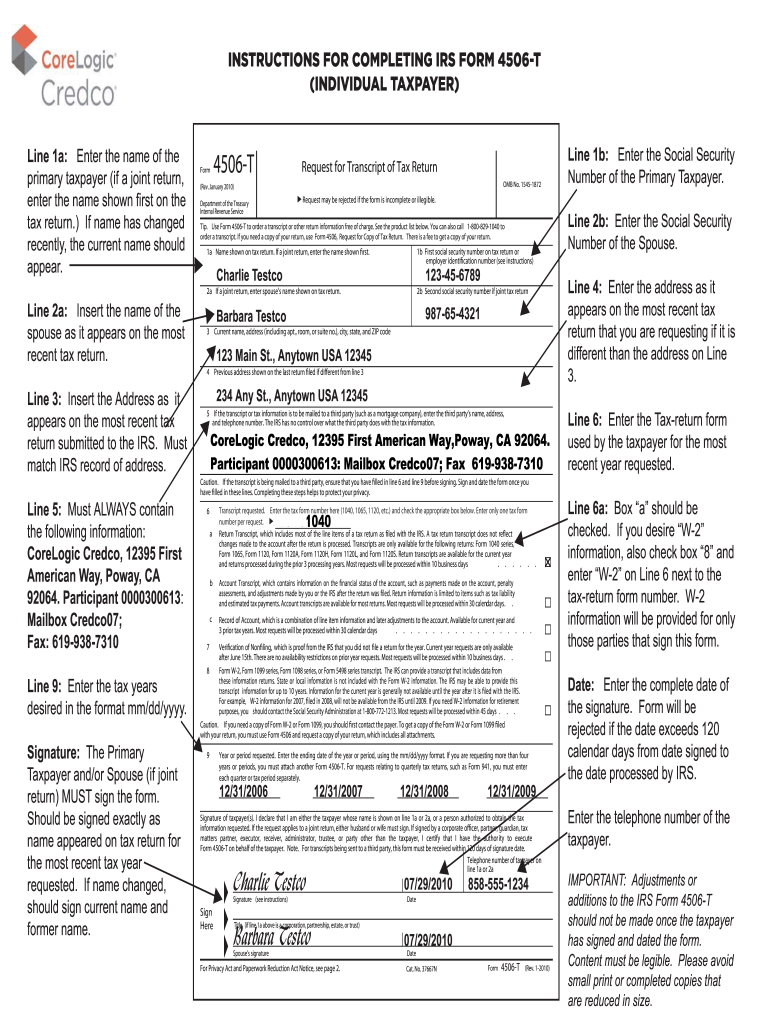

The 4506 T form, officially known as the Request for Transcript of Tax Return, is an essential document used by taxpayers in the United States to request a transcript of their tax return information from the Internal Revenue Service (IRS). This form is particularly useful for individuals and businesses that need to verify income for various purposes, including loan applications, mortgage approvals, or financial aid. The 4506 T form allows taxpayers to obtain a summary of their tax data, which can be crucial for accurate financial reporting and compliance.

Steps to complete the 4506 T form

Completing the 4506 T form involves several straightforward steps:

- Obtain the form: Download the 4506 T form from the IRS website or access it through a trusted tax software.

- Provide personal information: Fill in your name, Social Security number, and address. If applicable, include your spouse's information if you filed jointly.

- Select the type of transcript: Indicate which type of transcript you are requesting, such as tax return or account transcript.

- Specify the tax years: Clearly state the tax years for which you need the transcripts.

- Sign and date the form: Ensure you sign the form to validate your request.

- Submit the form: Send the completed form to the appropriate address provided in the instructions.

Legal use of the 4506 T form

The 4506 T form holds legal significance as it is recognized by the IRS for obtaining official tax information. When completed accurately, it serves as a legal request for transcripts, which can be used in various legal and financial contexts. For instance, lenders often require this form to verify a borrower's income during the loan approval process. Additionally, the information obtained through this form can be used to resolve discrepancies in tax filings or to support claims in audits.

Examples of using the 4506 T form

There are several scenarios in which the 4506 T form may be utilized:

- Loan applications: Individuals applying for mortgages or personal loans may need to provide proof of income, which can be obtained through this form.

- Financial aid applications: Students applying for financial aid may be required to submit tax transcripts to demonstrate their financial situation.

- Tax audits: If the IRS audits a taxpayer, they may need to provide transcripts of their tax returns as part of the audit process.

Required documents for the 4506 T form

When submitting the 4506 T form, certain documents may be required to support your request. Typically, you should have:

- Identification: A valid form of identification, such as a driver's license or Social Security card, may be needed to verify your identity.

- Previous tax returns: Having copies of your past tax returns can help ensure accuracy when filling out the form.

- Proof of address: Recent utility bills or bank statements can serve as proof of your current address if it differs from what is on file with the IRS.

Form submission methods

The 4506 T form can be submitted to the IRS in various ways, depending on your preference:

- By mail: Send the completed form to the address specified in the instructions based on your location.

- Online: Some tax software allows electronic submission of the 4506 T form, streamlining the process.

