Form St 10 2015

What is the Form ST-10?

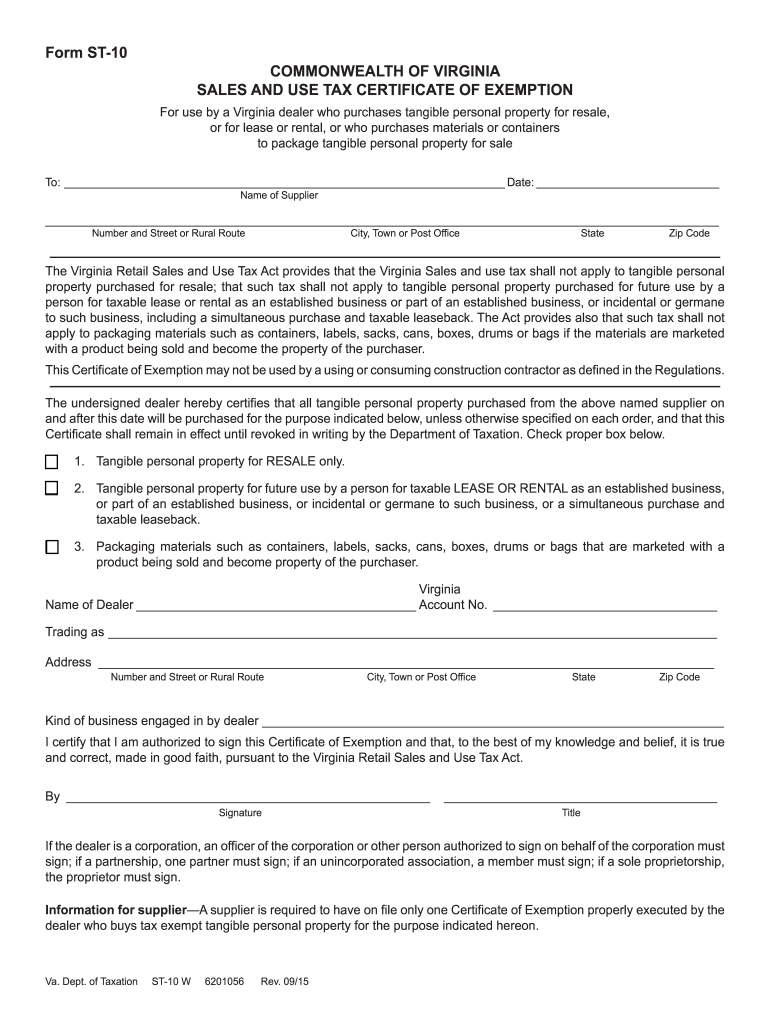

The Form ST-10 is a tax form used in Virginia for sales and use tax exemption. This form is primarily utilized by organizations and individuals who qualify for tax-exempt status under specific categories defined by Virginia law. The purpose of the form is to allow eligible entities to purchase goods and services without incurring sales tax, thereby facilitating compliance with state tax regulations.

How to Use the Form ST-10

To use the Form ST-10 effectively, individuals or organizations must first determine their eligibility for tax exemption. Once eligibility is confirmed, the form must be completed accurately, providing necessary details such as the purchaser's name, address, and the specific reason for the exemption. It is essential to present this form to the seller at the time of purchase to avoid being charged sales tax. Retaining a copy of the completed form for your records is also advisable.

Steps to Complete the Form ST-10

Completing the Form ST-10 involves several straightforward steps:

- Download the Form ST-10 from the Virginia Department of Taxation website or obtain a physical copy.

- Fill in the purchaser's name and address accurately.

- Indicate the type of exemption being claimed by checking the appropriate box.

- Provide a brief description of the items being purchased.

- Sign and date the form to certify the accuracy of the information provided.

After completing the form, present it to the seller to ensure the exemption is applied at the point of sale.

Legal Use of the Form ST-10

The legal use of the Form ST-10 is governed by Virginia tax law. Only entities that meet the criteria for tax exemption can utilize this form. Misuse of the form, such as claiming exemptions without proper eligibility, can lead to penalties, including fines and back taxes. It is crucial to understand the specific categories of exemption, which include non-profit organizations, government entities, and certain educational institutions.

Filing Deadlines / Important Dates

While the Form ST-10 is primarily used at the point of sale, it is important to be aware of any relevant deadlines related to tax filings or renewals of tax-exempt status. Generally, organizations should keep track of their tax-exempt status and ensure compliance with any annual reporting requirements set forth by the Virginia Department of Taxation. Regularly reviewing these deadlines helps maintain eligibility and avoid potential issues.

Form Submission Methods

The Form ST-10 does not require submission to the Virginia Department of Taxation; instead, it is presented directly to the seller at the time of purchase. However, organizations should keep a copy for their records. If there are any changes in status or if additional documentation is required, it may be necessary to submit other forms or documentation to the state tax authority.

Quick guide on how to complete form st 10 2015

Your assistance manual on how to prepare your Form St 10

If you’re wondering how to complete and send your Form St 10, here are some straightforward guidelines on how to make tax submission much simpler.

To start, you merely need to set up your airSlate SignNow account to revolutionize the way you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document management solution that allows you to modify, create, and finalize your income tax forms effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures, and return to adjust responses as necessary. Optimize your tax administration with advanced PDF editing, eSigning, and easy sharing.

Follow the steps below to complete your Form St 10 in just a few minutes:

- Create your account and start editing PDFs in no time.

- Utilize our catalog to obtain any IRS tax form; browse through variations and schedules.

- Hit Get form to access your Form St 10 in our editor.

- Enter the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if required).

- Examine your document and rectify any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Leverage this guide to file your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper can lead to return errors and delay refunds. Certainly, before e-filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form st 10 2015

FAQs

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

What is the time period to fill out form 10?

Well its a huge mission if you’re going to use a printer forget about it :)I’ve tried all the products and a lot of them you struggle with the mouse cursor to find the space to complete. So I think people can sometimes just get annoyed and use a printer.But the best is Paperjet. Go Paperless which uses field detection and makes the form fillable online immediately.No doubt the easiest and quickest way imho.

-

I am 2015 passed out CSE student, I am preparing for GATE2016 from a coaching, due to some reasons I do not have my provisional certificate, am I still eligible to fill application form? How?

Yes you are eligible. There is still time, application closes on October 1 this year. So if you get the provisional certificate in time you can just wait or if you know that you won't get it in time, just mail GATE organising institute at helpdesk@gate.iisc.ernet.in mentioning your problem. Hope it helps.

-

What is a W-10 tax form? Who has to fill one out?

Here is all the information regarding the W-10 tax form from the IRS. But, it is a request to get your Child’s Dependent Care Tax Information. If you are taking care of someone’s child for them you will need to fill it out. Again you are supposed to pay taxes on all Earned Income. But, a lot of people don’t and work under the table. I don’t know many drug dealers getting ready to report their earnings this year. I actually used that scenario in college. You can’t right off bribes as an expense.. Sorry off topic..About Form W10 | Internal Revenue Service

Create this form in 5 minutes!

How to create an eSignature for the form st 10 2015

How to create an electronic signature for the Form St 10 2015 in the online mode

How to make an electronic signature for the Form St 10 2015 in Google Chrome

How to create an electronic signature for putting it on the Form St 10 2015 in Gmail

How to generate an electronic signature for the Form St 10 2015 right from your mobile device

How to generate an electronic signature for the Form St 10 2015 on iOS devices

How to make an eSignature for the Form St 10 2015 on Android devices

People also ask

-

What is Form St 10, and how can airSlate SignNow help with it?

Form St 10 is a tax exemption certificate used in various states for sales tax purposes. With airSlate SignNow, you can easily prepare, send, and eSign Form St 10, streamlining the process and ensuring compliance with state regulations. Our platform simplifies document management, making it easy to track and store your completed forms.

-

How does pricing for airSlate SignNow compare when using Form St 10?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Using Form St 10 through our platform can save you time and resources, as our pricing includes unlimited eSigning and document storage. You can choose a plan that fits your budget while taking advantage of our user-friendly features.

-

What features does airSlate SignNow offer for managing Form St 10?

airSlate SignNow provides several features for managing Form St 10 efficiently, including customizable templates, in-app document editing, and real-time tracking of document status. You can also set reminders and notifications for yourself and your clients, ensuring timely completion and submission of the form.

-

Are there integrations available for using Form St 10 with airSlate SignNow?

Yes, airSlate SignNow seamlessly integrates with a variety of popular applications, enhancing your workflow when dealing with Form St 10. You can connect our platform with tools like Google Drive, Dropbox, and CRM systems to streamline document management and improve efficiency.

-

Can I customize Form St 10 using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize Form St 10 to fit your specific needs. You can add your company logo, adjust the layout, and include any additional fields required, ensuring that the form meets your business requirements while maintaining compliance.

-

Is it secure to eSign Form St 10 with airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. When you eSign Form St 10, your data is protected with advanced encryption and secure cloud storage. We comply with industry standards to ensure your documents are safe and confidential throughout the signing process.

-

What are the benefits of using airSlate SignNow for Form St 10?

Using airSlate SignNow for Form St 10 offers numerous benefits, including faster processing times, improved accuracy, and reduced paper waste. Our easy-to-use interface allows you to manage your forms digitally, saving you time and resources while enhancing overall productivity.

Get more for Form St 10

Find out other Form St 10

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy