I Received Certification for No Information Reporting on

What is the I Received Certification For No Information Reporting On

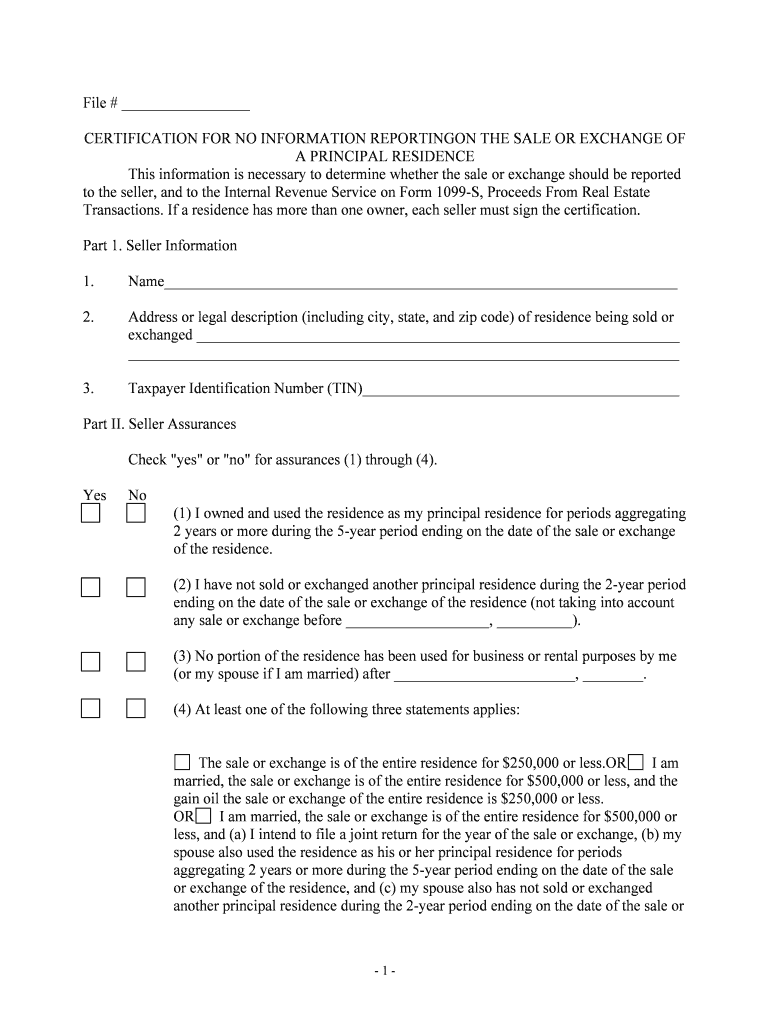

The "I Received Certification For No Information Reporting On" is a formal document used primarily in tax contexts. It serves to certify that an individual or entity has not received certain types of income that require reporting to the Internal Revenue Service (IRS). This certification can be crucial for taxpayers who want to clarify their reporting obligations and avoid unnecessary tax complications. Understanding this form is essential for compliance with tax regulations and ensuring accurate reporting.

How to use the I Received Certification For No Information Reporting On

Using the "I Received Certification For No Information Reporting On" involves several key steps. First, ensure that you meet the criteria for certification. This includes confirming that you have not received any reportable income during the specified period. Next, complete the form accurately, providing all necessary information. Once filled out, submit the form to the relevant authority, such as the IRS or your state tax agency, as required. Utilizing electronic signature solutions like signNow can streamline this process, allowing for secure and efficient submission.

Steps to complete the I Received Certification For No Information Reporting On

Completing the "I Received Certification For No Information Reporting On" involves a systematic approach:

- Gather necessary documentation to support your claim of no reportable income.

- Access the form through the appropriate tax authority's website or platform.

- Fill in your personal details, ensuring accuracy in all fields.

- Clearly state the period for which you are certifying no information reporting.

- Review the completed form for any errors or omissions.

- Sign the form electronically or manually, depending on submission method.

- Submit the form according to the guidelines provided by the IRS or relevant agency.

Legal use of the I Received Certification For No Information Reporting On

The legal use of the "I Received Certification For No Information Reporting On" is grounded in its compliance with IRS regulations. This form is recognized as a valid means of certifying that no income has been received that requires reporting. To ensure its legal standing, it is important to follow all guidelines set forth by the IRS, including accurate completion and timely submission. This helps protect taxpayers from potential penalties and ensures compliance with federal tax laws.

Required Documents

When preparing to complete the "I Received Certification For No Information Reporting On," certain documents may be necessary:

- Personal identification, such as a Social Security number or taxpayer identification number.

- Supporting documentation that verifies your claim of no reportable income, such as bank statements or previous tax returns.

- Any correspondence from the IRS or state tax agencies regarding your tax status.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the "I Received Certification For No Information Reporting On" can result in significant penalties. If the IRS determines that you incorrectly certified your income status, you may face fines, interest on unpaid taxes, and potential legal action. It is crucial to ensure that all information provided is accurate and truthful to avoid these consequences. Regularly reviewing your tax obligations can help mitigate risks associated with non-compliance.

Quick guide on how to complete i received certification for no information reporting on

Easily prepare I Received Certification For No Information Reporting On on any device

Digital document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents promptly without holdups. Manage I Received Certification For No Information Reporting On on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-based process today.

How to alter and eSign I Received Certification For No Information Reporting On effortlessly

- Find I Received Certification For No Information Reporting On and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select important parts of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to apply your changes.

- Decide how you wish to send your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in a few clicks from any device of your choice. Edit and eSign I Received Certification For No Information Reporting On and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does 'I Received Certification For No Information Reporting On' mean?

The phrase 'I Received Certification For No Information Reporting On' indicates that a business has been certified to manage documentation without the need to report specific information. This ensures compliance with regulations while simplifying the documentation process, enabling users to focus on their core activities.

-

How does airSlate SignNow support the certification process?

airSlate SignNow provides a streamlined platform for managing documents, which can assist users in achieving certification. The solution enables users to organize and eSign documents easily, ensuring that all necessary information is there for the certification process related to 'I Received Certification For No Information Reporting On.'

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans tailored to different business needs. Each plan provides access to essential features, including eSigning, without the complications often associated with certifications like 'I Received Certification For No Information Reporting On.' You can choose a plan that best fits your workflow and budget.

-

What features does airSlate SignNow provide for document management?

With airSlate SignNow, users benefit from a comprehensive set of features for document management, including eSigning, templates, and automated workflows. These features support your compliance needs, particularly for cases where 'I Received Certification For No Information Reporting On' is crucial, ensuring a straightforward documentation process.

-

Can I integrate airSlate SignNow with my existing tools?

Yes, airSlate SignNow offers integration with numerous third-party applications, enhancing your workflow. These integrations support your efforts to maintain compliance, especially in scenarios where you need to adhere to certification like 'I Received Certification For No Information Reporting On.'

-

What are the benefits of using airSlate SignNow for business processes?

Using airSlate SignNow simplifies document handling, saves time, and reduces costs, making it an effective solution for businesses. It's particularly helpful for organizations needing to facilitate processes related to 'I Received Certification For No Information Reporting On,' as it ensures documents are managed efficiently and securely.

-

Is airSlate SignNow compliant with legal standards?

Yes, airSlate SignNow is designed to comply with various legal standards and regulations regarding electronic signatures and document management. This compliance is essential for businesses pursuing processes related to 'I Received Certification For No Information Reporting On,' ensuring their documentation holds up under legal scrutiny.

Get more for I Received Certification For No Information Reporting On

Find out other I Received Certification For No Information Reporting On

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online