- In-person: Visit a local IRS office to submit the form directly, although appointments may be necessary.

Quick guide on how to complete instructions for completing irs form 4506 t

Effortlessly Prepare INSTRUCTIONS FOR COMPLETING IRS FORM 4506 T on Any Device

The management of online documents has gained traction among businesses and individuals alike. It presents an ideal environmentally friendly option to traditional printed and signed documents, as you can easily locate the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents rapidly without any holdups. Manage INSTRUCTIONS FOR COMPLETING IRS FORM 4506 T on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Modify and eSign INSTRUCTIONS FOR COMPLETING IRS FORM 4506 T Seamlessly

- Obtain INSTRUCTIONS FOR COMPLETING IRS FORM 4506 T and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal authority as an original handwritten signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign INSTRUCTIONS FOR COMPLETING IRS FORM 4506 T and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

What's the best way to get users to read a set of instructions for filling out a form?

Your question confuses me a bit. What's missing is "WHY are the instructions displayed?" What makes them so important? More to the point, what makes them so important to the user?You say it's a simple form, but also say they must read the instructions before filling it out. If it's simple, what are all the instructions for? I haven't seen the form and already I'm confused.People will do things if they understand (and agree with) the purpose for doing them. If they don't understand the need for the instructions (e.g. because the form appears to be simple), you'll have a hard time getting users to read them (they won't see the need).My suggestion would be to take a step back from the design a bit and look at the form's purpose. If the instructions are to minimize data entry errors, look for ways in your design to do that and eliminate an instruction or two. For example, do real-time validation of things like zip codes, phone numbers, usernames, and anything else your web page can do.If the instructions are to educate the user on some specific process, look at the process to see if it can be made simpler or more obvious such that it doesn't need any explanation.Finally, don't forget user testing--ask some potential (or representative) users what they think works for them.

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

How do you figure out if you owe the IRS on form 1040 when the instructions are the same for figuring out your refund?

You compare the amount of tax you owe (line 15) with the amount of tax you've paid (line 18).If the amount you've paid is less than the amount you owe, the difference between the two numbers is the additional tax you owe the IRS.If it is the other way around, then the difference between the two numbers is the refund you are due.

-

What are the formalities (instructions, filling out info in OMR, etc.) that we have to complete before starting the JEE Advanced exam? How much time do we get?

Hi!To know more about the formalities before starting JEE Advanced 2017 examination read JEE Advanced 2017 Exam Day Guidelines - What to carry to the examination hall?

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

Create this form in 5 minutes!

How to create an eSignature for the instructions for completing irs form 4506 t

How to create an electronic signature for the Instructions For Completing Irs Form 4506 T in the online mode

How to make an electronic signature for the Instructions For Completing Irs Form 4506 T in Chrome

How to make an electronic signature for putting it on the Instructions For Completing Irs Form 4506 T in Gmail

How to create an electronic signature for the Instructions For Completing Irs Form 4506 T straight from your mobile device

How to make an eSignature for the Instructions For Completing Irs Form 4506 T on iOS devices

How to generate an eSignature for the Instructions For Completing Irs Form 4506 T on Android OS

People also ask

-

What is the 4506t form, and why do I need it?

The 4506t form is used by the IRS to request a tax transcript directly from your tax records. Businesses often need this form for verifying income or tax information during mortgage or loan applications, making it essential for financial transactions.

-

How does airSlate SignNow simplify the 4506t signing process?

airSlate SignNow allows users to easily upload, edit, and eSign the 4506t form digitally. This streamlines the signing process, reducing paperwork and saving time, while ensuring compliance with eSignature laws.

-

Is there a cost associated with using airSlate SignNow for the 4506t form?

Yes, airSlate SignNow offers various pricing plans depending on your needs, but it remains a cost-effective solution for managing documents, including the 4506t form. Consider choosing a plan that best suits your business needs to maximize savings.

-

What features does airSlate SignNow offer for managing the 4506t form?

AirSlate SignNow includes features like reusable templates, document sharing, and signing workflows specifically designed for forms like the 4506t. These tools enhance efficiency and ensure a smooth user experience.

-

Can I integrate airSlate SignNow with other applications for handling the 4506t form?

Absolutely! AirSlate SignNow supports integrations with popular software such as Salesforce, Google Drive, and more, allowing seamless workflow management when dealing with the 4506t form.

-

What are the security measures for sending the 4506t form through airSlate SignNow?

AirSlate SignNow prioritizes security by using encryption technology to protect your data during transmission and storage. This ensures that your 4506t form and sensitive information remain secure and comply with industry standards.

-

How does airSlate SignNow enhance collaboration on the 4506t form?

With airSlate SignNow, multiple users can collaborate on the 4506t form by sharing documents and tracking changes in real-time. This fosters teamwork and ensures that everyone involved is on the same page throughout the signing process.

Get more for INSTRUCTIONS FOR COMPLETING IRS FORM 4506 T

Find out other INSTRUCTIONS FOR COMPLETING IRS FORM 4506 T

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA