NOTE If Either Spouse is Deceased, Enter the Date of Death on Form 1040ME, Page 3 in the Spaces Provided above the Signature Are

Understanding the Note if Either Spouse Is Deceased on Form 1040ME

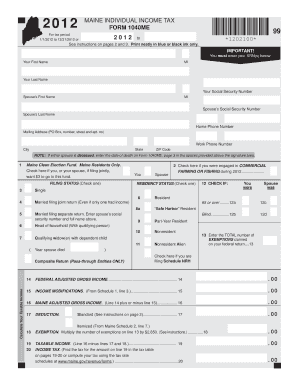

The note regarding the entry of a deceased spouse's date of death on Form 1040ME is crucial for accurate tax reporting. This specific instruction is found on page three of the form, in the designated spaces above the signature area. It serves to inform the IRS of the change in marital status, which can affect tax calculations, deductions, and credits. Properly documenting the date of death ensures compliance with tax regulations and helps avoid potential issues during the filing process.

Steps to Complete the Note if Either Spouse Is Deceased on Form 1040ME

To accurately complete the note if either spouse is deceased on Form 1040ME, follow these steps:

- Locate page three of Form 1040ME.

- Find the spaces provided above the signature area, specifically designated for entering the date of death.

- Enter the date of death in the format MM/DD/YYYY. Ensure that the date is accurate and corresponds with official documentation.

- Review the completed form for accuracy before submitting it to the IRS.

Legal Use of the Note if Either Spouse Is Deceased on Form 1040ME

The legal implications of accurately completing the note if either spouse is deceased on Form 1040ME are significant. This entry is not merely procedural; it ensures that the IRS has the most current information regarding your tax situation. Failure to report a spouse's death can lead to complications, including potential audits or penalties. By adhering to this requirement, taxpayers help maintain transparency and compliance with federal tax laws.

IRS Guidelines for Reporting a Deceased Spouse

The IRS has specific guidelines regarding the reporting of a deceased spouse on tax forms. It is essential to refer to the IRS instructions for Form 1040ME to understand the requirements fully. These guidelines clarify how to report income, deductions, and credits for the year of death. Additionally, the IRS provides information on filing status options, which may change following a spouse's passing.

Filing Deadlines and Important Dates for Form 1040ME

When dealing with the note if either spouse is deceased on Form 1040ME, it is vital to be aware of filing deadlines. Generally, the deadline for submitting Form 1040ME is April 15 of the following tax year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also consider any extensions they may wish to file, which can provide additional time for submission.

Examples of Situations Involving the Note if Either Spouse Is Deceased

Several scenarios may arise that necessitate the completion of the note if either spouse is deceased on Form 1040ME. For instance:

- A married couple filing jointly, where one spouse passed away during the tax year.

- A widow or widower filing as a single taxpayer after the death of their spouse.

- Taxpayers who need to amend a previously filed return to reflect the death of a spouse.

In each case, accurately entering the date of death is essential for proper tax reporting and compliance.

Quick guide on how to complete note if either spouse is deceased enter the date of death on form 1040me page 3 in the spaces provided above the signature area

Complete NOTE If Either Spouse Is Deceased, Enter The Date Of Death On Form 1040ME, Page 3 In The Spaces Provided Above The Signature Are effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can access the proper form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage NOTE If Either Spouse Is Deceased, Enter The Date Of Death On Form 1040ME, Page 3 In The Spaces Provided Above The Signature Are on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign NOTE If Either Spouse Is Deceased, Enter The Date Of Death On Form 1040ME, Page 3 In The Spaces Provided Above The Signature Are without hassle

- Locate NOTE If Either Spouse Is Deceased, Enter The Date Of Death On Form 1040ME, Page 3 In The Spaces Provided Above The Signature Are and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and hit the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign NOTE If Either Spouse Is Deceased, Enter The Date Of Death On Form 1040ME, Page 3 In The Spaces Provided Above The Signature Are and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the note if either spouse is deceased enter the date of death on form 1040me page 3 in the spaces provided above the signature area

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What should I do if one spouse has passed away while filing Form 1040ME?

If either spouse is deceased, you should enter the date of death on Form 1040ME, Page 3 in the spaces provided above the signature area. This ensures that the IRS has accurate information regarding the circumstances of the filing, which can impact tax liabilities and benefits.

-

How does airSlate SignNow simplify document signing for tax forms?

airSlate SignNow provides an intuitive platform for eSigning documents, making the process quick and efficient. You can easily sign and send Form 1040ME and other tax-related documents without the hassle of printing, ensuring compliance with the requirement to NOTE if either spouse is deceased, enter the date of death on Form 1040ME, Page 3 in the spaces provided.

-

Are there any fees associated with using airSlate SignNow?

airSlate SignNow offers various pricing plans that cater to different business needs. While there are subscription fees, the cost is often lower than traditional paper-based document handling, providing a cost-effective solution for managing forms, including instances where you need to NOTE if either spouse is deceased, enter the date of death on Form 1040ME, Page 3 in the spaces provided above the signature area.

-

What features does airSlate SignNow offer for businesses?

airSlate SignNow includes various features, such as document templates, automated workflows, and secure cloud storage. These tools streamline the document signing process while ensuring that important details, like the date of death if either spouse is deceased, are correctly noted on Form 1040ME, Page 3 in the designated areas.

-

Can airSlate SignNow integrate with other software tools?

Yes, airSlate SignNow seamlessly integrates with a variety of software applications, including CRM systems and cloud storage services. This enhances your document management experience and ensures you can effortlessly handle tax-related documents, remembering to NOTE if either spouse is deceased, enter the date of death on Form 1040ME, Page 3 in the designated spaces.

-

Is airSlate SignNow compliant with legal regulations for e-signatures?

Absolutely! airSlate SignNow adheres to legal regulations for electronic signatures, ensuring that all signed documents are legally binding. This includes compliance for tax forms like the 1040ME, especially in situations where you must NOTE if either spouse is deceased, enter the date of death on Form 1040ME, Page 3 in the spaces provided above the signature area.

-

How secure is the information shared through airSlate SignNow?

airSlate SignNow takes security seriously, using encryption and secure data storage to protect your sensitive information. You can eSign tax documents with confidence, knowing that crucial details such as when to NOTE if either spouse is deceased, enter the date of death on Form 1040ME, Page 3 in the required spaces are safeguarded.

Get more for NOTE If Either Spouse Is Deceased, Enter The Date Of Death On Form 1040ME, Page 3 In The Spaces Provided Above The Signature Are

- General warranty deed life estate form

- Texas owner form

- Landlord tenant notice 497327479 form

- Letter tenant notice 497327480 form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497327481 form

- Letter from tenant to landlord containing notice that premises leaks during rain and demand for repair texas form

- Texas letter notice form

- Texas repair form

Find out other NOTE If Either Spouse Is Deceased, Enter The Date Of Death On Form 1040ME, Page 3 In The Spaces Provided Above The Signature Are

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later