Prudential Foundation Matching Gifts Program Form

What is the Prudential Foundation Matching Gifts Program Form

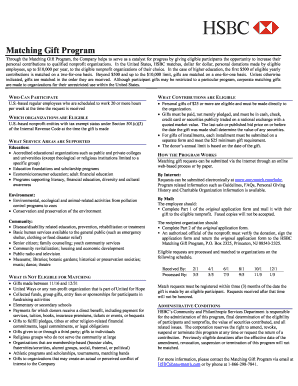

The Prudential Foundation Matching Gifts Program Form is a document designed to facilitate the matching gift process for employees of Prudential Financial. This program encourages employees to support eligible nonprofit organizations by matching their donations, effectively doubling the impact of their contributions. The form captures essential information about the employee, the organization receiving the donation, and the amount contributed. It serves as a formal request for the company to match the donation made by the employee, ensuring that charitable contributions are recognized and amplified.

How to use the Prudential Foundation Matching Gifts Program Form

Using the Prudential Foundation Matching Gifts Program Form involves several straightforward steps. First, the employee must complete the form with accurate details, including their personal information and the nonprofit organization’s specifics. Next, the employee submits the form along with proof of their donation, such as a receipt or acknowledgment letter from the nonprofit. Once submitted, Prudential reviews the request, verifies the eligibility of the organization, and processes the matching gift. It is important to ensure that all information is filled out correctly to avoid delays in processing.

Steps to complete the Prudential Foundation Matching Gifts Program Form

Completing the Prudential Foundation Matching Gifts Program Form requires careful attention to detail. Here are the steps to follow:

- Obtain the form from Prudential’s internal resources or website.

- Fill in your personal information, including your name, employee ID, and contact details.

- Provide the name and address of the nonprofit organization you supported.

- Indicate the amount of your donation and attach any necessary documentation, such as a receipt.

- Review the form for accuracy and completeness.

- Submit the completed form through the designated method, whether online, by mail, or in person.

Legal use of the Prudential Foundation Matching Gifts Program Form

The Prudential Foundation Matching Gifts Program Form is legally binding when completed and submitted according to Prudential's guidelines. To ensure its legal standing, the form must be filled out accurately, with all required signatures and documentation attached. Electronic submissions are accepted, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act, which recognizes electronic signatures as legally valid. Adhering to these legal frameworks helps protect both the employee's and the organization's interests.

Eligibility Criteria

To qualify for the Prudential Foundation Matching Gifts Program, certain eligibility criteria must be met. Employees must be active, full-time employees of Prudential Financial. The nonprofit organization receiving the donation must be a registered 501(c)(3) organization, recognized by the IRS. Additionally, there may be limits on the amount that can be matched per employee, typically capped at a specific dollar amount per calendar year. It is advisable for employees to verify the eligibility of their chosen organization before submitting the form.

Form Submission Methods

The Prudential Foundation Matching Gifts Program Form can be submitted through various methods to accommodate different preferences. Employees can choose to submit the form online via Prudential’s designated platform, ensuring a quick and efficient process. Alternatively, the form can be mailed to the appropriate department within Prudential or delivered in person at designated locations. Each submission method has its own guidelines, so employees should follow the instructions provided to ensure their requests are processed without delay.

Quick guide on how to complete prudential foundation matching gifts program form

Set up Prudential Foundation Matching Gifts Program Form effortlessly on any gadget

Digital document management has gained immense popularity among businesses and individuals. It serves as an ideal, eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents rapidly without delays. Handle Prudential Foundation Matching Gifts Program Form on any gadget using airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The simplest way to alter and electronically sign Prudential Foundation Matching Gifts Program Form without hassle

- Locate Prudential Foundation Matching Gifts Program Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize essential parts of the document or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Prudential Foundation Matching Gifts Program Form to ensure exceptional communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the prudential foundation matching gifts program form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Prudential Foundation Matching Gifts Program Form?

The Prudential Foundation Matching Gifts Program Form is a document that organizations use to request matching donations from the Prudential Foundation for charitable contributions made by their employees. This form streamlines the process, ensuring that both donors and recipients can easily navigate the matching gift process.

-

How can I access the Prudential Foundation Matching Gifts Program Form?

You can access the Prudential Foundation Matching Gifts Program Form through the Prudential Foundation's website or by contacting their customer service for direct assistance. Additionally, utilizing airSlate SignNow allows organizations to securely eSign and manage these forms digitally, simplifying the application process.

-

What are the benefits of using the Prudential Foundation Matching Gifts Program?

The benefits of utilizing the Prudential Foundation Matching Gifts Program include increased funding for nonprofits, enhanced company engagement in charitable giving, and the ability to amplify the impact of individual donations. By submitting the Prudential Foundation Matching Gifts Program Form, organizations can leverage these matching gifts effectively.

-

Are there any costs associated with the Prudential Foundation Matching Gifts Program?

Typically, there are no direct costs for employees to participate in the Prudential Foundation Matching Gifts Program. However, organizations may need to ensure their forms are completed accurately and submitted timely, which can be efficiently managed using airSlate SignNow to avoid any potential issues.

-

What features does the Prudential Foundation Matching Gifts Program Form include?

The Prudential Foundation Matching Gifts Program Form usually includes sections for donor information, recipient charity details, and donation verification. By using airSlate SignNow, you can take advantage of features like secure eSigning, automatic reminders, and tracking, enhancing the form submission process.

-

Can I integrate the Prudential Foundation Matching Gifts Program Form with my existing systems?

Yes, airSlate SignNow offers integration capabilities with various HR and financial software, allowing you to easily manage the Prudential Foundation Matching Gifts Program Form within your current systems. This enhances workflow efficiency and data management.

-

How does AirSlate SignNow simplify the Prudential Foundation Matching Gifts Program Form process?

AirSlate SignNow simplifies the Prudential Foundation Matching Gifts Program Form process by providing an intuitive, digital platform for eSigning and document management. This eliminates the need for paper forms and minimizes delays, ensuring that submissions are quick and efficient.

Get more for Prudential Foundation Matching Gifts Program Form

- Tx application form

- Motion to dismiss traffic ticket form

- Individual credit application texas form

- Interrogatories to plaintiff for motor vehicle occurrence texas form

- Tx accident 497327612 form

- Llc notices resolutions and other operations forms package texas

- Notice of dishonored check criminal keywords bad check bounced check texas form

- Mutual wills containing last will and testaments for man and woman living together not married with no children texas form

Find out other Prudential Foundation Matching Gifts Program Form

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast