Form a 3730 2010

What is the Form A 3730

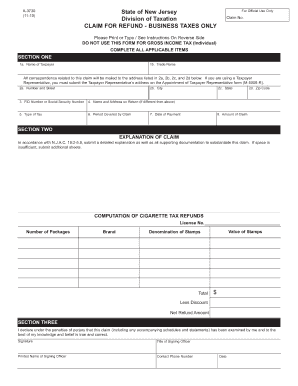

The Form A 3730 is a specific document used primarily for reporting and compliance purposes within various sectors. It is essential for individuals and businesses to understand its purpose and the context in which it is used. This form typically involves providing detailed information that may be required by regulatory agencies or for internal record-keeping. The accurate completion of the Form A 3730 is crucial for ensuring compliance with applicable laws and regulations.

How to use the Form A 3730

Using the Form A 3730 involves several steps to ensure that all required information is accurately captured. First, gather all necessary data related to the form's requirements. This may include personal identification details, financial information, or specific documentation relevant to the purpose of the form. Next, fill out the form carefully, ensuring that all sections are completed as instructed. After completing the form, review it for accuracy before submission. This process helps to avoid delays or issues with compliance.

Steps to complete the Form A 3730

Completing the Form A 3730 requires a methodical approach to ensure all information is provided correctly. Follow these steps:

- Gather all relevant documents and information needed for the form.

- Read the instructions carefully to understand each section of the form.

- Fill in the required fields with accurate and truthful information.

- Review the completed form for any errors or omissions.

- Submit the form through the appropriate channels, whether online, by mail, or in person.

Legal use of the Form A 3730

The legal use of the Form A 3730 is governed by specific regulations that ensure its validity. To be considered legally binding, the form must be completed in accordance with relevant laws, including those pertaining to electronic signatures if applicable. It is important to ensure that all required signatures are obtained and that the form is submitted within any specified deadlines. Compliance with these legal standards helps to protect individuals and organizations from potential penalties or disputes.

Key elements of the Form A 3730

Understanding the key elements of the Form A 3730 is essential for effective completion. The form typically includes:

- Identification information of the individual or entity submitting the form.

- Specific details relevant to the purpose of the form, such as financial data or compliance information.

- Signature lines for required parties to validate the information provided.

- Instructions for submission and any applicable deadlines.

Form Submission Methods

The Form A 3730 can be submitted through various methods, depending on the requirements set forth by the issuing authority. Common submission methods include:

- Online submission through designated platforms, which may offer a more efficient process.

- Mailing the completed form to the appropriate address, ensuring it is sent with adequate postage.

- In-person submission at designated locations, where assistance may be available if needed.

Quick guide on how to complete form a 3730

Prepare Form A 3730 effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the appropriate template and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form A 3730 on any device using the airSlate SignNow apps for Android or iOS and simplify your document-related processes today.

How to alter and eSign Form A 3730 with ease

- Locate Form A 3730 and click Get Form to begin.

- Employ the tools we offer to complete your document.

- Highlight relevant sections of the documents or obscure sensitive details using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your updates.

- Choose your preferred method to send your form, whether it be via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills your needs in document management with just a few clicks from any device you prefer. Alter and eSign Form A 3730 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form a 3730

Create this form in 5 minutes!

How to create an eSignature for the form a 3730

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to form a 3730 using airSlate SignNow?

To form a 3730, simply upload your document to airSlate SignNow, configure the necessary fields, and send it for eSignature. Our platform allows users to create custom workflows, ensuring that your form meets all requirements. With airSlate SignNow, forming a 3730 becomes a seamless experience.

-

What are the pricing options for forming a 3730 with airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to all business sizes and needs when you form a 3730. You can choose from monthly or annual subscriptions, ensuring you get the best value for your eSignature requirements. Pricing details can be found directly on our website.

-

What features does airSlate SignNow offer to help me form a 3730?

When you form a 3730 with airSlate SignNow, you gain access to robust features such as document templates, real-time tracking, and automated workflows. These capabilities streamline the signing process, making it faster and more efficient. Furthermore, our user-friendly interface ensures that anyone can use it effectively.

-

How secure is the process to form a 3730 with airSlate SignNow?

The security of your documents is our top priority. When you form a 3730 using airSlate SignNow, we utilize advanced encryption protocols to protect your information. Additionally, our platform complies with industry standards to guarantee that your documents remain confidential and secure.

-

Can I integrate airSlate SignNow with other applications while forming a 3730?

Yes, airSlate SignNow offers comprehensive integration options that allow you to connect with various applications. Whether you're using CRM software, document storage solutions, or project management tools, you can easily integrate these with our platform to enhance the process of forming a 3730. This ensures a cohesive workflow across your business operations.

-

What are the advantages of choosing airSlate SignNow to form a 3730?

Choosing airSlate SignNow to form a 3730 provides numerous advantages, including cost-effectiveness, ease of use, and quick turnaround times for document signing. Our platform is designed to simplify the signing process, allowing businesses to focus on their core activities. Additionally, our customer support team is always ready to assist you whenever needed.

-

Is there a mobile app available for forming a 3730 with airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows users to form a 3730 on-the-go. This app provides the same functionality as the desktop version, enabling you to upload documents, send them for signatures, and manage your workflows from anywhere. It's perfect for busy professionals who need to work remotely.

Get more for Form A 3730

- Tssaa eligibility form

- Immunotherapy vaccine administration form aaaai

- Case history form to fill out for children with auditory processing disorder

- Exparte 120081 form

- Blackbaud community matters grant application form

- Com the african american adolescent respect scale a measure of a prosocial attitude form

- Ada conformity assessments a model for other sigada sigada

- Cascade chipmunk order form

Find out other Form A 3730

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy