Individual Credit Application Texas Form

What is the Individual Credit Application Texas

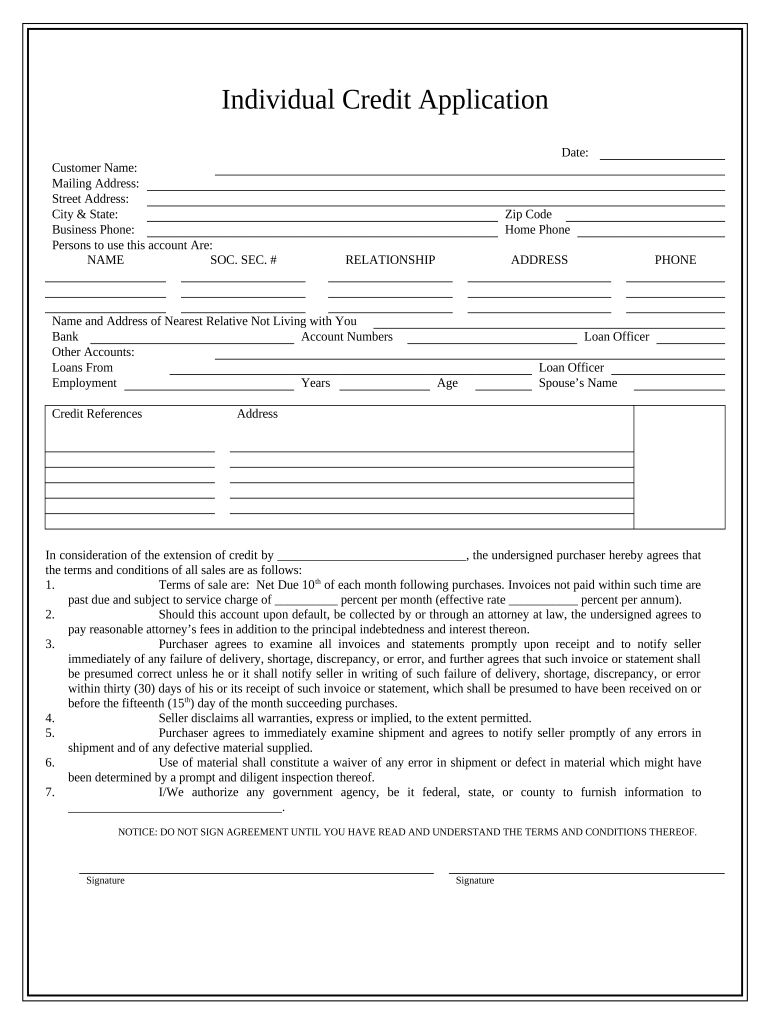

The Individual Credit Application Texas is a formal document used by individuals seeking credit from financial institutions within Texas. This application gathers essential personal and financial information to assess the applicant's creditworthiness. It typically includes details such as the applicant's name, address, Social Security number, employment information, income, and any existing debts. The information collected helps lenders evaluate the risk involved in extending credit and making informed lending decisions.

How to use the Individual Credit Application Texas

Using the Individual Credit Application Texas involves several straightforward steps. First, obtain the application form from a financial institution or download it from a reliable source. Next, carefully fill out the form with accurate and complete information. Ensure that all sections are addressed, as incomplete applications may delay the approval process. After completing the form, review it for errors and sign where required. Finally, submit the application according to the lender's specified method, which may include online submission, mailing, or in-person delivery.

Steps to complete the Individual Credit Application Texas

Completing the Individual Credit Application Texas requires attention to detail. Follow these steps for an efficient submission:

- Gather necessary documents, such as identification and proof of income.

- Fill out personal information, including your full name, address, and contact details.

- Provide employment details, including your employer's name, address, and your job title.

- List your income sources and amounts, ensuring accuracy to reflect your financial situation.

- Disclose any existing debts, including credit cards, loans, and other financial obligations.

- Review the application for completeness and accuracy before signing.

- Submit the application as per the lender's instructions.

Key elements of the Individual Credit Application Texas

The Individual Credit Application Texas contains several key elements that are crucial for the assessment process. These include:

- Personal Information: Full name, address, and contact details.

- Employment Information: Employer's name, address, and your position.

- Income Details: Monthly or annual income from all sources.

- Debt Information: A list of current debts, including amounts owed.

