9 12 Form 2015-2026

What is the 9 12 Form

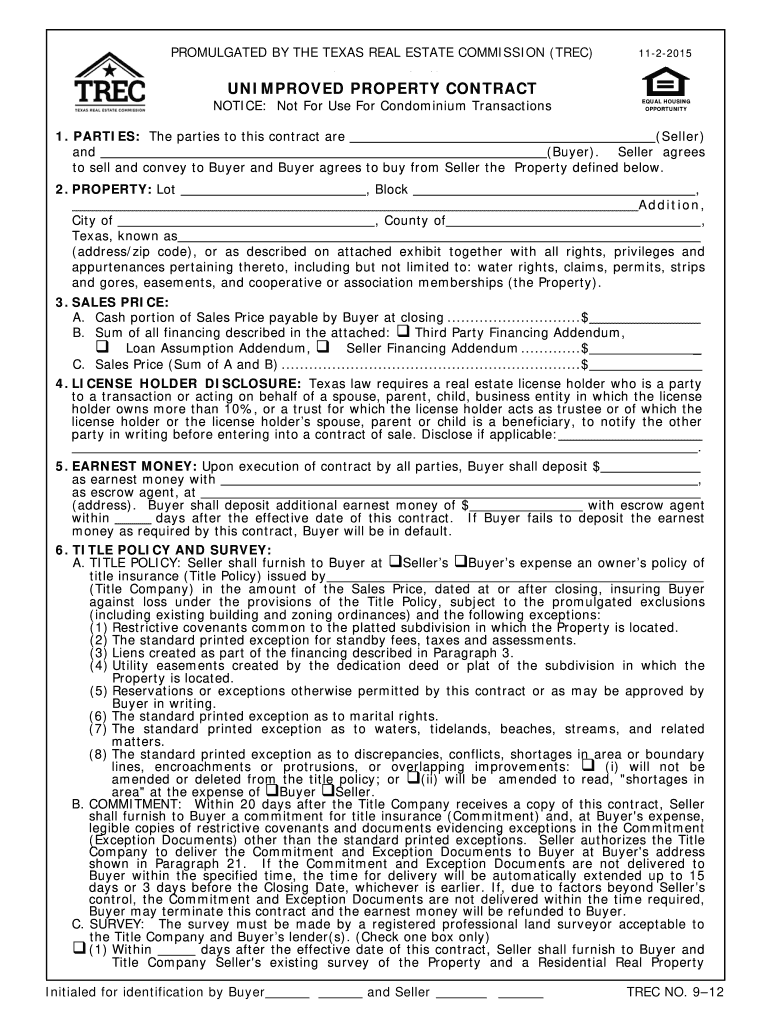

The 9 12 form is a legal document often used in real estate transactions in the United States. It serves as a crucial tool for buyers and sellers to formalize agreements regarding property transfers. This form typically includes essential details such as the names of the parties involved, a description of the property, and the agreed-upon price. It also requires signatures from all parties to validate the transaction.

How to use the 9 12 Form

Using the 9 12 form involves several steps to ensure it is completed accurately. First, gather all necessary information about the property and the parties involved. Next, fill out the form with precise details, including the property address, transaction dates, and any specific terms agreed upon. Once completed, all parties should review the document for accuracy before signing. Utilizing an electronic signature platform can streamline this process, making it easier to collect signatures and maintain a record of the transaction.

Steps to complete the 9 12 Form

Completing the 9 12 form involves a systematic approach:

- Gather all relevant information, including buyer and seller details.

- Provide a clear description of the property, including its address and any unique identifiers.

- Specify the sale price and any terms of the agreement.

- Ensure all parties review the form for accuracy and completeness.

- Obtain signatures from all parties involved, either electronically or in person.

- Keep a copy of the signed form for your records.

Legal use of the 9 12 Form

The 9 12 form is legally binding when executed correctly. For it to hold up in a court of law, it must include all necessary information about the transaction and be signed by all parties. Additionally, using a compliant eSignature platform can enhance the legal validity of the document by ensuring that all signatures are securely captured and that the transaction is documented through an audit trail.

Key elements of the 9 12 Form

Key elements of the 9 12 form include:

- Names and contact information of the buyer and seller.

- Detailed description of the property being sold.

- Sale price and payment terms.

- Transaction dates, including the date of signing.

- Signatures of all parties involved.

Who Issues the Form

The 9 12 form is typically issued by real estate professionals, such as agents or brokers, who facilitate property transactions. In some cases, it may also be available through state or local government agencies that oversee property sales. It is essential to ensure that the version of the form used is the most current and compliant with local regulations.

Quick guide on how to complete trec 9 12 form

Cross your t's and dot your i's on 9 12 Document

Managing contracts, overseeing listings, coordinating calls, and showings—real estate professionals oscillate between a diverse array of tasks on a daily basis. Many of these tasks involve considerable paperwork, such as 9 12 Form, that needs to be finalized swiftly and with great accuracy.

airSlate SignNow is a comprehensive solution that aids individuals in the real estate sector in alleviating the paperwork strain and allows them to focus more on their clients’ goals throughout the entire negotiating journey, helping them achieve optimal deal terms.

Steps to complete 9 12 Form with airSlate SignNow:

- Visit the 9 12 Form page or utilize our library’s search functions to locate the form you require.

- Click Get form-you’ll be swiftly redirected to the editor.

- Begin filling in the document by selecting fillable fields and typing your information into them.

- Insert additional text and modify its properties if needed.

- Choose the Sign tool in the upper toolbar to create your signature.

- Explore other features available to annotate and enhance your document, like drawing, highlighting, adding shapes, etc.

- Click the comments tab and include remarks about your document.

- Complete the process by downloading, sharing, or transmitting your document to your targeted users or organizations.

Eliminate paper for good and simplify the home purchasing experience with our user-friendly and powerful platform. Experience greater convenience when approving 9 12 Form and other real estate documents online. Try our solution today!

Create this form in 5 minutes or less

FAQs

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do we know the eligibility to fill out Form 12 BB?

Every year as a salaried employee many of you must have fill Form 12BB, but did you ever bothered to know its purpose. Don’t know ??It is indispensable for both, you and your employer. With the help of Form 12BB, you will be able to figure out how much income tax is to be deducted from your monthly pay. Further, with the help of Form 12BB, you will be in relief at the time of filing returns as at that time you will not have to pay anything due to correct TDS deduction.So, before filing such important form keep the below listed things in your mind so that you may live a tax hassle free life.For More Information:- 7 key points which must be known before filling Form 12BB

-

Why did my employer give me a W-9 Form to fill out instead of a W-4 Form?

I wrote about the independent-contractor-vs-employee issue last year, see http://nctaxpro.wordpress.com/20...Broadly speaking, you are an employee when someone else - AKA the employer - has control over when and where you work and the processes by which you perform the work that you do for that individual. A DJ or bartender under some circumstances, I suppose, might qualify as an independent contractor at a restaurant, but the waitstaff, bus help, hosts, kitchen aides, etc. almost certainly would not.There's always risk in confronting an employer when faced with a situation like yours - my experience is that most employers know full well that they are violating the law when they treat employees as independent contractors, and for that reason they don't tolerate questions about that policy very well - so you definitely should tread cautiously if you want to keep this position. Nonetheless, I think you owe it to yourself to ask whether or not the restaurant intends to withhold federal taxes from your checks - if for no other reason than you don't want to get caught short when it comes to filing your own return, even if you don't intend to challenge the policy.

-

I received my late husband's W-9 form to fill out for what I believe were our stocks. How am I supposed to fill this out or am I even supposed to?

You do not sound as a person who handles intricasies of finances on daily basis, this is why you should redirect the qustion to your family’s tax professional who does hte filings for you.The form itself, W-9 form, is a form created and approved by the IRS, if that’s your only inquiry.Whether the form applies to you or to your husband’s estate - that’s something only a person familiar with the situation would tell you about; there is no generic answer to this.

-

Why does my property management ask me to fill out a W-9 form?

To collect data on you in case they want to sue you and enforce a judgment.If the management co is required to pay inerest on security deposits then they need to account to ou for that interest income.If you are in a coop or condo they may apportion tax benefits or capital costs to you for tax purposes.

-

What percentage is needed in 12 class to apply for the NDA exam?

According to the latest notification ,there is no minimum percentage required in for joining NDA, but you should be pass in all the subjects , in terms of percentage you can take it as 33% . But aim to score a minimum of 80% so you can apply for other fields in the future also.

Create this form in 5 minutes!

How to create an eSignature for the trec 9 12 form

How to create an eSignature for your Trec 9 12 Form online

How to make an eSignature for your Trec 9 12 Form in Chrome

How to make an eSignature for putting it on the Trec 9 12 Form in Gmail

How to generate an electronic signature for the Trec 9 12 Form straight from your mobile device

How to generate an eSignature for the Trec 9 12 Form on iOS devices

How to generate an electronic signature for the Trec 9 12 Form on Android devices

People also ask

-

What is the 9 12 form in Marathi and why is it important?

The 9 12 form in Marathi is a document used for various official purposes, such as tax or regulatory purposes. Downloading the form in PDF format can streamline your record-keeping and ensure compliance with local laws. Accessing the 9 12 form Marathi PDF download is essential for individuals and businesses to maintain proper documentation.

-

How can I download the 9 12 form in Marathi PDF?

To download the 9 12 form in Marathi PDF, you can visit our website where we provide easy access to this document. Simply click on the download link, and the form will be available on your device. Our 9 12 form Marathi PDF download process is straightforward and quick.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow provides a range of features for document signing, including customizable templates, automated workflows, and in-app signing options. These features make the signing process efficient and user-friendly. Moreover, you can integrate the 9 12 form Marathi PDF download directly into your workflow for seamless processing.

-

Is airSlate SignNow a cost-effective solution for businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses looking to streamline document management. With competitive pricing plans and no hidden fees, users can easily budget for their document signing needs. Plus, the benefits of quick access to forms like the 9 12 form Marathi PDF download signNowly enhance the value.

-

Can I securely store my 9 12 form Marathi PDF documents with airSlate SignNow?

Absolutely! airSlate SignNow offers secure cloud storage for all your important documents, including the 9 12 form Marathi PDF downloads. Your files are safeguarded with robust encryption protocols to ensure confidentiality and security, making it easy for you to access and manage your documents anytime.

-

What integrations does airSlate SignNow support?

airSlate SignNow integrates with various third-party applications to enhance productivity and streamline operations. You can connect it with CRMs, payment systems, and cloud storage solutions. This allows for smooth handling of documents such as the 9 12 form Marathi PDF download within your existing workflow.

-

How does airSlate SignNow improve the efficiency of document workflows?

airSlate SignNow signNowly improves document workflows by automating repetitive tasks and simplifying the signing process. This reduces the time spent on each document, allowing teams to focus on more strategic activities. By utilizing tools for the 9 12 form Marathi PDF download, you can enhance overall workflow efficiency.

Get more for 9 12 Form

- Aviano ab pamphlet 31 218 form

- Beneficiary certificate form

- Heads holiday form

- Lra 7 18 form

- Carganet armas form

- Michigan quitclaim deed from individual to two individuals in joint tenancy 3352769 form

- Tuncurry market marine rescue nsw forster tuncurry form

- Www mandg com dam prudirect debit form pru mandg com

Find out other 9 12 Form

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation