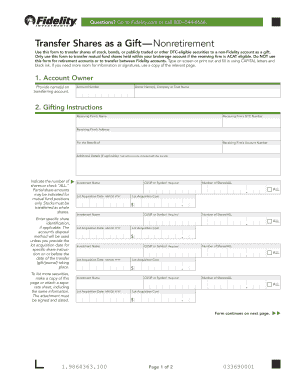

Fidelity Transfer Shares as a Gift Form

What is the Fidelity Transfer Shares As A Gift Form

The Fidelity Transfer Shares As A Gift Form is a legal document used to transfer ownership of shares from one individual to another as a gift. This form is essential for ensuring that the transfer is documented properly and complies with relevant regulations. It typically includes information such as the names of the donor and recipient, the number of shares being transferred, and the specific stock details. Completing this form correctly is crucial for both the donor and recipient to avoid any potential disputes or tax implications.

How to use the Fidelity Transfer Shares As A Gift Form

Using the Fidelity Transfer Shares As A Gift Form involves several key steps. First, ensure you have the correct form, which can be obtained from Fidelity's website or customer service. Next, fill out the required information accurately, including the names and addresses of both parties, the stock details, and any necessary signatures. Once completed, submit the form according to Fidelity's guidelines, which may include online submission or mailing it to a designated address. Keeping a copy of the completed form for your records is also advisable.

Steps to complete the Fidelity Transfer Shares As A Gift Form

Completing the Fidelity Transfer Shares As A Gift Form requires careful attention to detail. Follow these steps:

- Obtain the form from Fidelity.

- Fill in the donor's and recipient's full names and addresses.

- Specify the number of shares and the stock symbol.

- Sign and date the form, ensuring all signatures are in place.

- Review the form for accuracy before submission.

- Submit the form as per Fidelity's instructions.

Legal use of the Fidelity Transfer Shares As A Gift Form

The Fidelity Transfer Shares As A Gift Form is legally binding when completed correctly. It serves as proof of the transfer of ownership and can be used in case of disputes. To ensure its legal validity, the form must be signed by both the donor and recipient, and all information must be accurate. Additionally, compliance with IRS regulations regarding gift taxes is essential, as gifts above a certain value may have tax implications for the donor.

Key elements of the Fidelity Transfer Shares As A Gift Form

Several key elements must be included in the Fidelity Transfer Shares As A Gift Form to ensure its effectiveness:

- Donor Information: Full name and address of the individual giving the gift.

- Recipient Information: Full name and address of the individual receiving the gift.

- Stock Information: The name of the company, stock symbol, and number of shares being transferred.

- Signatures: Required signatures from both the donor and recipient.

- Date: The date on which the transfer is executed.

Form Submission Methods

The Fidelity Transfer Shares As A Gift Form can be submitted through various methods, depending on Fidelity's guidelines. Common submission methods include:

- Online Submission: Many users prefer to complete and submit the form electronically through Fidelity's online platform.

- Mail: Alternatively, the completed form can be printed and mailed to Fidelity's designated address.

- In-Person: Some individuals may choose to visit a Fidelity branch to submit the form directly.

Quick guide on how to complete fidelity transfer shares as a gift form

Complete Fidelity Transfer Shares As A Gift Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can access the correct form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents quickly without delays. Manage Fidelity Transfer Shares As A Gift Form on any device with airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to modify and electronically sign Fidelity Transfer Shares As A Gift Form effortlessly

- Locate Fidelity Transfer Shares As A Gift Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your delivery method for the form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Fidelity Transfer Shares As A Gift Form and ensure outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fidelity transfer shares as a gift form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to transfer shares as a gift using Fidelity?

To transfer shares as a gift through Fidelity, you will need to fill out the required forms, including the 'Transfer Shares as a Gift Fidelity PDF.' This form facilitates the transfer and ensures that both the giver and recipient understand the implications. Once completed, submit the form along with any necessary documentation to Fidelity.

-

Are there any fees associated with transferring shares as a gift through Fidelity?

Typically, there are no fees for transferring shares as a gift using Fidelity. However, it is recommended to check the specific conditions outlined in the 'Transfer Shares as a Gift Fidelity PDF.' It's always a good idea to consult with Fidelity for any updates on potential fees.

-

How can I ensure my gift transfer complies with tax regulations?

Utilizing the 'Transfer Shares as a Gift Fidelity PDF,' you can outline the transfer properly. It's important to consult with a tax advisor to ensure that the transaction complies with IRS regulations and to understand any tax implications for both parties involved in the gift.

-

What benefits does transferring shares as a gift provide?

Transferring shares as a gift can be a valuable way to support a loved one’s financial future. It not only provides them with ownership in a company but can also potentially save on tax obligations. The 'Transfer Shares as a Gift Fidelity PDF' simplifies this process, making it accessible and efficient.

-

Is it possible to transfer shares as a gift from a joint account?

Yes, shares can be transferred as a gift from a joint account. To initiate this process, you will need to complete the 'Transfer Shares as a Gift Fidelity PDF' ensuring that all account holders provide consent. This will help facilitate a smooth transfer without legal complications.

-

Can I track the status of my share transfer after submission?

After you submit your 'Transfer Shares as a Gift Fidelity PDF,' you can typically track the status through your Fidelity account. Fidelity provides updates and notifications regarding the completion of the transfer. Additionally, you can contact customer service for assistance.

-

What documents are needed along with the transfer form?

Along with the 'Transfer Shares as a Gift Fidelity PDF,' you may need to provide a copy of your identification and any supporting documents required by Fidelity. Be sure to review the specific instructions provided on the PDF to ensure all necessary information is included.

Get more for Fidelity Transfer Shares As A Gift Form

Find out other Fidelity Transfer Shares As A Gift Form

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free