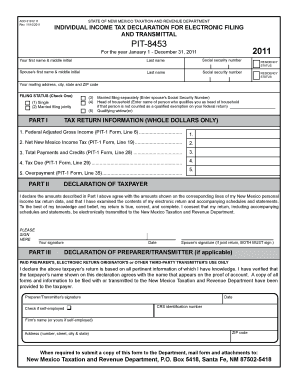

Pit 8453 Form

What is the IRS Tax Form 8453?

The IRS Tax Form 8453 is a declaration form that taxpayers use to authenticate their electronic tax returns. This form serves as a signature document for e-filing, allowing the IRS to verify the identity of the taxpayer. It is particularly important for individuals who file their returns electronically and need to ensure compliance with IRS regulations. The form captures essential information, including the taxpayer's name, Social Security number, and the tax year for which the return is filed.

Steps to Complete the IRS Tax Form 8453

Completing the IRS Tax Form 8453 involves several straightforward steps:

- Gather necessary documentation, such as your Social Security number and details from your tax return.

- Fill in your personal information, including your name and address.

- Indicate the tax year for which you are filing.

- Provide the necessary signatures, which may include your spouse's signature if filing jointly.

- Submit the form electronically alongside your e-filed tax return.

Legal Use of the IRS Tax Form 8453

The IRS Tax Form 8453 is legally binding when completed and submitted correctly. It meets the requirements set forth by the IRS for electronic signatures, ensuring that the electronic submission of your tax return is valid. Compliance with the eSignature laws, such as the ESIGN Act and UETA, is essential for the legal acceptance of this form. Using a reliable eSignature platform can enhance the security and legality of your submission.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Tax Form 8453 align with the general tax filing deadlines. Typically, individual tax returns must be filed by April 15 of each year. If April 15 falls on a weekend or holiday, the deadline may be extended. It is crucial to check the IRS website for any updates or changes to these dates, especially in light of any special circumstances that may arise.

Form Submission Methods

The IRS Tax Form 8453 can be submitted electronically when you file your tax return online. It is essential to follow the specific instructions provided by your e-filing software to ensure that the form is submitted correctly. Alternatively, if you choose to file by mail, you may need to print the form and send it along with your paper tax return. Always verify the submission method required for your specific tax situation.

Examples of Using the IRS Tax Form 8453

Taxpayers typically use the IRS Tax Form 8453 in various scenarios, such as:

- When filing electronically for the first time and needing to authenticate their identity.

- For taxpayers who are e-filing their returns through a tax professional or software.

- In cases where additional documentation is required to support the electronic submission of their tax return.

Quick guide on how to complete pit 8453

Complete Pit 8453 effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly and without delays. Handle Pit 8453 on any device using airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

Ways to edit and eSign Pit 8453 seamlessly

- Locate Pit 8453 and click Get Form to initiate the process.

- Utilize the tools available to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a standard wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Pit 8453 and ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pit 8453

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS tax form 8453 used for?

The IRS tax form 8453 is used to verify the authenticity of a taxpayer's electronic signatures when filing certain tax documents electronically. This form serves as a declaration of the electronic filing and is essential for maintaining the security of your data. Using airSlate SignNow, you can easily eSign and submit form 8453, ensuring full compliance with IRS requirements.

-

How does airSlate SignNow simplify the submission of IRS tax form 8453?

airSlate SignNow streamlines the process of submitting the IRS tax form 8453 by providing an intuitive platform for electronic signatures. With just a few clicks, users can complete the form, draw or upload their signatures, and securely send it to the IRS. This has signNowly reduced the time and complexity involved in tax submissions.

-

Are there any pricing options for using airSlate SignNow for IRS tax form 8453?

Yes, airSlate SignNow offers flexible pricing plans that cater to different business needs, whether you're a solo taxpayer or a larger business entity. You can choose a plan that best fits your budget and workflow requirements, ensuring affordable access to electronic signing services for IRS tax form 8453.

-

What features does airSlate SignNow offer to assist with IRS tax form 8453?

airSlate SignNow provides several key features designed to assist with the IRS tax form 8453, including efficient eSigning capabilities, document storage, and templates for easy reuse. Additionally, the platform ensures security and compliance, which is crucial when handling sensitive tax documents. These features help users manage their tax filings more effectively.

-

Can I integrate airSlate SignNow with other software to manage IRS tax form 8453?

Absolutely! airSlate SignNow offers integrations with popular software solutions, including accounting and tax software, allowing seamless management of IRS tax form 8453. These integrations enhance productivity and provide a comprehensive workflow for tax filing processes. This interoperability simplifies the management of all necessary documents related to your tax forms.

-

What are the benefits of using airSlate SignNow for IRS tax form 8453?

Using airSlate SignNow for the IRS tax form 8453 comes with several benefits, including increased efficiency, reduced paperwork, and higher compliance rates. Users can quickly obtain signatures and submit forms electronically, eliminating the hassles of printing and mailing. This not only saves time but also ensures that your tax filings are timely and secure.

-

Is it safe to eSign IRS tax form 8453 using airSlate SignNow?

Yes, it is safe to eSign the IRS tax form 8453 using airSlate SignNow. The platform employs advanced encryption and security measures to protect your sensitive information throughout the signing process. This ensures that your personal and tax-related data remain secure and confidential while meeting IRS guidelines.

Get more for Pit 8453

- Jury instruction sample form

- Jury instruction respondeat superior instruction mississippi form

- Metlife home quotation formpdf

- Request for life insurance policy information to

- Optional product disclosure lobel financial form

- The signer of this document has been paid in full for all form

- Credit application 778786781 form

- Distribution request form lincoln life group fixed annuity

Find out other Pit 8453

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure