Taxable Social Security Worksheet Form

Understanding the Taxable Social Security Worksheet

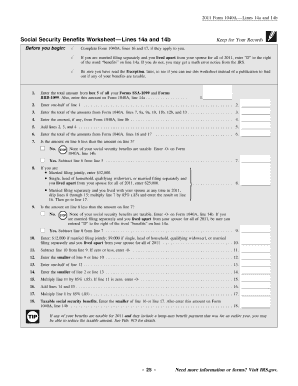

The Taxable Social Security Worksheet is a crucial tool for individuals who receive Social Security benefits and need to determine the taxable portion of those benefits. This worksheet helps taxpayers assess how much of their Social Security income is subject to federal income tax. It is particularly important for retirees and individuals with other sources of income, as it impacts overall tax liability. By accurately completing this worksheet, taxpayers can ensure compliance with IRS regulations and avoid potential penalties.

Steps to Complete the Taxable Social Security Worksheet

Completing the Taxable Social Security Worksheet involves several key steps:

- Gather necessary documents, including your Social Security benefit statements and any other income sources.

- Begin by entering your total Social Security benefits for the year on the worksheet.

- Include any additional income that may affect the taxation of your benefits, such as wages or interest income.

- Follow the worksheet's instructions to calculate the combined income, which is used to determine the taxable amount of your Social Security benefits.

- Use the provided thresholds to find out how much of your Social Security benefits will be taxed.

- Finally, record the taxable amount on your tax return.

Legal Use of the Taxable Social Security Worksheet

The Taxable Social Security Worksheet is legally recognized by the IRS as a valid method for calculating the taxable portion of Social Security benefits. It is important to complete the worksheet accurately to ensure compliance with federal tax laws. Misreporting income or failing to include all relevant sources can lead to issues with the IRS, including audits or penalties. Utilizing this worksheet helps taxpayers fulfill their legal obligations while accurately reporting their income.

Obtaining the Taxable Social Security Worksheet

The Taxable Social Security Worksheet is available through the IRS website and can be downloaded as a printable PDF. Taxpayers can also find the worksheet in tax preparation software, which often includes step-by-step guidance for completion. It is advisable to ensure you are using the correct version for the tax year, as forms may change annually. Keeping a copy of the completed worksheet for your records is also recommended.

IRS Guidelines for the Taxable Social Security Worksheet

The IRS provides specific guidelines on how to use the Taxable Social Security Worksheet effectively. These guidelines outline the income thresholds that determine how much of your Social Security benefits are taxable. It is essential to refer to the IRS instructions accompanying the worksheet to understand the calculations fully. Staying informed about any updates or changes to IRS regulations ensures that taxpayers can accurately complete their tax returns.

Examples of Using the Taxable Social Security Worksheet

Using the Taxable Social Security Worksheet can be illustrated through various taxpayer scenarios. For instance, a retiree receiving Social Security benefits and a pension may need to calculate their combined income to determine the taxable amount. Another example includes individuals who work part-time while receiving Social Security, affecting their total income. These examples highlight the worksheet's importance in accurately assessing tax liability based on individual financial situations.

Quick guide on how to complete taxable social security worksheet 100006207

Effortlessly Prepare Taxable Social Security Worksheet on Any Device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents swiftly without delays. Handle Taxable Social Security Worksheet on any device with the airSlate SignNow apps for Android or iOS and enhance any document-based workflow today.

The Easiest Method to Edit and eSign Taxable Social Security Worksheet with Ease

- Find Taxable Social Security Worksheet and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign Taxable Social Security Worksheet to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the taxable social security worksheet 100006207

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the social security benefits worksheet 2022?

The social security benefits worksheet 2022 is a comprehensive document designed to help individuals understand and calculate their potential social security benefits. It includes essential information and guidelines for accurately filling out and submitting the required forms to maximize benefits.

-

How can I use the social security benefits worksheet 2022 with airSlate SignNow?

With airSlate SignNow, you can easily upload and eSign the social security benefits worksheet 2022, streamlining your submission process. This user-friendly platform ensures that you keep track of your documents while ensuring they are securely signed and sent.

-

Is there a cost associated with accessing the social security benefits worksheet 2022 on airSlate SignNow?

Accessing the social security benefits worksheet 2022 through airSlate SignNow is part of our cost-effective eSignature solutions. Pricing plans are flexible, catering to businesses and individuals, making it affordable for anyone needing document management services.

-

What features does airSlate SignNow offer for managing the social security benefits worksheet 2022?

airSlate SignNow offers a variety of features for managing the social security benefits worksheet 2022, such as customizable templates, secure storage, and automated workflows. These features enhance your experience and simplify the process of signing and submitting critical documents.

-

Can I integrate airSlate SignNow with other tools while using the social security benefits worksheet 2022?

Yes, airSlate SignNow provides seamless integrations with many popular tools and applications, allowing you to manage the social security benefits worksheet 2022 alongside your existing workflows. This integration capability ensures greater efficiency and convenience in document management.

-

What are the benefits of using airSlate SignNow for the social security benefits worksheet 2022?

By using airSlate SignNow for the social security benefits worksheet 2022, you benefit from simplified document management, enhanced security, and faster processing times. This solution enables you to focus on what matters while ensuring your documents are handled efficiently.

-

How can I ensure the security of my social security benefits worksheet 2022 with airSlate SignNow?

airSlate SignNow employs advanced security protocols, including end-to-end encryption and secure access permissions, to protect your social security benefits worksheet 2022. Your sensitive information is safeguarded, ensuring peace of mind during the signing process.

Get more for Taxable Social Security Worksheet

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy district of columbia form

- Warranty deed from parents to child with life estate reserved by parents district of columbia form

- Dc joint 497301858 form

- Warranty deed to separate property of one spouse to both as joint tenants district of columbia form

- Dc deed online form

- District columbia llc form

- Dc deed form

- Dc quitclaim deed form

Find out other Taxable Social Security Worksheet

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple