AON Form 4 Monthly Certified Payroll Reporting

What is the AON Form 4 Monthly Certified Payroll Reporting

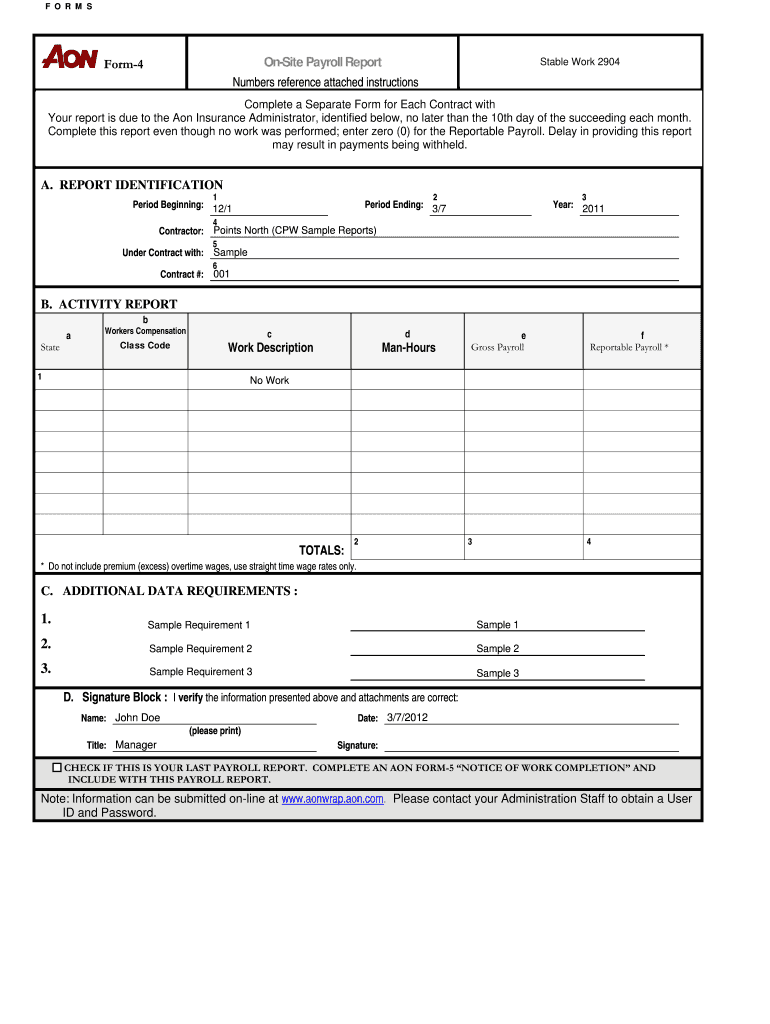

The AON Form 4 Monthly Certified Payroll Reporting is a crucial document used by employers to report payroll information for employees working on public works projects. This form ensures compliance with federal and state labor laws, specifically regarding wage rates and working conditions. It is essential for employers to accurately complete this form to demonstrate adherence to prevailing wage laws and to provide transparency in payroll reporting.

Steps to complete the AON Form 4 Monthly Certified Payroll Reporting

Completing the AON Form 4 requires careful attention to detail. Here are the key steps to follow:

- Gather employee information, including names, addresses, and social security numbers.

- Document the hours worked by each employee, including regular and overtime hours.

- Calculate the total wages paid, ensuring compliance with prevailing wage rates.

- Sign and date the form to certify that the information provided is accurate and complete.

Ensure that all entries are clear and legible to avoid delays in processing or potential compliance issues.

Legal use of the AON Form 4 Monthly Certified Payroll Reporting

The AON Form 4 serves a legal purpose by providing a certified record of payroll information. This document must be completed accurately to uphold compliance with the Davis-Bacon Act and other relevant labor laws. Failure to comply can result in penalties, including fines or disqualification from future public contracts. Employers must retain copies of submitted forms for their records, as they may be subject to audits by regulatory agencies.

How to use the AON Form 4 Monthly Certified Payroll Reporting

To effectively use the AON Form 4, employers should first familiarize themselves with the form's structure and required fields. It is advisable to complete the form on a monthly basis to ensure timely reporting. Employers can also utilize electronic tools to streamline the process, making it easier to track hours and wages. Regularly reviewing payroll records before submission can help identify and correct any discrepancies.

Filing Deadlines / Important Dates

Timely submission of the AON Form 4 is critical. Employers should be aware of the following important deadlines:

- The form must be submitted monthly, typically by the last day of the month following the reporting period.

- Employers should also be mindful of any specific deadlines set forth by local or state agencies overseeing public works projects.

Staying informed about these deadlines can help prevent penalties and ensure compliance with reporting requirements.

Required Documents

When completing the AON Form 4, employers should have the following documents on hand:

- Employee timecards or timesheets detailing hours worked.

- Payroll records showing wages paid for the reporting period.

- Any relevant contracts or agreements that specify wage rates for public works projects.

Having these documents readily available will facilitate accurate and efficient completion of the form.

Quick guide on how to complete aon form 4 monthly certified payroll reporting

Effortlessly prepare AON Form 4 Monthly Certified Payroll Reporting on any device

Managing documents online has gained traction among companies and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without delays. Handle AON Form 4 Monthly Certified Payroll Reporting on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign AON Form 4 Monthly Certified Payroll Reporting effortlessly

- Locate AON Form 4 Monthly Certified Payroll Reporting and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign AON Form 4 Monthly Certified Payroll Reporting and ensure exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

I never received any type of payroll forms when I was hired at my job a month ago, was I supposed to or do I find them myself and fill them out?

It is your employer's responsibility to provide you with the I-9 form and to complete it--within your first three days of employment--after you've completed the first section. Technically, they probably shouldn't allow you to work without a completed I-9; they are also putting themselves in the position of being out of compliance with the I-9 retention requirements. If they were audited, they'd be fined for not having the proper forms on file.Neither the W-4 nor the A-4 is required in order to pay you. The IRS wants you to fill it out (and so does Arizona, I'm sure) but if you haven't, that doesn't prevent you from being paid. The employer can default your withholding to Single with 0 exemptions for Federal, and for AZ the default is the 2.7% rate.If it has been more than 10 days since the end of your pay period and you still haven't been paid, your employer is breaking the AZ labor law regarding timely payment (and depending on specific circumstances, they could be in that position only 5 days after the end of the pay period). In that case, you might want to consider filing a complaint with the labor board.Note: Since you commented elsewhere that you're only 16, I'd also add that it's probably in your best interest to obtain and submit the W-4 and A-4 forms. Your tax liability for the year is likely to be quite low (and possibly 0) so you'll probably want to adjust the amount that's being deducted, rather than defaulting to the higher withholding rate and letting the IRS/State of AZ be your no-interest bankers until next year.

-

What form do I fill out, a W9 or a W8-BEN? I am a US citizen living in Canada as a permanent resident. I am a freelancer (not an employee on a payroll) working for someone in the US, but I will be reporting my earnings to Canada Revenue, not the IRS.

You fill out a W-9. As a US citizen, you are taxed on your worldwide income. It doesn't matter if you don't even set foot in the US.You will however receive a foreign tax credit on your US return equal to the tax paid in Canada or the US tax on the same income, whichever is lower.You also must file an FBAR each year with the US Treasury if you have non-US financial accounts totalling $10K or more. This is measured by finding the highest balance at any time of year for each account and adding up those numbers. Failure to file carries signNow penalties.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How do I fill out Form 16 if I'm not eligible for IT returns and just want to receive the TDS cut for the 6 months that I've worked?

use File Income Tax Return Online in India: ClearTax | e-Filing Income Tax in 15 minutes | Tax filing | Income Tax Returns | E-file Tax Returns for 2014-15It is free and simple.

Create this form in 5 minutes!

How to create an eSignature for the aon form 4 monthly certified payroll reporting

How to create an eSignature for your Aon Form 4 Monthly Certified Payroll Reporting in the online mode

How to generate an eSignature for your Aon Form 4 Monthly Certified Payroll Reporting in Chrome

How to generate an electronic signature for putting it on the Aon Form 4 Monthly Certified Payroll Reporting in Gmail

How to make an electronic signature for the Aon Form 4 Monthly Certified Payroll Reporting right from your smart phone

How to create an eSignature for the Aon Form 4 Monthly Certified Payroll Reporting on iOS devices

How to make an eSignature for the Aon Form 4 Monthly Certified Payroll Reporting on Android OS

People also ask

-

What is AON Form 4 Monthly Certified Payroll Reporting?

AON Form 4 Monthly Certified Payroll Reporting is a crucial document for contractors to report payroll information to comply with government regulations. This form ensures that all employees working on public projects are paid according to the prevailing wage laws. Using airSlate SignNow simplifies the process of completing and submitting AON Form 4, making compliance effortless.

-

How does airSlate SignNow streamline AON Form 4 Monthly Certified Payroll Reporting?

airSlate SignNow streamlines AON Form 4 Monthly Certified Payroll Reporting by providing a user-friendly platform that allows you to fill out, sign, and send documents electronically. With its intuitive interface, you can easily manage your payroll reporting, ensuring timely submissions and reducing the risk of errors. This efficiency saves you time and helps maintain compliance with labor laws.

-

Is there a cost associated with using airSlate SignNow for AON Form 4 Monthly Certified Payroll Reporting?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. Our pricing plans are flexible and scalable, allowing you to choose the features you need for efficient AON Form 4 Monthly Certified Payroll Reporting. The investment in our platform can lead to signNow savings in time and resources.

-

Can I integrate airSlate SignNow with other software for AON Form 4 Monthly Certified Payroll Reporting?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and project management software, which enhances your AON Form 4 Monthly Certified Payroll Reporting process. These integrations allow for easy data transfer, ensuring that all payroll information is accurate and up-to-date, thus simplifying compliance.

-

What are the benefits of using airSlate SignNow for AON Form 4 Monthly Certified Payroll Reporting?

The benefits of using airSlate SignNow for AON Form 4 Monthly Certified Payroll Reporting include enhanced accuracy, time savings, and improved compliance. Our platform reduces the chances of human error by automating data entry and document management. Additionally, you can track submissions and receive notifications, ensuring you never miss a deadline.

-

How secure is airSlate SignNow when handling AON Form 4 Monthly Certified Payroll Reporting?

Security is a top priority at airSlate SignNow. We employ advanced encryption protocols and secure cloud storage to protect your AON Form 4 Monthly Certified Payroll Reporting and sensitive payroll data. Our platform complies with industry standards for data protection, giving you peace of mind when submitting important documents.

-

Can I access airSlate SignNow for AON Form 4 Monthly Certified Payroll Reporting from mobile devices?

Yes, airSlate SignNow is fully optimized for mobile use, allowing you to complete AON Form 4 Monthly Certified Payroll Reporting on the go. Our mobile app provides the same functionality as the desktop version, enabling you to fill out, sign, and send documents from anywhere. This flexibility ensures that you can manage your payroll reporting efficiently, even when you're not at your desk.

Get more for AON Form 4 Monthly Certified Payroll Reporting

- Brock llc carrier setup form

- Policy review form mhcc

- Aopa icao flight plan form

- Ddr savings account form 14445466

- Optumrx prior authorization form pdf

- Jtkswk form

- Dea 254 csos certificate application registrant list form

- Form i 485 instructions for application to register permanent residence or adjust status

Find out other AON Form 4 Monthly Certified Payroll Reporting

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document