- Signature: An acknowledgment of the information provided and consent for the lender to verify it.

Legal use of the Individual Credit Application Texas

The legal use of the Individual Credit Application Texas is governed by federal and state regulations. It is essential that the information provided is truthful and accurate, as providing false information can lead to legal repercussions, including denial of credit or potential fraud charges. Additionally, lenders must comply with the Fair Credit Reporting Act (FCRA), which mandates that they inform applicants of their rights regarding credit reporting and allow them to review their credit reports. Ensuring compliance with these regulations protects both the applicant and the lender.

Eligibility Criteria

Eligibility for submitting the Individual Credit Application Texas generally includes several criteria that applicants must meet. These may include:

- Being at least eighteen years old.

- Having a valid Social Security number or Individual Taxpayer Identification Number.

- Providing proof of income or employment.

- Demonstrating a reasonable credit history, although some lenders may consider applicants with limited credit history.

Quick guide on how to complete individual credit application texas

Complete Individual Credit Application Texas effortlessly on any gadget

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and eSign your documents quickly and without delays. Manage Individual Credit Application Texas on any platform using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Individual Credit Application Texas with ease

- Find Individual Credit Application Texas and click on Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Individual Credit Application Texas while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Individual Credit Application Texas?

An Individual Credit Application Texas is a document used to assess the creditworthiness of an applicant in the state of Texas. It allows financial institutions to collect personal and financial information necessary for making lending decisions. Using airSlate SignNow, you can seamlessly eSign and submit your applications online.

-

How does airSlate SignNow simplify the Individual Credit Application Texas process?

airSlate SignNow streamlines the process of completing and signing the Individual Credit Application Texas by providing an easy-to-use platform for both lenders and applicants. With features like customizable templates and real-time notifications, users can efficiently manage their applications without any hassle.

-

Are there any costs associated with using airSlate SignNow for the Individual Credit Application Texas?

Yes, while airSlate SignNow offers a variety of pricing plans, users can choose one that fits their budget when processing the Individual Credit Application Texas. The platform is known for being cost-effective, making it accessible for individuals and businesses alike.

-

What features does airSlate SignNow offer for the Individual Credit Application Texas?

For the Individual Credit Application Texas, airSlate SignNow provides features such as document templates, cloud storage, and advanced eSignature options. This ensures that users can easily fill out, sign, and manage their applications securely and efficiently.

-

How can I integrate airSlate SignNow with other applications while processing Individual Credit Application Texas?

airSlate SignNow offers various integrations with popular applications, allowing you to incorporate your workflow for the Individual Credit Application Texas. Integrate seamlessly with CRM software, document storage solutions, and more to ensure that your application process is fully streamlined.

-

Is airSlate SignNow secure for submitting Individual Credit Application Texas?

Absolutely! airSlate SignNow prioritizes security, employing encryption and stringent compliance measures for the Individual Credit Application Texas. Your sensitive information is protected, giving you peace of mind while signing and submitting documents online.

-

What benefits does airSlate SignNow provide for users of the Individual Credit Application Texas?

Users benefit signNowly from airSlate SignNow when submitting an Individual Credit Application Texas through improved efficiency and faster processing times. The platform enhances user experience, reduces paper waste, and enables quick access to documents anytime, anywhere.

Get more for Individual Credit Application Texas

- Chapter 22 activity nationalism puzzle 64 usd 375 form

- Tabla de planificacin para el programa venturing form

- Ncaa football game report tyler refs form

- Form 200 2013 2019

- Woodforest dispute form

- Neceros pathfinder rpg character sheet visit wwwneceroscom for more products like this form

- Ucsd student life student timesheet as ucsd form

- Request for deceased do not issue cr edit notation form

Find out other Individual Credit Application Texas

- Sign North Carolina Banking Notice To Quit Free

- Sign Banking PPT Ohio Fast

- Sign Banking Presentation Oregon Fast

- Sign Banking Document Pennsylvania Fast

- How To Sign Oregon Banking Last Will And Testament

- How To Sign Oregon Banking Profit And Loss Statement

- Sign Pennsylvania Banking Contract Easy

- Sign Pennsylvania Banking RFP Fast

- How Do I Sign Oklahoma Banking Warranty Deed

- Sign Oregon Banking Limited Power Of Attorney Easy

- Sign South Dakota Banking Limited Power Of Attorney Mobile

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement