Form W 3 PR 2024

What is the Form W-3 PR?

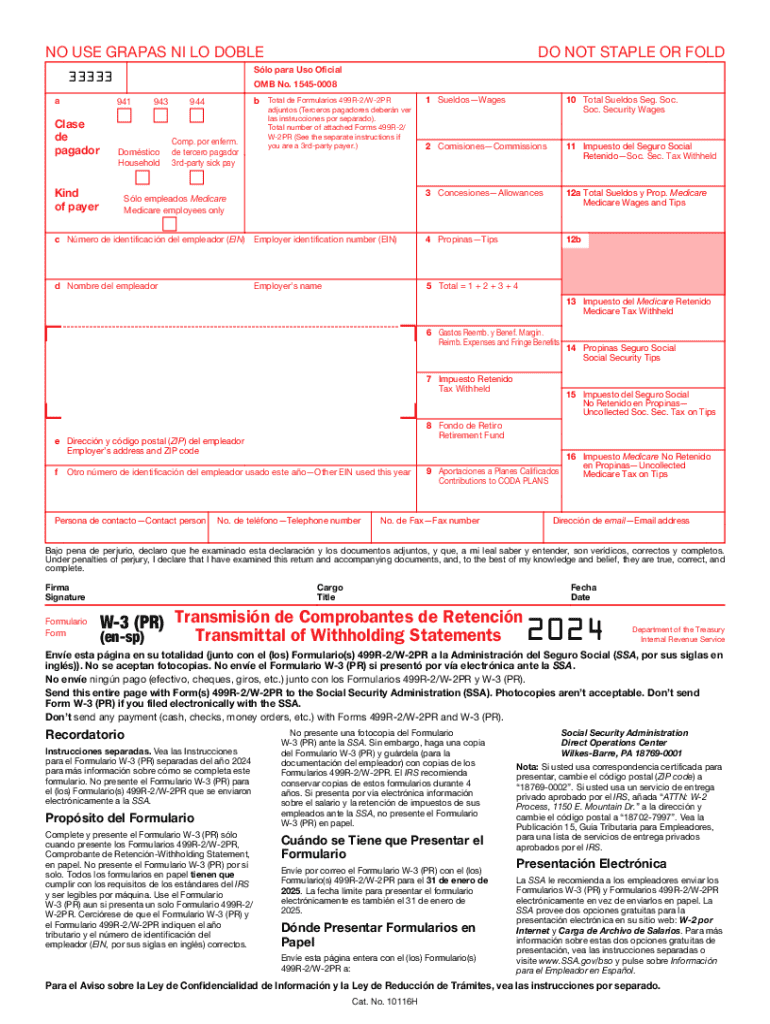

The Form W-3 PR is a transmittal form used in Puerto Rico to summarize and transmit employee wage and tax information to the Puerto Rico Department of Treasury. This form is essential for employers who must report wages paid and taxes withheld for their employees. It acts as a cover sheet for the accompanying Forms W-2 PR, providing a summary of the total amounts reported on those forms. The W-3 PR ensures that the Department of Treasury has a complete record of an employer's payroll information for the tax year.

How to use the Form W-3 PR

Employers use the Form W-3 PR to report the total wages, tips, and other compensation paid to employees, along with the total federal income tax withheld. This form is submitted alongside the individual W-2 PR forms for each employee. To use the form correctly, employers should ensure that all data is accurate and matches the information reported on the W-2 PR forms. It is important to double-check all figures to avoid discrepancies that could lead to penalties or issues with the Department of Treasury.

Steps to complete the Form W-3 PR

Completing the Form W-3 PR involves several key steps:

- Gather all W-2 PR forms for your employees.

- Fill in the employer's information, including name, address, and employer identification number (EIN).

- Enter the total number of W-2 PR forms being submitted.

- Calculate and input the total wages, tips, and other compensation.

- Report the total federal income tax withheld.

- Review the form for accuracy before submission.

Filing Deadlines / Important Dates

It is crucial for employers to be aware of the filing deadlines for the Form W-3 PR. Typically, the form must be submitted to the Puerto Rico Department of Treasury by the end of January following the tax year. Employers should also ensure that all W-2 PR forms are distributed to employees by the same deadline. Missing these deadlines can result in penalties and interest on unpaid taxes.

Legal use of the Form W-3 PR

The Form W-3 PR is legally required for employers in Puerto Rico to report wage and tax information. Failure to file this form can lead to significant penalties, including fines and interest on unpaid taxes. Employers must ensure compliance with all applicable regulations to avoid legal repercussions. Additionally, accurate reporting helps maintain good standing with the tax authorities and supports the integrity of the tax system.

Key elements of the Form W-3 PR

Key elements of the Form W-3 PR include:

- Employer identification information, including name and EIN.

- Total number of W-2 PR forms submitted.

- Total wages, tips, and other compensation reported.

- Total federal income tax withheld from employee wages.

- Signature of the employer or authorized representative.

Create this form in 5 minutes or less

Find and fill out the correct form w 3 pr

Create this form in 5 minutes!

How to create an eSignature for the form w 3 pr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is w3 pr 2024 and how does it relate to airSlate SignNow?

W3 pr 2024 refers to the latest updates and practices in web standards and performance. airSlate SignNow aligns with these standards by providing a secure and efficient platform for eSigning documents, ensuring that your business stays compliant and competitive in 2024.

-

How much does airSlate SignNow cost in 2024?

In 2024, airSlate SignNow offers flexible pricing plans tailored to different business needs. Whether you're a small business or a large enterprise, you can find a cost-effective solution that fits your budget while leveraging the benefits of w3 pr 2024.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow provides a range of features including customizable templates, real-time tracking, and secure cloud storage. These features are designed to enhance your document signing experience, making it easier and more efficient in line with w3 pr 2024 standards.

-

How can airSlate SignNow benefit my business in 2024?

By using airSlate SignNow, your business can streamline document workflows, reduce turnaround times, and improve overall efficiency. The platform's alignment with w3 pr 2024 ensures that you are utilizing the latest technology to enhance productivity and customer satisfaction.

-

Does airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers seamless integrations with various software applications, including CRM and project management tools. This capability allows you to enhance your workflows and maintain efficiency, keeping in line with the advancements of w3 pr 2024.

-

Is airSlate SignNow secure for eSigning documents?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure access controls, to protect your documents. This commitment to security aligns with the best practices outlined in w3 pr 2024, ensuring your data remains safe.

-

Can I customize my document templates in airSlate SignNow?

Yes, airSlate SignNow allows you to create and customize document templates to suit your specific needs. This feature not only saves time but also enhances your branding, making it a valuable tool for businesses looking to optimize their processes in 2024.

Get more for Form W 3 PR

Find out other Form W 3 PR

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast