IRS Form W 4

What is the IRS Form W-4

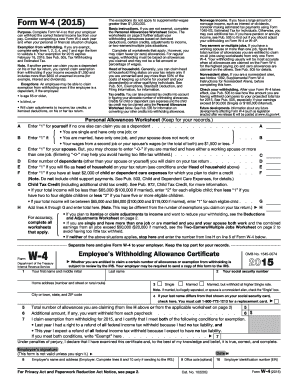

The IRS Form W-4, officially known as the Employee's Withholding Certificate, is a crucial document used by employees in the United States to inform their employers about the amount of federal income tax to withhold from their paychecks. This form helps ensure that the correct amount of tax is deducted, which can prevent underpayment or overpayment of taxes throughout the year. By accurately completing the W-4, employees can manage their tax liabilities more effectively and avoid surprises when filing their annual tax returns.

How to Use the IRS Form W-4

Using the IRS Form W-4 involves several straightforward steps. First, employees need to provide personal information, including their name, address, Social Security number, and filing status. Next, they will indicate the number of allowances they are claiming, which directly affects the withholding amount. Additionally, employees can choose to have extra withholding if they anticipate owing more taxes. It is important to review the completed form for accuracy before submitting it to the employer, as this ensures proper withholding throughout the year.

Steps to Complete the IRS Form W-4

Completing the IRS Form W-4 requires careful attention to detail. Here are the steps to follow:

- Enter your personal information, including your name, address, and Social Security number.

- Select your filing status: single, married filing jointly, married filing separately, or head of household.

- Claim allowances based on your personal situation, such as dependents and other factors.

- Decide if you want additional withholding and specify the amount if applicable.

- Sign and date the form before submitting it to your employer.

Key Elements of the IRS Form W-4

The IRS Form W-4 consists of several key elements that impact how much tax is withheld from an employee's paycheck. These include:

- Personal Information: Name, address, and Social Security number.

- Filing Status: Options include single, married filing jointly, married filing separately, or head of household.

- Allowances: The number of allowances claimed affects the withholding amount.

- Additional Withholding: Employees can request extra withholding if they expect to owe more taxes.

Legal Use of the IRS Form W-4

The legal use of the IRS Form W-4 is essential for compliance with federal tax laws. Employers are required to withhold the appropriate amount of federal income tax based on the information provided in the form. Failure to complete the W-4 accurately can result in incorrect withholding, leading to potential penalties for underpayment or overpayment of taxes. It is important for employees to keep their W-4 information updated, especially after significant life changes such as marriage, divorce, or the birth of a child.

Form Submission Methods

The IRS Form W-4 can be submitted to employers in various ways. Employees typically provide the completed form directly to their HR or payroll department. Many employers now accept electronic submissions, allowing employees to fill out and submit the form digitally. However, if an employee prefers to submit a paper form, they can print it out and deliver it in person or via mail. Regardless of the submission method, it is crucial to ensure that the form is submitted promptly to avoid any issues with tax withholding.

Quick guide on how to complete irs form w 4

Finalize IRS Form W 4 effortlessly on any gadget

Web-based document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute to conventional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage IRS Form W 4 on any system using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign IRS Form W 4 with ease

- Find IRS Form W 4 and click on Obtain Form to initiate.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Verify all the details and click on the Completed button to save your updates.

- Decide how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced files, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your choice. Edit and eSign IRS Form W 4 to ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form w 4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS Form W 4 and why is it important?

The IRS Form W 4 is a crucial document that allows employees to indicate their tax withholding preferences. Understanding the information on the IRS Form W 4 can help ensure that you pay the correct amount of taxes throughout the year, preventing surprises during tax season.

-

How does airSlate SignNow streamline the process of filling out IRS Form W 4?

airSlate SignNow provides an intuitive platform that simplifies the completion of IRS Form W 4. With easily accessible templates and e-signature capabilities, businesses can efficiently collect necessary employee information and ensure compliance with tax regulations.

-

Is airSlate SignNow cost-effective for managing IRS Form W 4?

Yes, airSlate SignNow offers a cost-effective solution for managing IRS Form W 4. Our pricing plans are designed to fit businesses of all sizes, allowing you to save both time and money while ensuring compliance with tax obligations.

-

What features does airSlate SignNow include for handling IRS Form W 4?

airSlate SignNow includes features such as customizable templates, e-signatures, and automated workflows specifically for IRS Form W 4. These tools help optimize the document management process, making it quicker and easier for your business.

-

Can I track the status of the IRS Form W 4 sent through airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for all documents, including the IRS Form W 4. You can easily monitor the status of your forms and receive notifications when they have been completed and signed.

-

How can airSlate SignNow ensure the security of IRS Form W 4 information?

Security is a top priority at airSlate SignNow. We employ advanced encryption and secure cloud storage to protect sensitive information on IRS Form W 4, ensuring that your data remains safe and compliant with industry standards.

-

Does airSlate SignNow integrate with other tools for better management of IRS Form W 4?

Yes, airSlate SignNow integrates seamlessly with numerous business applications, enhancing your management of IRS Form W 4. This allows for smoother workflows and better data synchronization across your existing systems.

Get more for IRS Form W 4

- Special or limited power of attorney for real estate purchase transaction by purchaser delaware form

- Limited power of attorney where you specify powers with sample powers included delaware form

- Limited power of attorney for stock transactions and corporate powers delaware form

- Special durable power of attorney for bank account matters delaware form

- Delaware statutory personal durable power of attorney delaware form

- Delaware small business startup package delaware form

- Delaware property management package delaware form

- New resident guide delaware form

Find out other IRS Form W 4

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application