The Domestic Partnership Act New Jersey Income TaxInheritance Tax Form

What is the Domestic Partnership Act New Jersey Income TaxInheritance Tax

The Domestic Partnership Act in New Jersey provides legal recognition to domestic partnerships, allowing couples to access certain rights and benefits similar to those of marriage. This act affects income tax and inheritance tax regulations for registered domestic partners. Under this law, partners may file joint tax returns and may be eligible for certain tax benefits that can reduce their overall tax liability. Understanding how this act influences tax obligations is essential for domestic partners to ensure compliance and optimize their tax situations.

Key elements of the Domestic Partnership Act New Jersey Income TaxInheritance Tax

Several key elements define the Domestic Partnership Act as it relates to income and inheritance tax. Firstly, registered domestic partners are treated similarly to married couples in terms of tax filing. This includes the ability to file joint returns, which can lead to tax savings. Secondly, inheritance tax rules may differ for domestic partners compared to non-partners, potentially allowing for exemptions or reduced rates. It is crucial for partners to be aware of these elements to navigate their tax responsibilities effectively.

Steps to complete the Domestic Partnership Act New Jersey Income TaxInheritance Tax

Completing the necessary forms under the Domestic Partnership Act involves several steps. First, couples must ensure they are officially registered as domestic partners in New Jersey. Next, they should gather all required financial documents, including income statements and previous tax returns. After that, partners can proceed to fill out the appropriate tax forms, ensuring they select the joint filing option if eligible. Finally, they must review the completed forms for accuracy before submitting them to the state tax authority.

Filing Deadlines / Important Dates

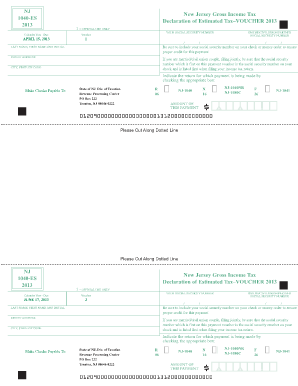

Filing deadlines for the Domestic Partnership Act-related tax forms align with standard state tax deadlines. Typically, individual income tax returns are due by April fifteenth each year. For any extensions, partners should be aware of the process to file for an extension, which usually provides an additional six months to submit their tax returns. Keeping track of these important dates is essential to avoid penalties and ensure compliance with New Jersey tax laws.

Legal use of the Domestic Partnership Act New Jersey Income TaxInheritance Tax

The legal use of the Domestic Partnership Act in relation to income and inheritance tax is significant for registered partners. This act allows partners to access specific legal rights that can affect their tax filings. For instance, the ability to file jointly can lead to better tax rates and deductions. Additionally, understanding how inheritance tax applies to domestic partners can help in estate planning, ensuring that assets are transferred without unnecessary tax burdens.

Eligibility Criteria

To qualify under the Domestic Partnership Act in New Jersey, partners must meet specific eligibility criteria. Both individuals must be at least eighteen years old and share a committed relationship. They must also reside together and demonstrate financial interdependence. Importantly, partners cannot be related by blood in a manner that would prohibit marriage. Ensuring compliance with these criteria is essential for couples seeking to benefit from the act's provisions.

Who Issues the Form

The forms related to the Domestic Partnership Act and associated tax filings are issued by the New Jersey Division of Taxation. This state agency oversees the administration of tax laws and ensures that domestic partners have access to the necessary documentation for filing their taxes. It is advisable for partners to consult the official resources provided by the Division of Taxation to obtain accurate and up-to-date forms.

Quick guide on how to complete the domestic partnership act new jersey income taxinheritance tax

Complete The Domestic Partnership Act New Jersey Income TaxInheritance Tax effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without delays. Manage The Domestic Partnership Act New Jersey Income TaxInheritance Tax on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centered task today.

The simplest way to edit and eSign The Domestic Partnership Act New Jersey Income TaxInheritance Tax without hassle

- Obtain The Domestic Partnership Act New Jersey Income TaxInheritance Tax and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive details with features that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign The Domestic Partnership Act New Jersey Income TaxInheritance Tax and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the the domestic partnership act new jersey income taxinheritance tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is The Domestic Partnership Act and how does it relate to New Jersey Income Tax and Inheritance Tax?

The Domestic Partnership Act provides legal recognition for domestic partnerships in New Jersey, which affects how partners file their income tax returns. Couples registered under this act must understand how it impacts New Jersey Income Tax and Inheritance Tax. By being aware of these implications, partners can make informed decisions on tax-related matters.

-

How does airSlate SignNow help with documents related to The Domestic Partnership Act in New Jersey?

AirSlate SignNow offers a user-friendly platform for creating, sending, and signing documents pertinent to The Domestic Partnership Act. This includes agreements or tax forms regarding New Jersey Income Tax and Inheritance Tax. Our solution streamlines the process, ensuring compliance and convenience for all parties involved.

-

What are the pricing options for airSlate SignNow that can assist with handling the Domestic Partnership Act documents?

AirSlate SignNow provides affordable pricing options tailored to your business needs, perfect for managing documents related to The Domestic Partnership Act. Our competitive packages help you save costs while efficiently handling New Jersey Income Tax and Inheritance Tax paperwork. You can choose from monthly or annual plans based on your expected document volume.

-

What features does airSlate SignNow offer to ensure compliance with The Domestic Partnership Act?

AirSlate SignNow includes features that help ensure compliance with The Domestic Partnership Act, such as customizable templates for partnership agreements. Additionally, the platform allows for secure electronic signatures and provides an audit trail for New Jersey Income Tax and Inheritance Tax documents. These features enhance compliance and reduce the risk of errors.

-

Can I integrate airSlate SignNow with other applications for managing The Domestic Partnership Act-related documentation?

Yes, airSlate SignNow seamlessly integrates with numerous applications that facilitate document management related to The Domestic Partnership Act. Whether you're using CRM systems or accounting software to handle New Jersey Income Tax and Inheritance Tax matters, our integrations simplify the workflow. This interconnectedness maximizes efficiency for all your documentation needs.

-

What benefits does using airSlate SignNow provide for managing taxes concerning The Domestic Partnership Act?

Using airSlate SignNow provides numerous benefits for managing taxes related to The Domestic Partnership Act, including time savings and reduced paperwork. Our platform improves collaboration among partners while ensuring adherence to New Jersey Income Tax and Inheritance Tax regulations. Plus, eSigning enhances document security, giving users peace of mind.

-

Is airSlate SignNow user-friendly for individuals unfamiliar with tax laws related to The Domestic Partnership Act?

Absolutely! AirSlate SignNow is designed to be user-friendly, even for individuals unfamiliar with tax laws surrounding The Domestic Partnership Act. Our intuitive interface simplifies the document preparation process needed for New Jersey Income Tax and Inheritance Tax. With helpful resources and customer support, you can navigate easily.

Get more for The Domestic Partnership Act New Jersey Income TaxInheritance Tax

Find out other The Domestic Partnership Act New Jersey Income TaxInheritance Tax

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later