Statement of Profit and Loss for the Year Ended 31st March Form

What is the Statement Of Profit And Loss For The Year Ended 31st March

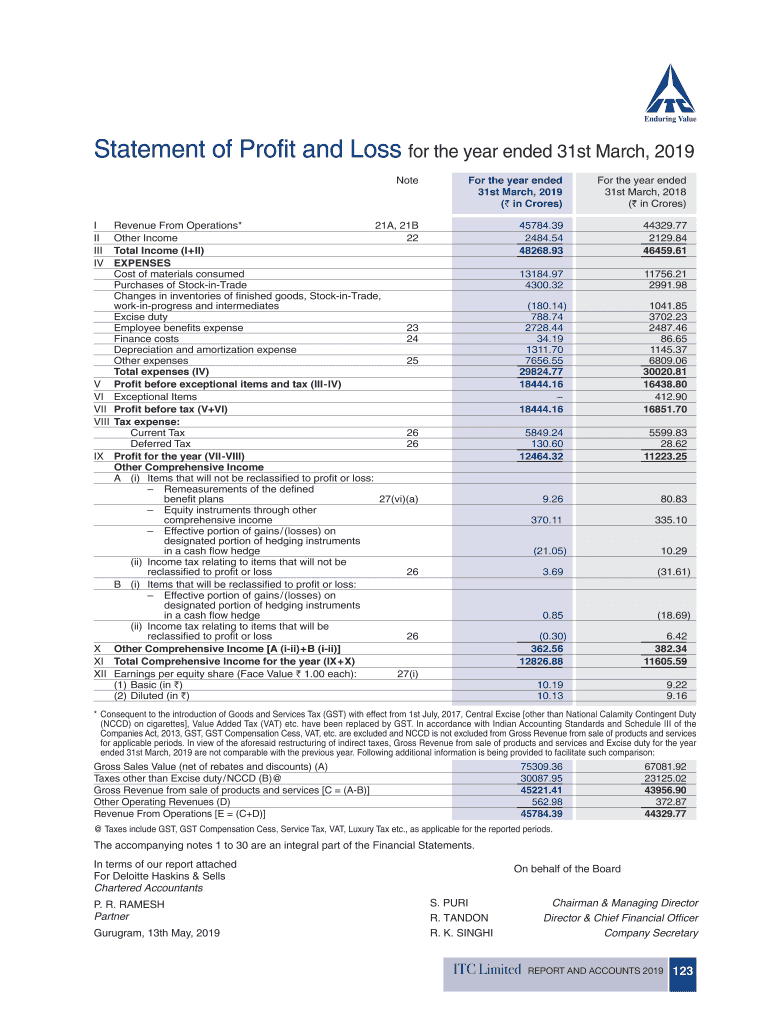

The Statement Of Profit And Loss For The Year Ended 31st March is a financial document that summarizes the revenues, costs, and expenses incurred during a specific fiscal year, concluding on March 31st. This statement provides a clear picture of a company's financial performance over that period, highlighting whether the business has made a profit or incurred a loss. It is essential for stakeholders, including management, investors, and regulatory bodies, as it aids in assessing the overall health and operational efficiency of the business.

Key elements of the Statement Of Profit And Loss For The Year Ended 31st March

This statement typically includes several key components:

- Revenue: Total income generated from sales of goods or services.

- Cost of Goods Sold (COGS): Direct costs attributable to the production of the goods sold.

- Gross Profit: Revenue minus COGS, indicating the profit made before deducting operating expenses.

- Operating Expenses: Costs incurred in the normal course of business operations, such as salaries, rent, and utilities.

- Net Profit or Loss: The final figure after all revenues and expenses have been accounted for, showing the overall profitability of the business.

Steps to complete the Statement Of Profit And Loss For The Year Ended 31st March

Completing this statement involves several steps to ensure accuracy and compliance:

- Gather all financial records, including sales invoices, expense receipts, and bank statements.

- Calculate total revenue from all sources during the fiscal year.

- Determine the cost of goods sold by summing up all direct costs associated with the production of goods sold.

- Subtract COGS from total revenue to find the gross profit.

- List all operating expenses and subtract them from the gross profit to determine the net profit or loss.

- Review the completed statement for accuracy and compliance with accounting standards.

Legal use of the Statement Of Profit And Loss For The Year Ended 31st March

This statement serves a vital role in legal and regulatory contexts. It is often required for tax filings, providing evidence of a business's financial performance to the IRS. Additionally, it may be used in legal proceedings, such as disputes over business valuations or during audits. Proper completion and filing of the statement can help ensure compliance with federal and state regulations, thereby avoiding potential legal issues.

How to obtain the Statement Of Profit And Loss For The Year Ended 31st March

The Statement Of Profit And Loss can be prepared internally by the accounting department or outsourced to professional accountants or financial advisors. Businesses may also utilize accounting software that includes templates for generating this statement. It is crucial to ensure that the data used is accurate and reflects all transactions for the fiscal year ending March 31st.

Digital vs. Paper Version

In today's digital age, many businesses prefer to maintain electronic versions of their financial statements, including the Statement Of Profit And Loss For The Year Ended 31st March. Digital documents offer advantages such as easier storage, retrieval, and sharing. They can also be securely signed and shared electronically, which enhances efficiency. However, some businesses may still opt for paper versions for record-keeping or compliance purposes, depending on their internal policies or regulatory requirements.

Quick guide on how to complete statement of profit and loss for the year ended 31st march

Prepare Statement Of Profit And Loss For The Year Ended 31st March effortlessly on any device

Managing documents online has gained traction among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, enabling you to access the correct format and securely store it in the cloud. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents rapidly without any holdups. Handle Statement Of Profit And Loss For The Year Ended 31st March on any platform using airSlate SignNow's Android or iOS applications and simplify any documentation process today.

How to edit and electronically sign Statement Of Profit And Loss For The Year Ended 31st March with ease

- Find Statement Of Profit And Loss For The Year Ended 31st March and then click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of the documents or conceal sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to send your document, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Statement Of Profit And Loss For The Year Ended 31st March and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the statement of profit and loss for the year ended 31st march

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Statement Of Profit And Loss For The Year Ended 31st March?

The Statement Of Profit And Loss For The Year Ended 31st March is a financial document that summarizes the revenues, costs, and expenses incurred during a specific financial year, providing insights into the profitability of a business. This statement is crucial for businesses to assess their financial performance and make informed decisions.

-

How can airSlate SignNow help in preparing the Statement Of Profit And Loss For The Year Ended 31st March?

airSlate SignNow streamlines the process of documenting and managing financial statements, including the Statement Of Profit And Loss For The Year Ended 31st March. Our platform allows users to easily create, send, and eSign documents, ensuring that your financial statements are well-prepared and legally binding.

-

What are the pricing options for using airSlate SignNow for my financial documents?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you need to prepare the Statement Of Profit And Loss For The Year Ended 31st March or other documents, our plans are designed to be cost-effective and provide valuable tools that meet your eSigning and document management needs.

-

Can I customize the formats for the Statement Of Profit And Loss For The Year Ended 31st March?

Yes, with airSlate SignNow, you can customize the formats for your Statement Of Profit And Loss For The Year Ended 31st March as per your business requirements. Our user-friendly tools allow you to create tailored templates to ensure that all necessary information is accurately represented.

-

What are the key features of airSlate SignNow for managing Statements Of Profit And Loss?

airSlate SignNow offers a range of features to effectively manage your financial documents, including secure eSignature capabilities, template creation for documents like the Statement Of Profit And Loss For The Year Ended 31st March, and real-time tracking of document status. These features enhance efficiency and compliance, allowing you to focus on critical financial tasks.

-

Is it easy to integrate airSlate SignNow with existing accounting software?

Absolutely! airSlate SignNow provides seamless integration with various accounting software, ensuring that you can easily manage your Statement Of Profit And Loss For The Year Ended 31st March alongside your other financial documentation. This integration streamlines processes and enhances workflow efficiency.

-

How does eSigning improve the process of finalizing financial statements?

eSigning with airSlate SignNow simplifies the process of finalizing financial documents like the Statement Of Profit And Loss For The Year Ended 31st March by allowing quick and secure approvals. This digital method reduces delays, enhances collaboration, and ensures that your documents are compliant and legally binding without the hassle of physical signatures.

Get more for Statement Of Profit And Loss For The Year Ended 31st March

- Put the conversation in order form

- Agm common proposal form

- Chai sacco forms 82202171

- Orea form 310

- European aviation safety agency easa form 42 amoc request

- Realtors association of new mexico addendum to purchase form

- Pto form 1478 rev 92006

- Short term mission trip rish acknowledgement and release form

Find out other Statement Of Profit And Loss For The Year Ended 31st March

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe