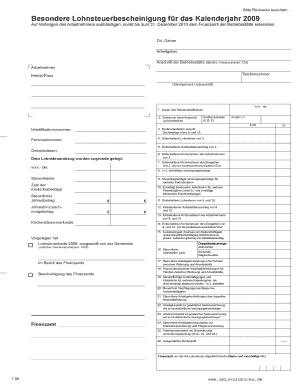

Lohnsteuerbescheinigung Form

What is the Lohnsteuerbescheinigung?

The Lohnsteuerbescheinigung is a tax document issued in Germany that summarizes an employee's earnings and the taxes withheld by the employer during a specific tax year. This form is essential for employees as it provides a detailed account of their income and tax contributions, which is necessary for filing annual tax returns. The document includes key information such as gross salary, tax deductions, and any additional contributions to social security or health insurance.

How to Obtain the Lohnsteuerbescheinigung

Employees typically receive their Lohnsteuerbescheinigung from their employer at the end of the tax year. Employers are required to provide this document by February 28 of the following year. If an employee does not receive the form, they should contact their HR department or payroll administrator. In some cases, employees can also access their Lohnsteuerbescheinigung through online payroll systems if their employer offers such services.

Steps to Complete the Lohnsteuerbescheinigung

Completing the Lohnsteuerbescheinigung involves several steps:

- Gather necessary information, including personal details and income data.

- Fill in the form accurately, ensuring all earnings and deductions are reported.

- Review the completed form for any errors or omissions.

- Submit the form to the appropriate tax authority or include it with your annual tax return.

Legal Use of the Lohnsteuerbescheinigung

The Lohnsteuerbescheinigung serves as an official document for tax purposes. It is legally binding and must be filled out accurately to reflect the employee's earnings and tax withholdings. Misrepresentation or errors can lead to penalties from tax authorities. Therefore, it is crucial for employees to ensure that the information provided on the form is correct and complete.

Key Elements of the Lohnsteuerbescheinigung

Several key elements are included in the Lohnsteuerbescheinigung:

- Personal Information: Name, address, and tax identification number of the employee.

- Employer Details: Name and address of the employer.

- Income Information: Total gross salary and any additional payments.

- Tax Deductions: Amount of income tax withheld, including solidarity surcharges and church tax.

- Social Security Contributions: Contributions to health, pension, and unemployment insurance.

Filing Deadlines / Important Dates

It is important to be aware of the deadlines associated with the Lohnsteuerbescheinigung:

- The employer must provide the Lohnsteuerbescheinigung to the employee by February 28 of the following year.

- Employees must file their annual tax return, including the Lohnsteuerbescheinigung, by July 31 of the same year, unless an extension is granted.

Digital vs. Paper Version

With the increasing shift towards digital solutions, the Lohnsteuerbescheinigung can be provided in both paper and electronic formats. The digital version is often more convenient, allowing for easier storage and submission. However, both formats are equally valid for tax purposes, provided they contain the necessary information and are submitted correctly.

Quick guide on how to complete lohnsteuerbescheinigung

Effortlessly Prepare Lohnsteuerbescheinigung on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and electronically sign your documents swiftly without any holdups. Manage Lohnsteuerbescheinigung on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused activity today.

How to Edit and eSign Lohnsteuerbescheinigung with Ease

- Locate Lohnsteuerbescheinigung and then click Get Form to begin.

- Utilize the tools we offer to submit your form.

- Highlight important sections of your documents or obscure sensitive information with special tools provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Lohnsteuerbescheinigung and ensure seamless communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the lohnsteuerbescheinigung

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a lohnsteuerbescheinigung 2019 and why is it important?

A lohnsteuerbescheinigung 2019 is a tax certificate issued by employers in Germany that summarizes the annual income and tax contributions of an employee. It is crucial for employees as it is used when filing annual tax returns. Accurate documentation ensures compliance and can maximize potential tax refunds.

-

How can airSlate SignNow help me with my lohnsteuerbescheinigung 2019?

airSlate SignNow simplifies the process of managing your lohnsteuerbescheinigung 2019 by allowing you to send, receive, and eSign documents securely. Our platform ensures that all signNow documents are accessible and legally binding, streamlining your tax documentation process and improving overall efficiency.

-

Is airSlate SignNow a cost-effective solution for handling lohnsteuerbescheinigung 2019?

Yes, airSlate SignNow offers a competitive pricing structure that makes managing your lohnsteuerbescheinigung 2019 affordable for businesses of all sizes. With our subscription plans, you can efficiently manage your documentation without incurring hefty costs, making it a smart investment for both small and large enterprises.

-

What features does airSlate SignNow offer for processing lohnsteuerbescheinigung 2019?

Our platform includes features such as document templates, automated workflows, and real-time tracking that enhance how you manage your lohnsteuerbescheinigung 2019. Additionally, the user-friendly interface allows for easy navigation, enabling quick edits and sharing of documents with stakeholders.

-

Can I integrate airSlate SignNow with other software for my lohnsteuerbescheinigung 2019?

Absolutely! airSlate SignNow supports numerous integrations with popular software like Dropbox, Google Drive, and Salesforce. This connectivity ensures that your workflow involving the lohnsteuerbescheinigung 2019 is seamless and allows for efficient collaboration within your existing systems.

-

How secure is my data when using airSlate SignNow for my lohnsteuerbescheinigung 2019?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols and compliance measures to protect sensitive information, including your lohnsteuerbescheinigung 2019. Your data remains confidential and secure throughout the entire eSigning process.

-

What are the benefits of using airSlate SignNow for my lohnsteuerbescheinigung 2019?

Using airSlate SignNow for your lohnsteuerbescheinigung 2019 means increased efficiency, better tracking, and lower operational costs. This allows you to focus more on your core business while ensuring that all necessary documents are processed quickly and accurately.

Get more for Lohnsteuerbescheinigung

- Mt name change 497316541 form

- Montana name change 497316542 form

- Montana order form

- Montana unsecured installment payment promissory note for fixed rate montana form

- Montana installments fixed rate promissory note secured by residential real estate montana form

- Montana note 497316546 form

- Montana installments fixed rate promissory note secured by commercial real estate montana form

- Complaint coversheet montana form

Find out other Lohnsteuerbescheinigung

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast