Request for Release of Funds Corporation or LLC Ohio Form

What is the Request For Release Of Funds Corporation Or LLC Ohio

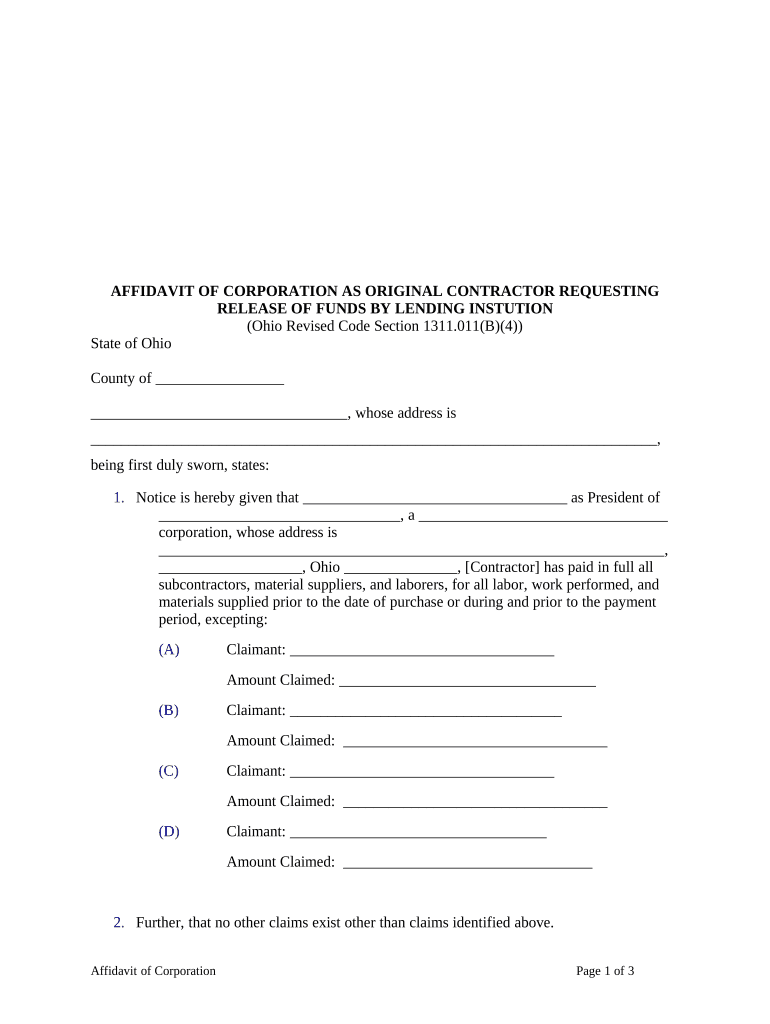

The Request For Release Of Funds Corporation Or LLC Ohio is a formal document used by corporations or limited liability companies (LLCs) in Ohio to request the release of funds held in trust or escrow. This form serves as a critical tool in financial transactions, particularly when funds are being held pending the completion of certain conditions or agreements. By submitting this request, businesses can initiate the process of accessing their funds, ensuring that all legal and procedural requirements are met.

How to Use the Request For Release Of Funds Corporation Or LLC Ohio

Using the Request For Release Of Funds Corporation Or LLC Ohio involves several steps to ensure proper completion and submission. First, the entity must gather all necessary information, including details about the funds being requested and the conditions under which they are held. Next, the form should be filled out accurately, ensuring that all required fields are completed. Once the form is filled, it can be submitted to the appropriate financial institution or escrow agent, following any specific submission guidelines they may have.

Steps to Complete the Request For Release Of Funds Corporation Or LLC Ohio

Completing the Request For Release Of Funds Corporation Or LLC Ohio requires careful attention to detail. Here are the essential steps:

- Gather relevant documentation, including agreements related to the funds.

- Fill out the form, ensuring all information is accurate and complete.

- Sign the form, either physically or electronically, depending on the submission method.

- Submit the form to the designated financial institution or escrow agent.

- Keep a copy of the submitted form for your records.

Legal Use of the Request For Release Of Funds Corporation Or LLC Ohio

The legal use of the Request For Release Of Funds Corporation Or LLC Ohio is governed by state laws and regulations. To be considered valid, the form must comply with Ohio’s legal requirements regarding signatures and documentation. This includes ensuring that the form is properly executed by authorized representatives of the corporation or LLC. Additionally, the request must meet any specific conditions outlined in the agreement that governs the funds in question.

Key Elements of the Request For Release Of Funds Corporation Or LLC Ohio

Several key elements must be included in the Request For Release Of Funds Corporation Or LLC Ohio to ensure its validity:

- Name and contact information of the requesting corporation or LLC.

- Details about the funds being requested, including the amount and purpose.

- Conditions under which the funds were held.

- Signature of an authorized representative.

- Date of the request.

State-Specific Rules for the Request For Release Of Funds Corporation Or LLC Ohio

Ohio has specific rules governing the Request For Release Of Funds Corporation Or LLC Ohio. These rules dictate how the form should be filled out, the necessary signatures required, and how the request should be submitted. It is important for businesses to familiarize themselves with these regulations to ensure compliance and avoid delays in the release of funds. Consulting with a legal professional can provide additional guidance on state-specific requirements.

Quick guide on how to complete request for release of funds corporation or llc ohio

Complete Request For Release Of Funds Corporation Or LLC Ohio seamlessly on any gadget

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-conscious alternative to conventional printed and signed papers, allowing you to acquire the necessary form and safely archive it online. airSlate SignNow equips you with all the resources required to create, amend, and eSign your documents quickly without holdups. Handle Request For Release Of Funds Corporation Or LLC Ohio on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

The easiest method to edit and eSign Request For Release Of Funds Corporation Or LLC Ohio effortlessly

- Locate Request For Release Of Funds Corporation Or LLC Ohio and then select Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to retain your adjustments.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Request For Release Of Funds Corporation Or LLC Ohio and ensure seamless communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process to Request For Release Of Funds for a Corporation Or LLC in Ohio?

To Request For Release Of Funds for a Corporation Or LLC in Ohio, you typically need to submit a formal request accompanied by specific documentation that proves your entitlement to the funds. This can include a signed agreement or any relevant contracts. Utilizing airSlate SignNow can streamline this process by allowing you to easily prepare, sign, and send your request digitally.

-

Are there any fees associated with the Request For Release Of Funds for a Corporation Or LLC in Ohio?

Yes, there may be fees associated with completing a Request For Release Of Funds for a Corporation Or LLC in Ohio, depending on the service provider you choose. With airSlate SignNow, we offer cost-effective pricing plans that are transparent and competitive. This ensures you can efficiently manage your document workflows without unexpected costs.

-

What features does airSlate SignNow offer for managing fund release requests?

airSlate SignNow offers several features designed to facilitate the Request For Release Of Funds for a Corporation Or LLC in Ohio, including eSignature capabilities, document templates, and automated reminders. These features help ensure that your documents are completed quickly and that you maintain compliance throughout the process.

-

How can airSlate SignNow benefit my Corporation Or LLC in Ohio when making a fund release request?

Using airSlate SignNow for your Request For Release Of Funds for a Corporation Or LLC in Ohio offers numerous benefits, including ease of use, enhanced security, and time savings. You can manage all your documents on a single platform, ensuring that all necessary signatures are collected efficiently while reducing the chances of errors.

-

Is airSlate SignNow compliant with Ohio regulations for fund release requests?

Yes, airSlate SignNow is designed to comply with Ohio regulations regarding the Request For Release Of Funds for a Corporation Or LLC. Our platform follows the necessary guidelines to ensure that your documents meet legal standards, providing peace of mind that your requests will be valid and enforceable.

-

Can I integrate airSlate SignNow with other business tools for my fund release requests?

Absolutely! airSlate SignNow offers seamless integration with various business tools and applications, enhancing your ability to effectively manage the Request For Release Of Funds for a Corporation Or LLC in Ohio. This connectivity allows you to streamline processes with tools like CRM systems, cloud storage, and accounting software.

-

How quickly can I expect my Request For Release Of Funds to be processed?

The processing time for your Request For Release Of Funds for a Corporation Or LLC in Ohio can vary depending on the specific circumstances and the institutions involved. However, using airSlate SignNow can substantially speed up this process as electronic signatures and digital document exchange facilitate quicker approvals and responses.

Get more for Request For Release Of Funds Corporation Or LLC Ohio

Find out other Request For Release Of Funds Corporation Or LLC Ohio

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors