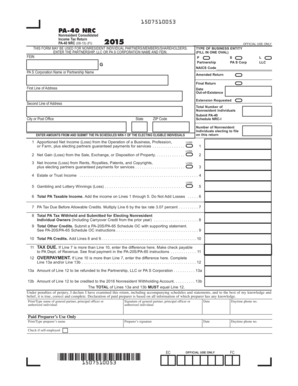

PA 40 NRC Nonresident Consolidated Income Tax Return PA 40 NRC FormsPublications

What is the PA 40 NRC Nonresident Consolidated Income Tax Return?

The PA 40 NRC is a specific form used by nonresident individuals and entities to report income earned in Pennsylvania. This form consolidates various income sources, allowing taxpayers to file a comprehensive return. It is essential for nonresidents to accurately report their income to comply with Pennsylvania tax regulations. The PA 40 NRC helps ensure that taxes are calculated based on the income generated within the state, avoiding potential legal issues related to tax compliance.

Steps to Complete the PA 40 NRC Nonresident Consolidated Income Tax Return

Completing the PA 40 NRC involves several key steps to ensure accuracy and compliance:

- Gather all necessary documentation, including W-2s, 1099s, and any other income statements.

- Fill out the personal information section, ensuring that names and addresses are accurate.

- Report all income earned in Pennsylvania, including wages, rental income, and business income.

- Calculate deductions and credits applicable to nonresidents, as these can significantly affect your tax liability.

- Review the completed form for accuracy before submission.

Legal Use of the PA 40 NRC Nonresident Consolidated Income Tax Return

The PA 40 NRC is legally binding when completed and submitted correctly. It must comply with Pennsylvania's tax laws, which dictate how nonresidents should report their income. To ensure legal use, taxpayers should adhere to the guidelines provided by the Pennsylvania Department of Revenue. Additionally, using a reliable electronic signature solution can enhance the legal standing of the submitted form, as it provides a digital certificate that verifies the signer's identity.

Filing Deadlines / Important Dates

Timely filing of the PA 40 NRC is crucial to avoid penalties. The standard deadline for submitting this form is typically April 15 of the following year. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Nonresidents should also be aware of any extensions that may apply, as well as specific due dates for estimated tax payments throughout the year.

Required Documents for the PA 40 NRC Nonresident Consolidated Income Tax Return

To complete the PA 40 NRC, taxpayers must gather several essential documents:

- W-2 forms from employers reporting Pennsylvania wages.

- 1099 forms for any freelance or contract work performed in the state.

- Documentation for any other income sources, such as rental properties or investments.

- Records of deductions and credits that apply to nonresident filers.

Form Submission Methods for the PA 40 NRC

The PA 40 NRC can be submitted through various methods, ensuring flexibility for taxpayers. Options include:

- Online submission through the Pennsylvania Department of Revenue's e-filing system.

- Mailing a paper copy of the completed form to the designated tax office.

- In-person submission at local tax offices, if preferred.

Quick guide on how to complete pa 40 nrc nonresident consolidated income tax return pa 40 nrc formspublications

Complete PA 40 NRC Nonresident Consolidated Income Tax Return PA 40 NRC FormsPublications seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally-friendly substitute to traditional printed and signed paperwork, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents rapidly without delays. Manage PA 40 NRC Nonresident Consolidated Income Tax Return PA 40 NRC FormsPublications on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign PA 40 NRC Nonresident Consolidated Income Tax Return PA 40 NRC FormsPublications with ease

- Obtain PA 40 NRC Nonresident Consolidated Income Tax Return PA 40 NRC FormsPublications and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or block out sensitive information with tools that airSlate SignNow supplies specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign PA 40 NRC Nonresident Consolidated Income Tax Return PA 40 NRC FormsPublications and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa 40 nrc nonresident consolidated income tax return pa 40 nrc formspublications

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pa 40 nrc in airSlate SignNow?

The pa 40 nrc refers to a specific document type supported by airSlate SignNow. This feature allows users to efficiently create, send, and eSign the pa 40 nrc documents electronically, streamlining the signature process and improving overall workflow.

-

How much does the airSlate SignNow service cost for handling pa 40 nrc documents?

Pricing for airSlate SignNow varies based on plan selection, but it offers a cost-effective solution to manage pa 40 nrc documents. Users can choose from various subscription tiers, ensuring they find the right fit for their needs without exceeding their budgets.

-

What are the key features of airSlate SignNow relevant to the pa 40 nrc?

AirSlate SignNow provides numerous features for managing pa 40 nrc documents, including customizable templates, automated workflows, and secure storage. These features ensure that users can efficiently handle their documents while maintaining compliance with legal requirements.

-

Can I integrate airSlate SignNow with other applications to manage my pa 40 nrc paperwork?

Yes, airSlate SignNow offers seamless integrations with a variety of applications, allowing users to manage their pa 40 nrc paperwork alongside other business tools. This enhances productivity and ensures a unified workflow across different platforms.

-

What are the benefits of using airSlate SignNow for pa 40 nrc electronic signatures?

Using airSlate SignNow for pa 40 nrc electronic signatures signNowly speeds up the process, reduces paperwork, and minimizes the risk of errors. Additionally, it enhances security and provides a certified audit trail for all signed documents.

-

Is airSlate SignNow legally compliant for signing pa 40 nrc documents?

Absolutely! AirSlate SignNow is designed to comply with eSignature laws, making it a legitimate solution for signing pa 40 nrc documents. The platform adheres to the ESIGN Act and UETA, ensuring that your electronic signatures are legally binding.

-

How user-friendly is airSlate SignNow for new users handling pa 40 nrc documents?

AirSlate SignNow is built with user-friendliness in mind, making it ideal for new users managing the pa 40 nrc documents. The intuitive interface allows for easy navigation, enabling users to quickly get accustomed to the platform without extensive training.

Get more for PA 40 NRC Nonresident Consolidated Income Tax Return PA 40 NRC FormsPublications

Find out other PA 40 NRC Nonresident Consolidated Income Tax Return PA 40 NRC FormsPublications

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure