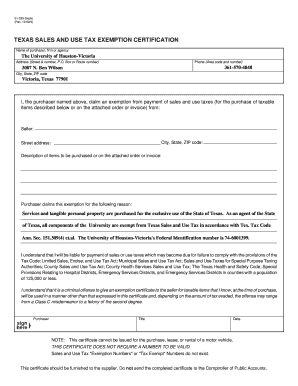

Texas Sales and Use Tax Exemption Certification University of Uhv Form

What is the Texas Sales and Use Tax Exemption Certification?

The Texas Sales and Use Tax Exemption Certification is a crucial document that allows eligible entities to purchase certain goods and services without paying sales tax. This form is primarily used by organizations such as non-profits, educational institutions, and governmental entities that qualify for tax-exempt status under Texas law. By submitting this certification, entities can ensure compliance with state tax regulations while minimizing their tax burden. The form is officially recognized and must be presented to sellers when making tax-exempt purchases.

Steps to Complete the Texas Sales and Use Tax Exemption Certification

Completing the Texas Sales and Use Tax Exemption Certification involves several straightforward steps:

- Obtain the official form, which can be downloaded from the Texas Comptroller's website or requested from the appropriate state office.

- Fill in the required information, including the name of the organization, address, and type of exemption being claimed.

- Provide a description of the goods or services being purchased tax-exempt.

- Sign and date the form, ensuring that the signature is from an authorized representative of the entity.

- Submit the completed form to the vendor at the time of purchase.

Eligibility Criteria for the Texas Sales and Use Tax Exemption Certification

To qualify for the Texas Sales and Use Tax Exemption Certification, entities must meet specific eligibility criteria. Generally, these include:

- Being a recognized non-profit organization, educational institution, or governmental body.

- Engaging in activities that are exempt under Texas tax laws, such as charitable, educational, or religious purposes.

- Providing documentation that verifies the organization's tax-exempt status, which may include IRS determination letters.

Legal Use of the Texas Sales and Use Tax Exemption Certification

The legal use of the Texas Sales and Use Tax Exemption Certification is governed by state laws and regulations. It is essential for organizations to use this form correctly to avoid potential legal issues. Misuse of the exemption can lead to penalties, including the obligation to pay back taxes, interest, and fines. Therefore, it is crucial to ensure that the form is only used for eligible purchases and that it is filled out accurately.

How to Obtain the Texas Sales and Use Tax Exemption Certification

Obtaining the Texas Sales and Use Tax Exemption Certification is a straightforward process. Organizations can acquire the form through the Texas Comptroller's website or by contacting their local tax office. It is important to ensure that the form is the most current version, as outdated forms may not be accepted. Additionally, organizations should gather any necessary documentation to support their tax-exempt status before submitting the form.

Examples of Using the Texas Sales and Use Tax Exemption Certification

Organizations can use the Texas Sales and Use Tax Exemption Certification in various scenarios. For instance:

- A non-profit organization purchasing supplies for a community event can present this form to avoid sales tax on those items.

- An educational institution acquiring textbooks for students can utilize the exemption to reduce costs.

- A governmental entity purchasing equipment for public services can also benefit from the tax-exempt status.

Quick guide on how to complete texas sales and use tax exemption certification university of uhv

Easily Prepare Texas Sales And Use Tax Exemption Certification University Of Uhv on Any Device

The online management of documents has gained popularity among both businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to quickly create, edit, and electronically sign your documents without any delays. Manage Texas Sales And Use Tax Exemption Certification University Of Uhv on any platform with the airSlate SignNow Android or iOS applications and streamline your document-related processes today.

How to Edit and Electronically Sign Texas Sales And Use Tax Exemption Certification University Of Uhv Effortlessly

- Find Texas Sales And Use Tax Exemption Certification University Of Uhv and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using features provided specifically for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which only takes seconds and carries the same legal validity as a traditional ink signature.

- Review all information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Texas Sales And Use Tax Exemption Certification University Of Uhv while ensuring effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the texas sales and use tax exemption certification university of uhv

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Texas sales tax?

Texas sales tax is a tax imposed by the state on retail sales of goods and services. It typically affects businesses that sell products directly to consumers. Understanding Texas sales tax is essential for compliance and accurate accounting.

-

How does airSlate SignNow help with Texas sales tax documentation?

airSlate SignNow facilitates the eSigning and management of vital documents related to Texas sales tax compliance. With our solution, businesses can streamline the process of collecting signatures on important tax-related documents, making compliance easier and faster.

-

Can airSlate SignNow assist with filing Texas sales tax forms?

While airSlate SignNow does not file Texas sales tax forms directly, it helps businesses prepare the necessary documents for filing. By easily collecting and managing signed documents, we ensure that your Texas sales tax forms are accurate and ready for submission.

-

What pricing options does airSlate SignNow offer for businesses managing Texas sales tax?

airSlate SignNow provides various pricing plans tailored to accommodate businesses of all sizes dealing with Texas sales tax. We offer flexible monthly subscriptions that allow you to choose the level of features you need, making it a cost-effective solution.

-

Are there any integrations available to help with Texas sales tax reporting?

Yes, airSlate SignNow integrates with various accounting and tax software to enhance Texas sales tax reporting. These integrations ensure that your signed documents sync seamlessly with your financial systems, simplifying your overall sales tax management.

-

What features does airSlate SignNow offer that are beneficial for Texas businesses?

airSlate SignNow offers features such as eSigning, document templates, and real-time tracking, which are especially beneficial for Texas businesses. These functionalities streamline workflows, ensure compliance with Texas sales tax regulations, and reduce the turnaround time for approvals.

-

How secure is airSlate SignNow when handling Texas sales tax documents?

airSlate SignNow prioritizes security and employs advanced encryption to protect sensitive Texas sales tax documents. Our platform ensures that all eSigned documents are stored securely, providing peace of mind for businesses handling financial information.

Get more for Texas Sales And Use Tax Exemption Certification University Of Uhv

- Buy sell agreement package south carolina form

- Option to purchase package south carolina form

- Amendment of lease package south carolina form

- Annual financial checkup package south carolina form

- Sc bill sale form

- Living wills and health care package south carolina form

- Last will and testament package south carolina form

- Sc subcontractors form

Find out other Texas Sales And Use Tax Exemption Certification University Of Uhv

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement