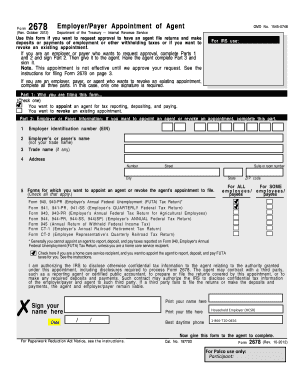

IRS Form 2678

What is the IRS Form 2678

The IRS Form 2678, also known as the Election to Treat a Qualified Subchapter S Subsidiary as a Separate Entity, is a crucial document for businesses operating as S corporations. This form allows an S corporation to elect to treat its qualified subsidiary as a separate entity for federal tax purposes. The primary purpose of this form is to simplify tax reporting and compliance for S corporations with subsidiaries, ensuring that the income, deductions, and credits of the subsidiary are reported correctly.

How to use the IRS Form 2678

Using the IRS Form 2678 involves several steps. First, ensure that the parent S corporation meets the eligibility criteria, which includes owning 100% of the subsidiary. Next, complete the form by providing necessary details such as the name and address of the parent corporation and the subsidiary. The form must be signed by an authorized officer of the S corporation. Once completed, submit the form to the IRS by the specified deadline to ensure compliance and avoid penalties.

Steps to complete the IRS Form 2678

Completing the IRS Form 2678 requires careful attention to detail. Follow these steps:

- Gather information about the parent S corporation and the qualified subsidiary.

- Fill out the form with accurate details, including the names, addresses, and tax identification numbers.

- Ensure that the form is signed by an authorized representative of the S corporation.

- Review the form for completeness and accuracy before submission.

- Submit the form to the IRS by mail or electronically, as appropriate.

Legal use of the IRS Form 2678

The legal use of the IRS Form 2678 is essential for ensuring that the election to treat a qualified subsidiary as a separate entity is recognized by the IRS. This form must be filed in accordance with IRS guidelines and within the specified time frame to be valid. Failure to comply with these regulations may result in the subsidiary being treated as a disregarded entity, which could lead to unintended tax consequences.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the IRS Form 2678. The form must typically be filed by the due date of the S corporation's tax return, including extensions. Missing this deadline can result in the loss of the election, which may have significant tax implications for the corporation and its subsidiaries. Always check the IRS website or consult a tax professional for the most current deadlines.

Required Documents

To successfully file the IRS Form 2678, certain documents may be required. These typically include:

- Tax identification numbers for both the parent S corporation and the subsidiary.

- Recent financial statements for the subsidiary.

- Any previous tax returns related to the S corporation and its subsidiaries.

Having these documents on hand will streamline the completion and submission process.

Quick guide on how to complete irs form 2678

Effortlessly Prepare IRS Form 2678 on Any Device

Online document management has become increasingly favored by organizations and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, enabling you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools you require to create, modify, and electronically sign your documents quickly and without complications. Manage IRS Form 2678 on any device with the airSlate SignNow applications for Android or iOS and streamline any document-related tasks today.

The Easiest Way to Modify and Electronically Sign IRS Form 2678 Effortlessly

- Obtain IRS Form 2678 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all information thoroughly and click on the Done button to preserve your changes.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and electronically sign IRS Form 2678 while ensuring exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 2678

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 2678 and why is it important?

Form 2678 is a crucial document used for authorizing an agent to act on behalf of a business for federal tax purposes. Understanding how to properly complete and submit Form 2678 can ensure compliance and simplify the tax filing process for your business.

-

How can airSlate SignNow help with Form 2678?

airSlate SignNow provides a seamless platform to electronically sign and send Form 2678 securely. This functionality facilitates faster transactions and ensures that your document is legally binding, enhancing your efficiency in handling important tax documents.

-

Is there a cost associated with using airSlate SignNow for Form 2678?

Yes, airSlate SignNow offers various pricing plans depending on the features you require. These plans are designed to be cost-effective, ensuring that you can efficiently manage Form 2678 and other important documents without breaking the bank.

-

What features does airSlate SignNow offer for managing Form 2678?

With airSlate SignNow, you can easily create, edit, and send Form 2678. The platform includes features like templates, customizable workflows, and real-time tracking, making the document management process smooth and manageable.

-

Can I integrate airSlate SignNow with other applications for Form 2678?

Absolutely! airSlate SignNow integrates with a variety of applications, allowing you to streamline your workflow for Form 2678. Whether you are using customer relationship management (CRM) software or document storage solutions, these integrations enhance your productivity.

-

How secure is airSlate SignNow when handling Form 2678?

airSlate SignNow prioritizes security, employing advanced encryption methods to ensure that Form 2678 and other sensitive documents are protected. This commitment to safety provides peace of mind for businesses when managing their essential documentation.

-

What benefits will I gain from using airSlate SignNow for Form 2678?

Utilizing airSlate SignNow for Form 2678 can signNowly reduce the time spent on document preparation and signing. Additionally, its ease of use and accessibility enhance collaboration, allowing team members to handle documents efficiently from anywhere.

Get more for IRS Form 2678

- Warranty product form

- Website user agreement form

- Trust advisory form 497330104

- Sample letter expansion form

- Letter repairs form

- Affidavit denying paternity form

- Testamentary trust provision with stock to held in trust for grandchild and no distributions to be made until a certain age is form

- Child support payments texas form

Find out other IRS Form 2678

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement