Ri 2848 Form

What is the RI-2848?

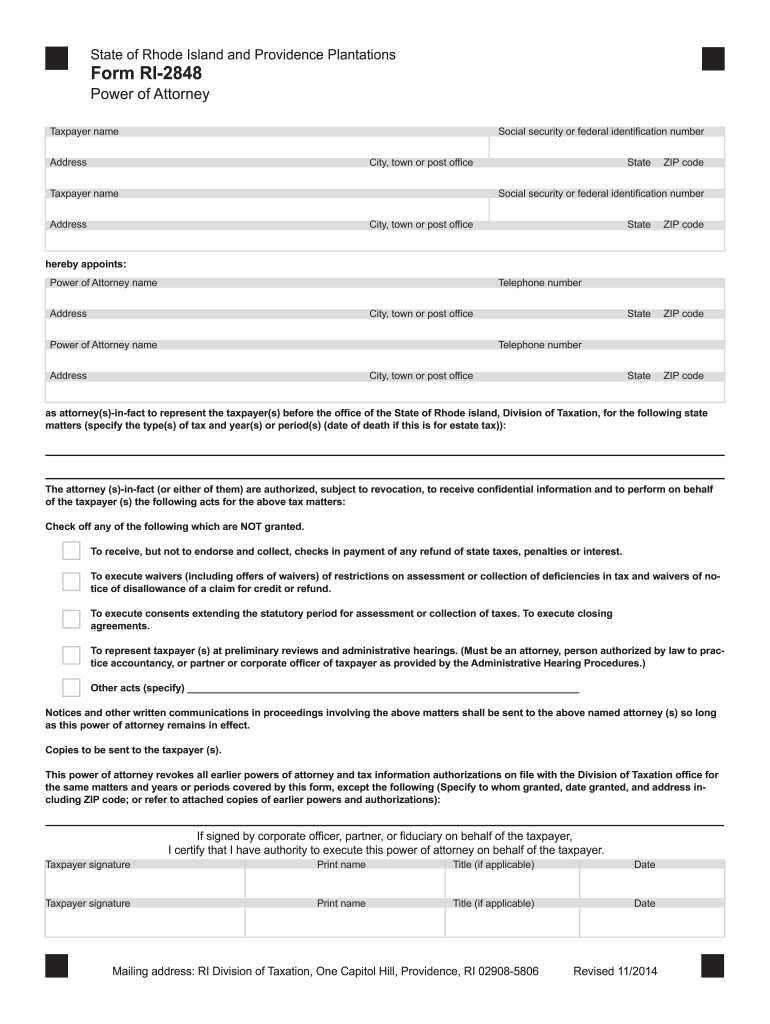

The RI-2848 is a specific form used in the state of Rhode Island that allows individuals to authorize another person to act on their behalf in tax matters. This form is particularly important for taxpayers who wish to grant power of attorney to a representative, such as an accountant or tax advisor. By completing the RI-2848, the taxpayer ensures that their chosen representative can communicate with the Rhode Island Division of Taxation regarding their tax obligations and rights.

How to Use the RI-2848

Using the RI-2848 involves several straightforward steps. First, the taxpayer must fill out the form with accurate personal information, including their name, address, and tax identification number. Next, the taxpayer must specify the representative's details, such as their name and contact information. Once completed, the form must be signed and dated by the taxpayer to validate the authorization. It is crucial to ensure that all information is correct to avoid any delays in processing.

Steps to Complete the RI-2848

Completing the RI-2848 requires careful attention to detail. Follow these steps:

- Obtain a blank copy of the RI-2848 form.

- Fill in the taxpayer's name, address, and tax identification number.

- Provide the representative's name, address, and phone number.

- Indicate the specific tax matters for which the authorization applies.

- Sign and date the form to confirm the authorization.

After completing these steps, the form can be submitted according to the preferred method of filing.

Legal Use of the RI-2848

The RI-2848 is legally recognized as a valid power of attorney for tax matters in Rhode Island. To ensure that the authorization is effective, it must be signed by the taxpayer and submitted to the Rhode Island Division of Taxation. The form grants the designated representative the authority to handle tax-related issues on behalf of the taxpayer, which can include filing returns, making payments, and responding to inquiries from the tax authority.

Form Submission Methods

The RI-2848 can be submitted through various methods, making it accessible for all taxpayers. The primary submission methods include:

- Online submission through the Rhode Island Division of Taxation website.

- Mailing the completed form to the appropriate tax office.

- In-person delivery at designated tax offices.

Choosing the right submission method can depend on the urgency of the request and personal preferences.

Key Elements of the RI-2848

Understanding the key elements of the RI-2848 is essential for its proper use. The form typically includes:

- Taxpayer's personal information.

- Representative's details.

- Scope of authority granted to the representative.

- Signature and date of the taxpayer.

Each of these elements plays a critical role in ensuring that the form is valid and that the authorization is clear and enforceable.

Quick guide on how to complete form ri 2848_layout 1 tax ri

Prepare Ri 2848 effortlessly on any device

Web-based document management has become favored among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, enabling you to locate the correct form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and eSign your paperwork swiftly without any holdups. Manage Ri 2848 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Ri 2848 effortlessly

- Obtain Ri 2848 and click Get Form to begin.

- Utilize the tools at your disposal to complete your document.

- Emphasize essential sections of your documents or obscure sensitive details with features that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to share your form, whether via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Ri 2848 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What is the right way to fill out Two-Earners Worksheet tax form?

Wages, in this context, are what you expect to appear in box 1 of your W-2.The IRS recommends that the additional withholding be applied to the higher-paid spouse and that the lesser-paid spouse should simply claim zero withholding allowances, as this is usually more accurate (due to the way that withholding is actually calculated by payroll programs, you may wind up with less withheld than you want if you split it).

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do you fill out line 5 on a 1040EZ tax form?

I suspect the question is related to knowing whether someone can claim you as a dependent, because otherwise line 5 itself is pretty clear.General answer: if you are under 19, or a full-time student under the age of 24, your parents can probably claim you as a dependent. If you are living with someone to whom you are not married and who is providing you with more than half of your support, that person can probably claim you as a dependent. If you are married and filing jointly, your spouse needs to answer the same questions.Note that whether those individuals actually do claim you as a dependent doesn't matter; the question is whether they can. It is not a choice.

-

What is a W-10 tax form? Who has to fill one out?

Here is all the information regarding the W-10 tax form from the IRS. But, it is a request to get your Child’s Dependent Care Tax Information. If you are taking care of someone’s child for them you will need to fill it out. Again you are supposed to pay taxes on all Earned Income. But, a lot of people don’t and work under the table. I don’t know many drug dealers getting ready to report their earnings this year. I actually used that scenario in college. You can’t right off bribes as an expense.. Sorry off topic..About Form W10 | Internal Revenue Service

-

Do I have to fill out a 1099 tax form for my savings account interest?

No, the bank files a 1099 — not you. You’ll get a copy of the 1099-INT that they filed.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out the 1080 form when filing taxes?

There is no such form in US taxation. Thus you can not fill it out. If you mean a 1098 T you still do not. The University issues it to you. Please read the answers to the last 4 questions you posted about form 1080. IT DOES NOT EXIST.

Create this form in 5 minutes!

How to create an eSignature for the form ri 2848_layout 1 tax ri

How to make an eSignature for your Form Ri 2848_layout 1 Tax Ri online

How to create an eSignature for your Form Ri 2848_layout 1 Tax Ri in Chrome

How to generate an electronic signature for signing the Form Ri 2848_layout 1 Tax Ri in Gmail

How to generate an eSignature for the Form Ri 2848_layout 1 Tax Ri from your mobile device

How to make an eSignature for the Form Ri 2848_layout 1 Tax Ri on iOS devices

How to create an eSignature for the Form Ri 2848_layout 1 Tax Ri on Android

People also ask

-

What is a RI TDI printable form?

A RI TDI printable form is a document used to file for Temporary Disability Insurance in Rhode Island. Through airSlate SignNow, you can easily create, upload, and manage these forms to ensure smooth and efficient processing. Our platform also allows you to eSign these documents securely.

-

How does airSlate SignNow streamline the use of RI TDI printable forms?

airSlate SignNow simplifies the creation and management of RI TDI printable forms by providing templates and automation features. You can quickly fill out and eSign these forms directly within our platform, reducing the time and effort required for completion. This streamlining ensures you can focus on what matters most—your health and recovery.

-

Is airSlate SignNow affordable for businesses needing RI TDI printable forms?

Yes, airSlate SignNow offers cost-effective solutions for businesses that require RI TDI printable forms. We provide various pricing plans tailored to your needs, ensuring you only pay for what you use. Our competitive rates make it accessible for businesses of all sizes to manage their document signing processes.

-

Can I integrate airSlate SignNow with other tools for handling RI TDI printable forms?

Absolutely! airSlate SignNow integrates seamlessly with a variety of third-party applications, enhancing your workflow with RI TDI printable forms. Whether you use CRM systems, cloud storage solutions, or project management tools, our integrations enable you to manage documents efficiently across platforms.

-

What features should I look for in an airSlate SignNow account for RI TDI printable forms?

When using airSlate SignNow for RI TDI printable forms, look for features such as eSignature capabilities, document templates, and automated workflows. Additionally, the ability to track document status and store completed forms securely will signNowly enhance your experience. These tools make managing your forms quicker and more efficient.

-

How secure is the handling of RI TDI printable forms on airSlate SignNow?

Security is a top priority at airSlate SignNow. Our platform ensures that your RI TDI printable forms are protected with bank-level encryption and secure access controls. Additionally, audit trails are maintained for all signed documents, providing you with peace of mind regarding the integrity and security of your information.

-

Can I edit a RI TDI printable form after it has been created?

Yes, you can easily edit your RI TDI printable forms on airSlate SignNow even after creation. Our platform allows you to make necessary modifications before sending for signatures, ensuring that all information is accurate and up-to-date. This flexibility helps minimize errors and improves the overall efficiency of your document management.

Get more for Ri 2848

Find out other Ri 2848

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement