New Employee Payroll Setup Form

What is the New Employee Payroll Setup Form

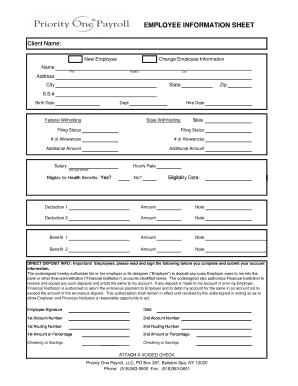

The New Employee Payroll Setup Form is a crucial document that collects essential information from new hires to ensure accurate payroll processing. This form typically includes personal details such as the employee's name, address, Social Security number, and tax withholding preferences. It serves as the foundation for setting up an employee's payroll profile within the company's payroll system. By gathering this information, businesses can comply with federal and state regulations while ensuring that employees are compensated correctly and on time.

Steps to Complete the New Employee Payroll Setup Form

Completing the New Employee Payroll Setup Form involves several straightforward steps to ensure accuracy and compliance. First, the employee should fill in their personal information, including their full name, address, and Social Security number. Next, they need to indicate their tax withholding preferences, which may involve selecting a filing status and claiming allowances. Additionally, the employee may be required to provide direct deposit information if they wish to receive their salary electronically. Finally, it is essential for the employee to review the form for any errors before submitting it to HR or the payroll department.

Legal Use of the New Employee Payroll Setup Form

The New Employee Payroll Setup Form is legally binding and must comply with various federal and state regulations. It is essential for employers to ensure that the information collected is accurate and securely stored. The form must adhere to the guidelines set forth by the Internal Revenue Service (IRS) regarding tax withholding and reporting. Additionally, employers should be aware of privacy laws that protect employee information, ensuring that the data is only accessible to authorized personnel and used solely for payroll purposes.

Key Elements of the New Employee Payroll Setup Form

Several key elements are essential to include in the New Employee Payroll Setup Form to facilitate effective payroll processing. These elements typically encompass:

- Personal Information: Employee's full name, address, and Social Security number.

- Tax Withholding Information: Selection of filing status and allowances claimed.

- Direct Deposit Details: Bank account information for electronic salary payments.

- Signature: Employee's signature to validate the information provided.

By ensuring these elements are accurately completed, employers can streamline payroll operations and maintain compliance with legal requirements.

How to Obtain the New Employee Payroll Setup Form

Employers can obtain the New Employee Payroll Setup Form through various channels. Typically, this form is available on the company's human resources or payroll department website. Additionally, HR personnel can provide a physical copy of the form during the onboarding process. It is advisable for employers to ensure that the form is up-to-date and compliant with current regulations to avoid any issues with payroll processing.

Form Submission Methods

Once the New Employee Payroll Setup Form is completed, there are several methods for submission. Employees can submit the form electronically via a secure HR portal, ensuring that their information is transmitted safely. Alternatively, they may choose to submit a physical copy in person to the HR department or send it via mail. It is important for employees to confirm the submission method preferred by their employer to ensure timely processing of their payroll information.

Quick guide on how to complete new employee payroll setup form

Effortlessly prepare New Employee Payroll Setup Form on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly and without delays. Manage New Employee Payroll Setup Form on any platform through airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign New Employee Payroll Setup Form with ease

- Obtain New Employee Payroll Setup Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign New Employee Payroll Setup Form while ensuring effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new employee payroll setup form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a new hire payroll form?

A new hire payroll form is a document that collects essential employee information required for payroll processing. It typically includes details such as the employee's name, address, Social Security number, and tax withholding preferences. Using airSlate SignNow, businesses can easily streamline the completion and submission of new hire payroll forms.

-

Why should I use airSlate SignNow for new hire payroll forms?

airSlate SignNow provides a user-friendly platform that simplifies the eSigning and management of new hire payroll forms. With its intuitive interface and secure storage, businesses can efficiently handle payroll documentation while ensuring compliance and accuracy. This saves both time and resources compared to traditional paper methods.

-

Is there a cost associated with using airSlate SignNow for payroll forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan includes features to manage new hire payroll forms effectively, along with other document management tools. It's important to evaluate which plan aligns best with your organization's size and usage.

-

Can I integrate airSlate SignNow with other HR software?

Absolutely! airSlate SignNow offers seamless integrations with several popular HR software systems. This enables users to automatically populate new hire payroll forms with existing employee data, streamlining the onboarding process and reducing manual entry errors.

-

What features does airSlate SignNow offer for new hire payroll forms?

airSlate SignNow includes features such as customizable templates, secure eSignature capabilities, and automated workflows for managing new hire payroll forms. These features help improve efficiency and ensure that all necessary information is captured accurately and securely.

-

How does airSlate SignNow ensure the security of new hire payroll forms?

Security is a top priority for airSlate SignNow. The platform uses advanced encryption protocols to protect sensitive information within new hire payroll forms. Additionally, it complies with industry standards to ensure that all data remains confidential and secure during processing.

-

Can I track the status of my new hire payroll forms in airSlate SignNow?

Yes, airSlate SignNow allows users to track the status of new hire payroll forms easily. You can see whether a form is pending signature, completed, or requires further action. This feature helps streamline workflows and keeps you informed throughout the onboarding process.

Get more for New Employee Payroll Setup Form

- Nevada caretaker form

- Nv guardian form

- Bankruptcy chapters 7 497320807 form

- Bill of sale with warranty by individual seller nevada form

- Bill of sale with warranty for corporate seller nevada form

- Bill of sale without warranty by individual seller nevada form

- Bill of sale without warranty by corporate seller nevada form

- Verification of creditors matrix nevada form

Find out other New Employee Payroll Setup Form

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy