Kelly Services W2 Form

What is the Kelly Services W2

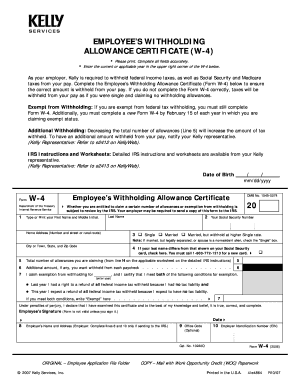

The Kelly Services W2 is a tax document that summarizes an employee's earnings and the taxes withheld during a specific tax year. It is issued by Kelly Services, a staffing agency, to its employees. This form is essential for individuals to accurately report their income to the Internal Revenue Service (IRS) and to prepare their tax returns. The W2 form includes key information such as wages, tips, and other compensation, as well as federal, state, and other taxes withheld. Understanding this form is crucial for compliance with tax regulations.

How to obtain the Kelly Services W2

To obtain your Kelly Services W2, you can follow a few straightforward steps. First, log in to your Kelly Services account through the Kellyconnect portal. Once logged in, navigate to the tax documents section where you can access your W2 form. If you encounter any issues accessing your account, you may contact Kelly Services' customer support for assistance. Additionally, W2 forms are typically mailed out by the end of January each year, so ensure that your address is current to receive it promptly.

Steps to complete the Kelly Services W2

Completing your Kelly Services W2 involves several important steps. First, ensure that all your personal information is accurate, including your name, address, and Social Security number. Next, review the earnings and tax information reported on the form to confirm its accuracy. If you find any discrepancies, contact Kelly Services immediately to rectify the issue. Once verified, you can use the information on the W2 to fill out your federal and state tax returns. It is advisable to keep a copy of the W2 for your records.

Legal use of the Kelly Services W2

The Kelly Services W2 is legally binding and must be used in accordance with IRS regulations. It serves as proof of income and tax withholding, which is critical when filing your tax return. Failure to report the income shown on your W2 can lead to penalties or audits by the IRS. Additionally, employers are required to provide accurate W2 forms to their employees by January 31st of each year, ensuring compliance with tax laws. Utilizing this form correctly helps maintain transparency and accountability in tax reporting.

Filing Deadlines / Important Dates

When dealing with the Kelly Services W2, it is important to be aware of key filing deadlines. The IRS requires that employers issue W2 forms to employees by January 31st each year. Taxpayers must file their federal tax returns by April 15th, unless an extension is requested. It is advisable to keep track of these dates to avoid any late filing penalties. Additionally, state tax deadlines may vary, so checking your specific state's requirements is essential.

Who Issues the Form

The Kelly Services W2 is issued by Kelly Services, the staffing agency that employs individuals. As the employer, Kelly Services is responsible for accurately reporting the wages paid and taxes withheld for each employee. The company must ensure that the information provided on the W2 is correct and submitted to the IRS in a timely manner. If you have questions about your W2, contacting Kelly Services directly is the best course of action.

Quick guide on how to complete kelly services w2

Effortlessly Prepare Kelly Services W2 on Any Device

Digital document administration has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly without any delays. Manage Kelly Services W2 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

How to Modify and Electronically Sign Kelly Services W2 with Ease

- Find Kelly Services W2 and then click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Select relevant sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and then click the Done button to save your changes.

- Choose your preferred method to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or errors needing the reprinting of new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device you choose. Modify and electronically sign Kelly Services W2 and ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kelly services w2

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to obtain my Kelly Services W2?

To obtain your Kelly Services W2, you can log into the Kelly Services employee portal where you will find the option to download or request your W2. If you encounter any issues, you can contact the Kelly customer service team for assistance. It's important to ensure your personal information is up-to-date to receive your W2 without any delays.

-

Can I access my Kelly Services W2 online?

Yes, you can access your Kelly Services W2 online through the Kelly Services employee portal. Make sure to have your login credentials handy. Online access provides a quick and easy way to view and download your W2, making tax season more manageable.

-

What should I do if I haven't received my Kelly Services W2?

If you haven't received your Kelly Services W2 by mid-February, you should first check if your address is correct in their system. You can also download your W2 from the employee portal or contact the payroll department for further assistance.

-

Are there any fees associated with obtaining a Kelly Services W2?

Typically, there are no fees associated with obtaining your Kelly Services W2, especially if you access it through the employee portal. However, if you require a physical copy sent to you after the initial distribution, there may be some fees for processing and mailing.

-

How does the Kelly Services W2 impact my tax filings?

The Kelly Services W2 is essential for accurately filing your taxes, as it provides details of your earnings and the taxes withheld throughout the year. It's important to include this document when preparing your tax return to ensure compliance and avoid potential issues with tax authorities.

-

Can I make corrections to my Kelly Services W2 if it's inaccurate?

If you find discrepancies on your Kelly Services W2, you should contact the Kelly Services payroll department immediately. They can guide you through the process of obtaining a corrected W2, ensuring that your tax information is accurate and up-to-date.

-

Is it possible to receive my Kelly Services W2 before tax season?

Typically, Kelly Services W2s are distributed by the end of January, but you may not receive yours before that time. You can access your W2 any time after it has been released through the employee portal, ensuring you have it ready for tax season.

Get more for Kelly Services W2

- General notice of default for contract for deed ohio form

- Ohio seller form

- Sellers disclosure of financing terms for residential property in connection with contract or agreement for deed aka land 497322092 form

- Ohio contract deed form

- Notice of default for past due payments in connection with contract for deed ohio form

- Final notice of default for past due payments in connection with contract for deed ohio form

- Assignment of contract for deed by seller ohio form

- Notice of assignment of contract for deed ohio form

Find out other Kelly Services W2

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form