Tax Exempt Form PDF ST119 Non Profit CC Rental

Understanding the Tax Exempt Form PDF ST119 for Nonprofits

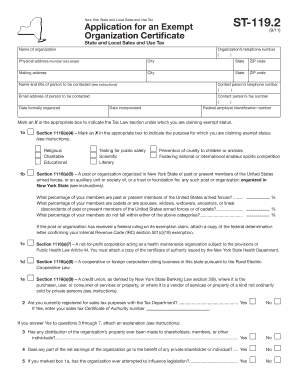

The Tax Exempt Form PDF ST119 is crucial for nonprofit organizations in the United States seeking to obtain tax-exempt status. This form allows eligible organizations to make purchases without paying sales tax, which can significantly reduce operational costs. Nonprofits must ensure they meet the eligibility criteria set forth by the state in which they operate, as this form is typically used to verify their tax-exempt status to vendors. Understanding the specific requirements and implications of this form is essential for effective financial management within a nonprofit.

Steps to Complete the Tax Exempt Form PDF ST119

Completing the Tax Exempt Form PDF ST119 involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information about your organization, including its legal name, address, and federal tax identification number. Next, clearly state the purpose of the exemption and provide details about the types of purchases that will qualify. After filling out the form, review it for completeness and accuracy. Finally, submit the form to the appropriate state authority, ensuring you retain a copy for your records.

Legal Use of the Tax Exempt Form PDF ST119

The legal use of the Tax Exempt Form PDF ST119 is governed by state laws and regulations. Nonprofits must use this form strictly for qualifying purchases related to their exempt purposes. Misuse of the form, such as using it for personal purchases or for non-qualifying items, can lead to penalties, including the revocation of tax-exempt status. It is essential for organizations to understand the legal implications and ensure compliance with all relevant laws to maintain their tax-exempt status.

Eligibility Criteria for the Tax Exempt Form PDF ST119

To qualify for the Tax Exempt Form PDF ST119, an organization must meet specific eligibility criteria. Typically, this includes being recognized as a nonprofit under IRS regulations, having a valid federal Employer Identification Number (EIN), and being engaged in activities that serve a public purpose. Organizations should also ensure they are registered with the appropriate state authorities to maintain their tax-exempt status. Understanding these criteria is vital for nonprofits seeking to benefit from tax exemptions.

Who Issues the Tax Exempt Form PDF ST119

The Tax Exempt Form PDF ST119 is issued by the state tax authority. Each state has its own regulations and processes for issuing tax-exempt certificates. Nonprofits must apply through the relevant state agency to obtain this form, which serves as proof of their tax-exempt status. It is important for organizations to familiarize themselves with their state’s specific requirements and procedures to ensure timely and accurate issuance of the form.

Examples of Using the Tax Exempt Form PDF ST119

Nonprofits can use the Tax Exempt Form PDF ST119 in various scenarios to benefit from tax exemptions. For instance, when purchasing supplies for fundraising events, educational materials, or equipment necessary for their charitable activities, organizations can present this form to vendors to avoid sales tax. Additionally, it can be used when contracting services that directly relate to the nonprofit's mission. Understanding how to effectively use this form can lead to significant cost savings for nonprofits.

Filing Deadlines and Important Dates for the Tax Exempt Form PDF ST119

Filing deadlines for the Tax Exempt Form PDF ST119 may vary by state, but it is crucial for nonprofits to be aware of these dates to maintain compliance. Organizations should check with their state tax authority for specific deadlines related to the application for tax-exempt status and any renewals required. Staying informed about these important dates helps ensure that nonprofits can continue to operate without interruption and retain their tax-exempt benefits.

Quick guide on how to complete tax exempt form pdf st119 non profit cc rental

Effortlessly prepare Tax Exempt Form PDF ST119 Non Profit CC Rental on any device

Digital document management has gained traction among companies and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without any hold-ups. Manage Tax Exempt Form PDF ST119 Non Profit CC Rental on any platform using the airSlate SignNow Android or iOS applications and enhance any document-based task today.

The easiest way to modify and eSign Tax Exempt Form PDF ST119 Non Profit CC Rental effortlessly

- Obtain Tax Exempt Form PDF ST119 Non Profit CC Rental and select Get Form to begin.

- Employ the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your updates.

- Select how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Erase the hassle of missing or lost files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Tax Exempt Form PDF ST119 Non Profit CC Rental and guarantee exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax exempt form pdf st119 non profit cc rental

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 501c3 form PDF?

A 501c3 form PDF is a document used to apply for tax-exempt status under IRS Section 501(c)(3). It outlines the organization's purpose, structure, and activities. This form is essential for nonprofits seeking charitable status and potential funding opportunities.

-

How can I fill out a 501c3 form PDF using airSlate SignNow?

With airSlate SignNow, you can easily fill out a 501c3 form PDF online. Our user-friendly platform allows you to upload, edit, and add signatures to your documents seamlessly. This ensures that your application is completed accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow to manage my 501c3 form PDF?

airSlate SignNow offers a competitive pricing structure tailored to nonprofits and small businesses. You can choose from various subscription plans that suit your needs, allowing you to manage the 501c3 form PDF and other documents without breaking the bank.

-

What are the primary features of airSlate SignNow for managing 501c3 form PDFs?

AirSlate SignNow provides features such as eSignature, document templates, and real-time collaboration for managing 501c3 form PDFs. These tools streamline the workflow, ensuring your documents can be shared and signed quickly, which enhances your organization’s efficiency.

-

Can I integrate airSlate SignNow with other tools for my 501c3 form PDF management?

Yes! airSlate SignNow integrates seamlessly with numerous applications, including Google Drive and Dropbox, facilitating your 501c3 form PDF management. This integration allows you to access and store your documents efficiently within your preferred workflows.

-

What benefits does airSlate SignNow offer for nonprofits handling 501c3 form PDFs?

AirSlate SignNow offers nonprofits numerous benefits when managing 501c3 form PDFs, such as increased productivity and reduced paperwork. Utilizing our eSignature capabilities ensures a faster approval process, allowing your organization to focus on its mission instead of administrative tasks.

-

How secure is my 501c3 form PDF when using airSlate SignNow?

Security is a top priority at airSlate SignNow. We use industry-standard encryption and compliance measures to protect your 501c3 form PDF and other sensitive documents. You can manage your forms confidently, knowing that your data is safeguarded against unauthorized access.

Get more for Tax Exempt Form PDF ST119 Non Profit CC Rental

- Worksheet strengths and weaknesses analysis form

- Startup costs form

- Self assessment worksheet form

- Preliminary meeting form

- Sample letter promotional 497332793 form

- Sample letter reinstatement 497332794 form

- Products and services differentiation worksheet form

- Ride along form la plata county government co laplata co

Find out other Tax Exempt Form PDF ST119 Non Profit CC Rental

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form