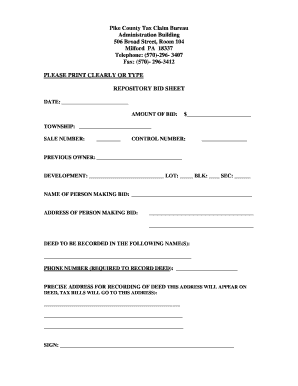

Pike County Tax Claim Bureau Form

What is the Pike County Tax Claim Bureau

The Pike County Tax Claim Bureau is a governmental entity responsible for managing the collection of property taxes and handling tax claims within Pike County, Pennsylvania. This bureau oversees the process of tax lien sales, ensuring that property owners meet their tax obligations. It plays a crucial role in maintaining the county's financial health by ensuring that taxes are collected efficiently and transparently. The bureau also provides resources and assistance to taxpayers, helping them navigate their responsibilities and understand the implications of tax claims.

How to use the Pike County Tax Claim Bureau

Utilizing the Pike County Tax Claim Bureau involves several steps. Taxpayers can access information regarding their property taxes, payment options, and potential tax claims. The bureau offers online resources, including forms and guidelines, to facilitate the process. Individuals can also contact the bureau directly for assistance or clarification on specific issues related to their tax claims. Understanding the bureau's procedures and available resources can significantly ease the burden of managing property taxes.

Steps to complete the Pike County Tax Claim Bureau form

Completing the Pike County Tax Claim Bureau form requires careful attention to detail. First, gather all necessary documentation, including property information and tax records. Next, accurately fill out the form, ensuring that all required fields are completed. It is essential to review the form for any errors or omissions before submission. Finally, submit the form through the appropriate method, whether online, by mail, or in person. Following these steps helps ensure that the form is processed without delays.

Legal use of the Pike County Tax Claim Bureau

The legal use of the Pike County Tax Claim Bureau is governed by state laws and regulations. Taxpayers must comply with the established guidelines to ensure their forms and claims are valid. This includes understanding the legal implications of tax claims and the rights of property owners. The bureau adheres to the Pennsylvania Consolidated Statutes, which outline the responsibilities of both the bureau and the taxpayers. Familiarity with these legal frameworks is essential for anyone engaging with the bureau.

Required Documents

When dealing with the Pike County Tax Claim Bureau, certain documents are required to facilitate the process. Taxpayers typically need to provide proof of property ownership, tax payment history, and any previous correspondence with the bureau. Additional documents may include identification and financial statements, depending on the specific circumstances of the tax claim. Ensuring that all required documents are prepared in advance can streamline the process and reduce the likelihood of delays.

Form Submission Methods

The Pike County Tax Claim Bureau offers multiple methods for submitting forms. Taxpayers can choose to submit their forms online through the bureau's official website, which provides a convenient and efficient option. Alternatively, forms can be mailed directly to the bureau or submitted in person at their office. Each submission method has its own guidelines and timelines, so it is important to select the method that best suits the individual's needs and circumstances.

Filing Deadlines / Important Dates

Filing deadlines and important dates are critical for taxpayers engaging with the Pike County Tax Claim Bureau. These dates dictate when forms must be submitted and when payments are due to avoid penalties. It is essential for taxpayers to stay informed about these deadlines to ensure compliance and avoid potential issues with their property taxes. The bureau typically publishes a calendar of important dates, which can be accessed through their official resources.

Quick guide on how to complete pike county tax claim bureau

Prepare Pike County Tax Claim Bureau effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without hindrances. Manage Pike County Tax Claim Bureau on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related workflow today.

How to alter and eSign Pike County Tax Claim Bureau seamlessly

- Obtain Pike County Tax Claim Bureau and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred delivery method for your form, by email, SMS, or invite link, or download it to your PC.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Pike County Tax Claim Bureau and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pike county tax claim bureau

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What services does the Pike County Tax Claim Bureau offer?

The Pike County Tax Claim Bureau provides essential services related to tax claims, including the collection of delinquent taxes, property tax assessments, and tax lien sales. By utilizing their services, residents can ensure compliance with all tax obligations and avoid penalties.

-

How can I check the status of my tax claim at the Pike County Tax Claim Bureau?

To check the status of your tax claim at the Pike County Tax Claim Bureau, you can visit their official website or contact their office directly. It's vital to have your tax identification number handy for more efficient assistance.

-

Are there any fees associated with services from the Pike County Tax Claim Bureau?

Yes, the Pike County Tax Claim Bureau does impose certain fees for their services, such as processing and administrative fees when handling tax claims. It’s advisable to review their fee schedule provided on their website for a clear understanding of the costs involved.

-

What are the benefits of using the Pike County Tax Claim Bureau for property tax issues?

Using the Pike County Tax Claim Bureau simplifies managing property tax issues. They offer expert guidance, streamlined processing of claims, and a transparent approach to resolving tax debts, ensuring that residents can quickly and efficiently address their tax responsibilities.

-

Can the Pike County Tax Claim Bureau help with payment plans for delinquent taxes?

Yes, the Pike County Tax Claim Bureau can assist taxpayers in setting up payment plans for delinquent taxes. This option allows taxpayers to manage their tax liabilities more effectively, helping them avoid further penalties while making manageable payments.

-

What documents do I need to provide to the Pike County Tax Claim Bureau for a tax claim?

To initiate a tax claim with the Pike County Tax Claim Bureau, you will typically need to provide documentation such as proof of ownership, tax identification information, and any previous tax notices. Ensuring you have all necessary documents will expedite the processing of your claim.

-

Is it possible to appeal a decision made by the Pike County Tax Claim Bureau?

Yes, residents have the right to appeal decisions made by the Pike County Tax Claim Bureau. If you believe an error has occurred or disagree with an assessment, you can file an appeal by following their specified procedures outlined in their guidelines.

Get more for Pike County Tax Claim Bureau

- Name affidavit of buyer rhode island form

- Name affidavit of seller rhode island form

- Non foreign affidavit under irc 1445 rhode island form

- Owners or sellers affidavit of no liens rhode island form

- Ri occupancy form

- Complex will with credit shelter marital trust for large estates rhode island form

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts where 497325265 form

- Marital domestic separation and property settlement agreement minor children no joint property or debts where divorce action 497325266 form

Find out other Pike County Tax Claim Bureau

- Electronic signature New York Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Computer

- Electronic signature South Carolina Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Easy

- How To Electronic signature South Carolina Bookkeeping Contract

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online