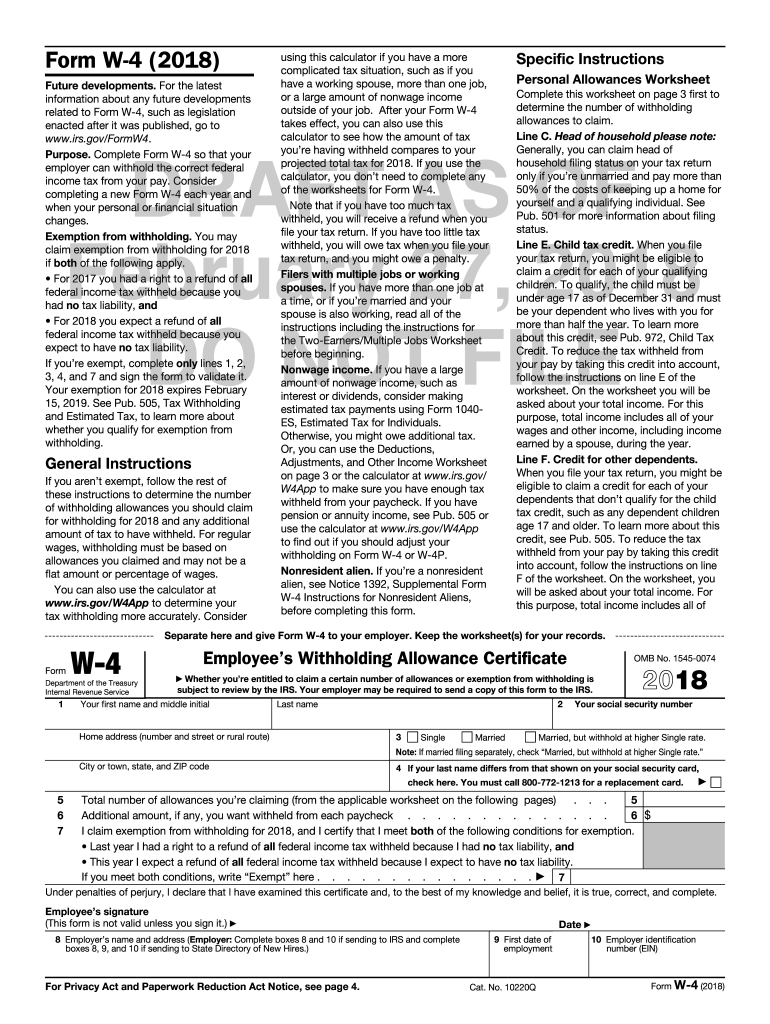

Irs Form

What is the IRS?

The Internal Revenue Service (IRS) is the U.S. government agency responsible for tax collection and tax law enforcement. Established in 1862, the IRS administers the federal tax code, ensuring compliance and facilitating the collection of income taxes, corporate taxes, and various other taxes. The agency plays a critical role in the nation's economy by managing tax revenue that funds public services and infrastructure.

How to Use the IRS

Using the IRS involves understanding its various functions, including filing taxes, making payments, and accessing resources for tax-related inquiries. Taxpayers can utilize the IRS website to find forms, check the status of their tax returns, and access tools for estimating taxes owed. Additionally, the IRS provides guidelines for different taxpayer scenarios, including self-employed individuals and businesses.

Steps to Complete the IRS Form

Completing an IRS form requires careful attention to detail. Here are essential steps to follow:

- Gather necessary documents, such as W-2s, 1099s, and other income statements.

- Choose the appropriate form based on your tax situation, such as the 1040 for individual income tax.

- Fill out the form accurately, ensuring all income and deductions are reported.

- Review the completed form for errors or omissions before submission.

- Sign and date the form, as electronic signatures may not be accepted for all forms.

Legal Use of the IRS

The legal use of IRS forms is governed by federal tax law. Taxpayers must ensure that all information provided is truthful and accurate to avoid penalties. The IRS allows electronic filing, which is considered legally binding when done through approved methods. Compliance with IRS regulations is essential for maintaining good standing and avoiding audits.

Filing Deadlines / Important Dates

Filing deadlines for IRS forms vary depending on the type of form and taxpayer status. Typically, individual tax returns are due on April fifteenth each year. Extensions may be granted, but any taxes owed must still be paid by the original deadline to avoid penalties. It is crucial for taxpayers to be aware of these dates to ensure timely compliance.

Required Documents

When preparing to file with the IRS, specific documents are necessary to ensure accurate reporting. Common required documents include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Records of any tax credits claimed

Having these documents ready can streamline the filing process and reduce the likelihood of errors.

Quick guide on how to complete irs

Manage Irs effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can access the necessary form and securely archive it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and without hold-ups. Handle Irs on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign Irs with ease

- Obtain Irs and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes just moments and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Irs and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

What is the IRS form W-10 and how is it correctly filled out?

While you may have never heard of IRS Form W-10, you will if you’re currently paying or planning to pay someone to care for a child, dependent, or spouse? If you are, then you may qualify to claim what’s called the Child and Dependent Care credit on your federal income tax return. To claim this credit, your care provider must fill out a W-10. You may also need to fill out the form if you receive benefits from an employer sponsored dependent care plan.It’s certainly worth it to see if you qualify (and for this we recommend that you consult with a tax professional). The child and dependent care credit can be up to 35 percent of qualifying expenses, depending on adjusted gross income. For 2011, filers may use up to $3,000 of expenses paid in a year for one qualifying individual or $6,000 for two or more qualifying individuals. (When it comes time to figure your qualifying expenses, remember that they must be reduced by the amount of any dependent care benefits provided by your employer, if those benefits were deducted or excluded from your income.)Do You Qualify for the Credit?To see if you need to have your care provider fill out a W-10, first determine if you qualify for the credit for child and dependent care expenses. To qualify, the care must have been provided for one or more qualifying persons, generally a dependent child age 12 or younger when the care was provided. Certain other individuals, spouses and those who are incapable of self-care, may also be considered qualifying persons. (Note: each qualifying individual must be listed on your tax return.)Remember also that the amount you can claim as a credit is reduced as your income rises. According to the Tax Policy Center, “Families with income below $15,000 qualify for the 35 percent credit. That rate falls by 1 percentage point for each additional $2,000 of income (or part thereof) until it signNowes 20 percent for families with income of $43,000 or more.”Next, consider why the care was provided. To qualify, the person (or couple, if married and filing jointly) claiming the credit must have sought care so they could work or search for employment. Further, the individual or couple filing must be considered earned income earners. Wages, salaries, tips, other taxable employee compensation, and net earnings from self-employment all qualify individuals as having earned income. For married filers, one spouse may be considered as having earned income if they were a full-time student, or if they were unable to care for themselves.Who did you pay for care? Qualifying funds spent for care cannot be paid to a filer’s spouse, a dependent of the filer, or to the filer’s child, unless that child will signNow age 19 or older by the end of the year. (The rule for payments to the filer’s child does not change, even if the child is not the filer’s dependent.) Filers must identify care providers on their tax return.There are just a few more qualifying details. To qualify, filing status must be single, married filing jointly, head of household or qualifying widow(er) with a dependent child. The qualifying person must have lived with the person filing for over one half of the year. There are exceptions, for the birth or death of a qualifying person, and for children of divorced or separated parents.IRS Form W-10So, if you meet those criteria, then its time to make sure your care provider fills out a W-10. The form is simple to fill out, requiring only the provider’s name, address, signature and taxpayer identification number (usually their social security number). The form is only for your records; details about the provider will come when you fill out form 2441 for Child and Dependent Care Expenses.Source: The Child and Dependent Care Credit and IRS W-10 Form

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

Create this form in 5 minutes!

How to create an eSignature for the irs

How to make an electronic signature for the Irs in the online mode

How to make an eSignature for the Irs in Google Chrome

How to create an eSignature for signing the Irs in Gmail

How to generate an eSignature for the Irs right from your smartphone

How to create an eSignature for the Irs on iOS

How to create an eSignature for the Irs on Android OS

People also ask

-

How can airSlate SignNow help with IRS document submissions?

airSlate SignNow provides an efficient way to prepare and eSign documents required by the IRS. With its user-friendly interface, you can quickly send tax forms and other necessary documents securely, ensuring compliance with IRS regulations. This can save you signNow time during tax season.

-

What pricing plans does airSlate SignNow offer for IRS-related eSigning?

airSlate SignNow offers various pricing plans that cater to different business needs, including those frequently dealing with IRS documents. Each plan provides a range of features that can help streamline the signing process for IRS forms and other important documents. Choose a plan that fits your volume of IRS submissions to maximize cost-effectiveness.

-

Is airSlate SignNow compliant with IRS electronic signature regulations?

Yes, airSlate SignNow is compliant with IRS electronic signature regulations, ensuring that your eSigned documents are legally binding. This compliance is critical for businesses that need to submit IRS forms electronically. You can trust that your eSignatures meet all necessary legal standards.

-

What features does airSlate SignNow offer for managing IRS documents?

airSlate SignNow includes features such as customizable templates, secure storage, and real-time tracking, which are essential for managing IRS documents. These features facilitate easy access and organization of your IRS-related paperwork, helping you maintain compliance and efficiency.

-

How does airSlate SignNow integrate with accounting software for IRS purposes?

airSlate SignNow seamlessly integrates with popular accounting software, making it easier to manage IRS filings and documentation. This integration allows you to automate the eSigning process for tax-related documents directly from your accounting platform, streamlining your workflow signNowly.

-

Can I use airSlate SignNow for multiple users handling IRS documents?

Absolutely! airSlate SignNow allows multiple users to collaborate on IRS documents, making it ideal for teams. You can assign roles, track changes, and ensure everyone involved in the IRS submission process is on the same page.

-

What are the benefits of using airSlate SignNow for IRS documentation processes?

Using airSlate SignNow for your IRS documentation processes offers numerous benefits, including enhanced security, faster turnaround times, and reduced paperwork. By digitizing your IRS submissions, you can improve efficiency and minimize the risk of errors in your tax documentation.

Get more for Irs

Find out other Irs

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT